Region:Middle East

Author(s):Shubham

Product Code:KRAD6701

Pages:96

Published On:December 2025

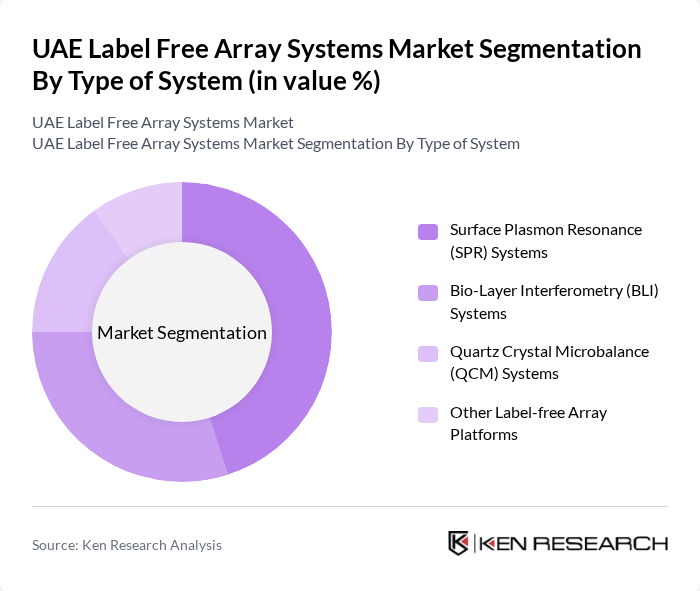

By Type of System:The market is segmented into various types of systems, including Surface Plasmon Resonance (SPR) Systems, Bio-Layer Interferometry (BLI) Systems, Quartz Crystal Microbalance (QCM) Systems, and Other Label-free Array Platforms. Among these, SPR systems are leading globally and in early-adopting regional markets due to their high sensitivity, quantitative capabilities, and versatility in various applications, particularly in drug discovery, kinetic analysis, and biomolecular interaction studies. BLI systems are also gaining traction owing to their ease of use, higher throughput in some formats, minimal sample preparation, and real-time analysis capabilities that suit biologics development and screening workflows. The adoption of QCM and other niche label-free platforms is expanding in specialized research labs for biophysical interaction and material–biomolecule interface studies.

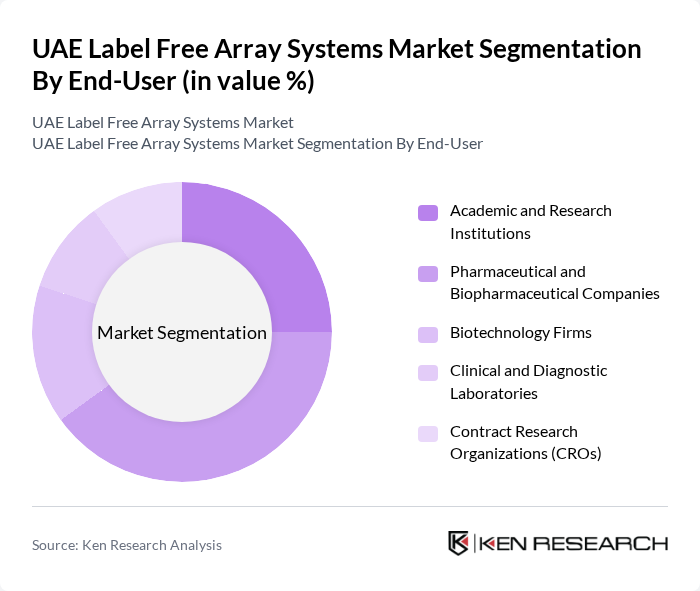

By End-User:The end-user segmentation includes Academic and Research Institutions, Pharmaceutical and Biopharmaceutical Companies, Biotechnology Firms, Clinical and Diagnostic Laboratories, and Contract Research Organizations (CROs). The pharmaceutical and biopharmaceutical companies segment is the largest globally, driven by the increasing focus on small?molecule and biologics drug development, the need for efficient, label-free screening methods, and detailed kinetic characterization in lead optimization. Academic and research institutions also play a significant role, as they are often at the forefront of fundamental research, biomarker discovery, and method development in this field, supported by rising public and private funding for life sciences research in the UAE and wider Middle East region.

