Region:Middle East

Author(s):Dev

Product Code:KRAD1701

Pages:90

Published On:November 2025

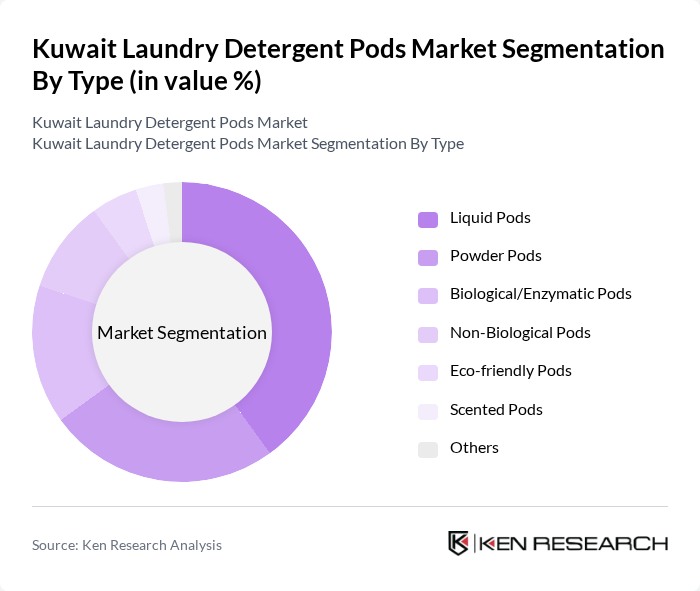

By Type:The market is segmented into various types of laundry detergent pods, including Liquid Pods, Powder Pods, Biological/Enzymatic Pods, Non-Biological Pods, Eco-friendly Pods, Scented Pods, and Others.Liquid Podsare experiencing the highest consumer traction due to their superior stain removal, convenience, and compatibility with modern washing machines. The growing preference for hassle-free laundry solutions and the perception of liquid formulations as more efficient and user-friendly are key factors driving this segment’s growth .

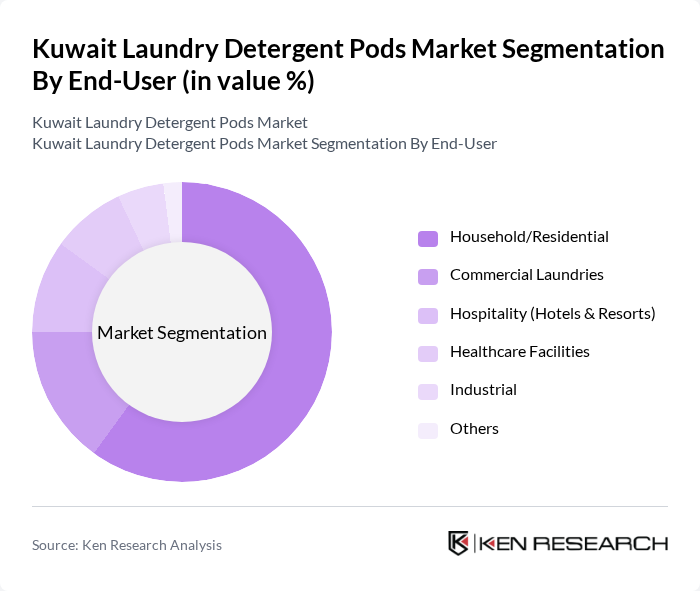

By End-User:The end-user segmentation includes Household/Residential, Commercial Laundries, Hospitality (Hotels & Resorts), Healthcare Facilities, Industrial, and Others. TheHousehold/Residentialsegment is the clear leader, supported by the increasing number of nuclear families, rising adoption of washing machines, and a strong trend toward convenient laundry solutions. Pods are favored for their pre-measured dosing, reducing waste and simplifying the laundry process for everyday users .

The Kuwait Laundry Detergent Pods Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble (Tide, Ariel), Unilever (OMO, Persil Arabia), Henkel (Persil, Dixan), Reckitt Benckiser (Woolite), Colgate-Palmolive, Church & Dwight (Arm & Hammer), Ecover, Seventh Generation, Method, Al Sanea Chemical Products (Kuwait), National Detergent Company (Oman, regional presence), Al Babtain Detergents (Kuwait), Purex, OxiClean, Mrs. Meyer's Clean Day contribute to innovation, geographic expansion, and service delivery in this space.

The future of the laundry detergent pods market in Kuwait appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, manufacturers are likely to innovate with eco-friendly formulations and packaging. Additionally, the expansion of e-commerce platforms will facilitate greater accessibility, allowing brands to reach a broader audience. The market is expected to adapt to these trends, focusing on convenience and environmental responsibility, which will shape consumer purchasing decisions in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Liquid Pods Powder Pods Biological/Enzymatic Pods Non-Biological Pods Eco-friendly Pods Scented Pods Others |

| By End-User | Household/Residential Commercial Laundries Hospitality (Hotels & Resorts) Healthcare Facilities Industrial Others |

| By Packaging Type | Single-use Packs Multi-use Packs Eco-friendly Packaging Resealable Packaging Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Specialty Stores Local Retailers Others |

| By Price Range | Budget Mid-range Premium Others |

| By Consumer Demographics | Age Group (18-25, 26-35, 36-50, 51+) Income Level (Low, Middle, High) Family Size (Single, Couple, Family) Others |

| By Product Formulation | Standard Formulation Hypoallergenic Formulation Organic Formulation Fragrance-Free Formulation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Household Consumers | 100 | Primary users of laundry detergents, including families and single households |

| Retailers and Distributors | 60 | Store managers, procurement officers, and supply chain coordinators |

| Manufacturers | 40 | Product development managers and marketing executives from detergent companies |

| Market Analysts | 40 | Industry analysts and consultants specializing in consumer goods |

| Environmental Experts | 20 | Sustainability officers and environmental compliance managers |

The Kuwait Laundry Detergent Pods Market is valued at approximately USD 15 million, reflecting a growing trend towards convenient, single-dose laundry solutions, driven by rising household incomes and a preference for eco-friendly products.