Region:Middle East

Author(s):Shubham

Product Code:KRAC2805

Pages:88

Published On:October 2025

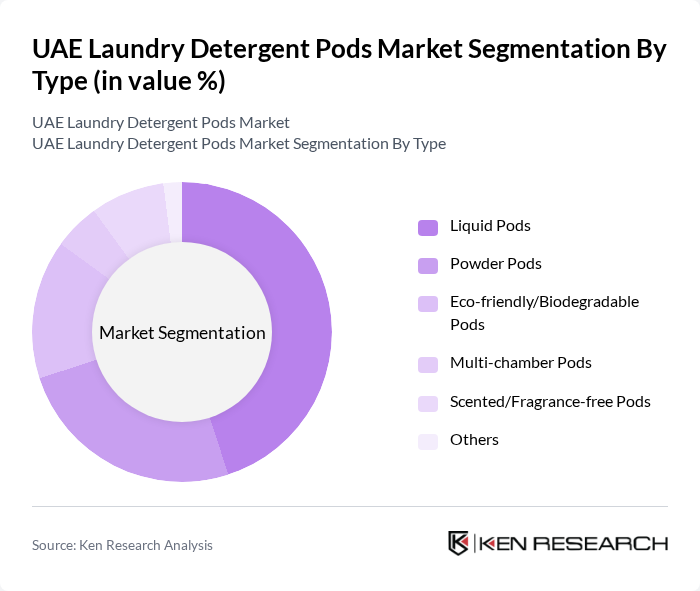

By Type:The market is segmented into various types of laundry detergent pods, including Liquid Pods, Powder Pods, Eco-friendly/Biodegradable Pods, Multi-chamber Pods, Scented/Fragrance-free Pods, and Others. Liquid Pods remain the dominant segment, favored for their ease of use, rapid dissolution, and superior stain removal capabilities. Their popularity is reinforced by the fast-paced urban lifestyle and the preference for mess-free, pre-measured laundry solutions. Eco-friendly and multi-chamber pods are gaining traction as sustainability and performance become key purchase drivers.

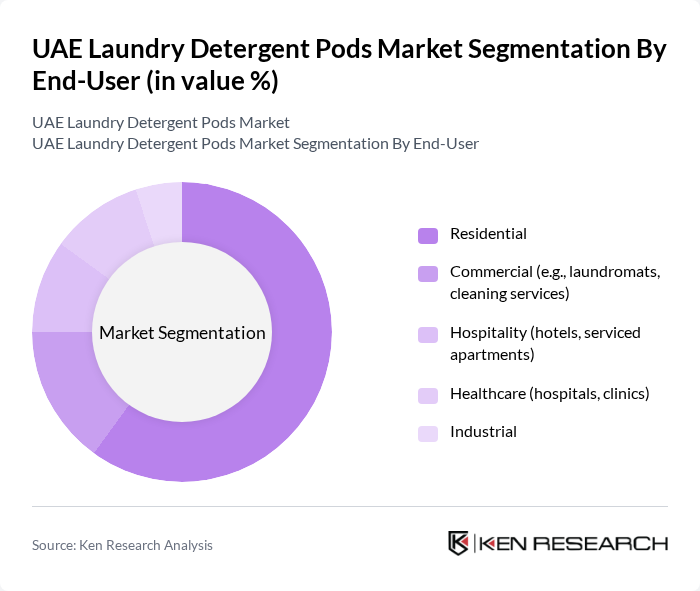

By End-User:The end-user segmentation includes Residential, Commercial (e.g., laundromats, cleaning services), Hospitality (hotels, serviced apartments), Healthcare (hospitals, clinics), and Industrial. The Residential segment leads the market, supported by the increasing number of households, urbanization, and the preference for laundry convenience among consumers. Dual-income families and time-constrained urban dwellers are significant contributors to the demand for efficient laundry solutions. Commercial and hospitality sectors are also adopting pods for operational efficiency and hygiene.

The UAE Laundry Detergent Pods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble (Ariel, Tide), Unilever (OMO, Persil Arabia), Henkel AG (Persil, Dac), Reckitt Benckiser (Woolite), Colgate-Palmolive (Fab), Church & Dwight Co., Inc. (Arm & Hammer), Ecover, Dropps, Seventh Generation, Method Products, Frosch, Alokozay Group (UAE), National Detergent Company (NDC, Bahar), Future Consumer LLC (UAE), Fine Hygienic Holding (UAE/GCC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE laundry detergent pods market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a focal point, manufacturers are likely to invest in eco-friendly formulations and packaging. Additionally, the rise of subscription-based services is expected to enhance customer loyalty and convenience. With the increasing penetration of e-commerce, brands that effectively leverage digital platforms will likely capture a larger market share, positioning themselves for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Pods Powder Pods Eco-friendly/Biodegradable Pods Multi-chamber Pods Scented/Fragrance-free Pods Others |

| By End-User | Residential Commercial (e.g., laundromats, cleaning services) Hospitality (hotels, serviced apartments) Healthcare (hospitals, clinics) Industrial |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail/E-commerce Convenience Stores Wholesale/Distributors Specialty Stores |

| By Packaging Type | Single-use Packs Multi-pack Options Bulk Packaging Refillable Packaging |

| By Price Range | Premium Mid-range Economy |

| By Brand Loyalty | Brand Loyal Customers Price-sensitive Customers First-time Buyers |

| By Product Features | Stain Removal Color Protection Fabric Care Hypoallergenic Quick Dissolve Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Household Consumers | 100 | Homeowners, Renters, Family Decision Makers |

| Retail Sector Insights | 50 | Store Managers, Category Buyers |

| Manufacturers and Suppliers | 40 | Product Development Managers, Sales Executives |

| Market Analysts | 40 | Industry Analysts, Market Researchers |

| Environmental and Regulatory Bodies | 30 | Policy Makers, Sustainability Officers |

The UAE Laundry Detergent Pods Market is valued at approximately USD 55 million, reflecting a growing segment within the broader laundry care market, driven by consumer demand for convenience and eco-friendly products.