The UAE Label Free Array Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Agilent Technologies, Inc., Cytiva (Danaher Corporation), Sartorius AG, Biacore AB, Horiba, Ltd., PerkinElmer, Inc., Malvern Panalytical Ltd. (Spectris plc), Creoptix AG, Nicoya Lifesciences, Inc., Pall Corporation, Mindray Medical International Limited, Sengenics Corporation Pte. Ltd., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., Local Distributors and Channel Partners (e.g., Gulf Scientific Corporation, Al Hayat Pharmaceuticals) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE label-free array systems market appears promising, driven by ongoing technological advancements and increasing healthcare investments. The integration of artificial intelligence and machine learning into diagnostic processes is expected to enhance data analysis capabilities, leading to more accurate and timely results. Additionally, the growing emphasis on personalized medicine will likely create new avenues for the application of label-free technologies, further solidifying their role in modern healthcare solutions across the region.

| Segment | Sub-Segments |

|---|---|

| By Type of System | Surface Plasmon Resonance (SPR) Systems Bio-Layer Interferometry (BLI) Systems Quartz Crystal Microbalance (QCM) Systems Other Label-free Array Platforms |

| By End-User | Academic and Research Institutions Pharmaceutical and Biopharmaceutical Companies Biotechnology Firms Clinical and Diagnostic Laboratories Contract Research Organizations (CROs) |

| By Application | Drug Discovery and Lead Optimization Biomarker Discovery and Validation Clinical Diagnostics and Translational Research Protein–Protein and Protein–Small Molecule Interaction Analysis Others (Food Safety, Environmental and Industrial Applications) |

| By Detection Technology | Optical Detection (SPR, BLI and Related) Mass-sensitive Detection (QCM and QCM-D) Electrical / Impedance-based Detection Microfluidic and Nanoplasmonic Platforms |

| By Emirate | Abu Dhabi Dubai Sharjah Ajman Other Emirates (Fujairah, Ras Al Khaimah, Umm Al Quwain) |

| By Customer Type | Government and Public Sector Institutions Private Sector Healthcare and Life Science Companies Academic and Non-profit Research Organizations Others |

| By Procurement & Distribution Channel | Direct Tenders and Institutional Procurement Local Distributors and System Integrators Online and OEM Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Clinical Diagnostics Laboratories | 100 | Laboratory Directors, Clinical Researchers |

| Biotechnology Research Institutions | 80 | Research Scientists, Lab Managers |

| Pharmaceutical Companies | 70 | R&D Managers, Product Development Leads |

| Academic Institutions | 60 | Professors, Graduate Researchers |

| Healthcare Providers | 90 | Healthcare Administrators, Pathologists |

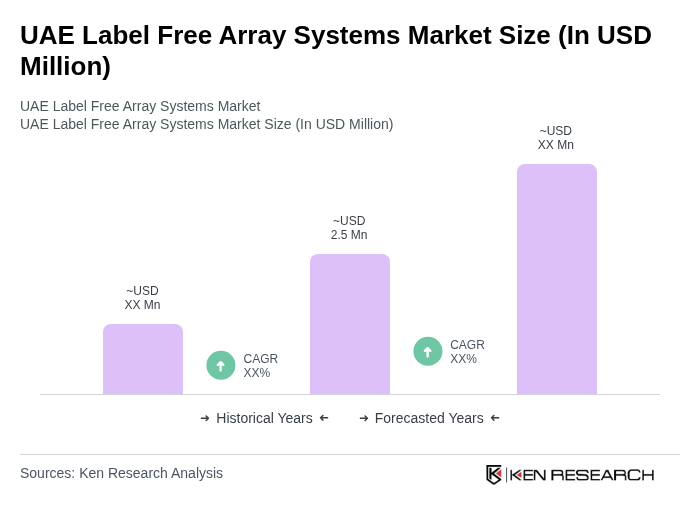

The UAE Label Free Array Systems Market is valued at approximately USD 2.5 million, reflecting a five-year historical analysis. This valuation highlights the market's growth driven by advancements in biotechnology and increasing research activities in drug discovery.