Region:Middle East

Author(s):Shubham

Product Code:KRAD3700

Pages:81

Published On:November 2025

Market.png)

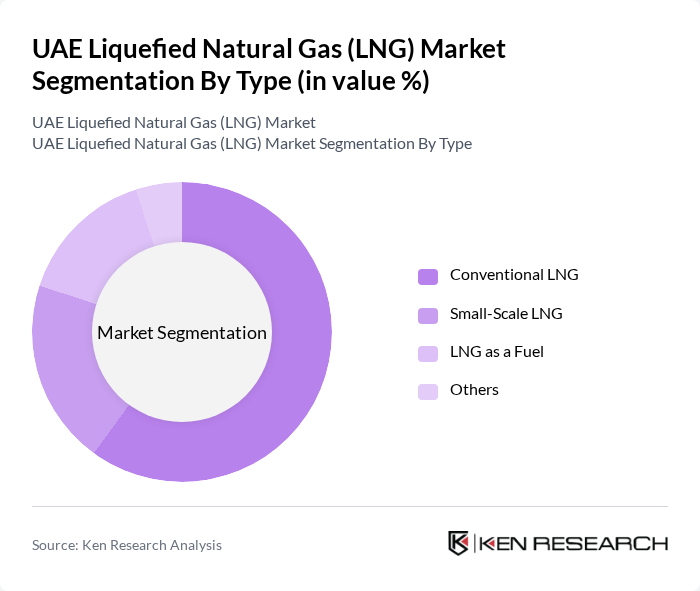

By Type:The LNG market can be segmented into various types, including Conventional LNG, Small-Scale LNG, LNG as a Fuel, and Others. Among these, Conventional LNG is the most dominant segment due to its widespread use in power generation and industrial applications. The demand for Conventional LNG is driven by its efficiency and lower emissions compared to other fossil fuels. Small-Scale LNG is gaining traction, particularly in remote areas where pipeline infrastructure is lacking, while LNG as a Fuel is increasingly adopted in the transportation sector for its environmental benefits.

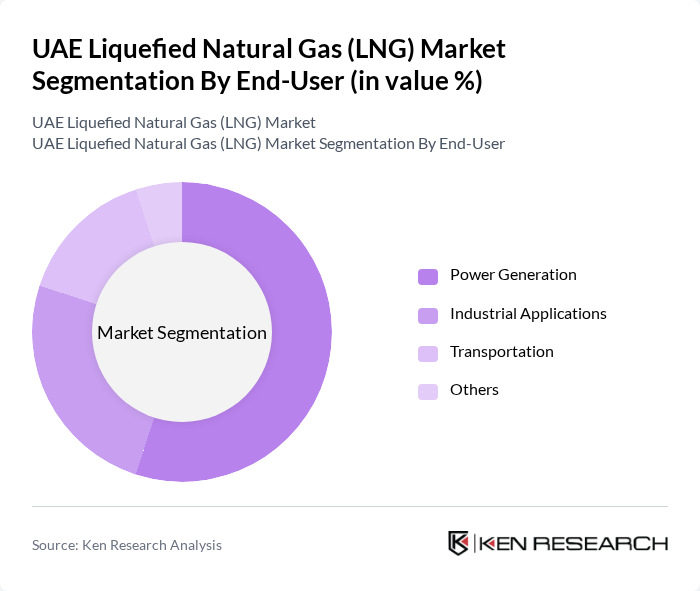

By End-User:The end-user segmentation of the LNG market includes Power Generation, Industrial Applications, Transportation, and Others. Power Generation is the leading segment, driven by the UAE's focus on transitioning to cleaner energy sources for electricity production. The industrial sector also significantly contributes to LNG demand, as industries seek to reduce their carbon footprint. Transportation is emerging as a key area for LNG adoption, particularly in maritime and heavy-duty vehicles, due to its lower emissions compared to diesel.

The UAE Liquefied Natural Gas (LNG) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi National Oil Company (ADNOC), Qatar Petroleum, Shell, TotalEnergies, ExxonMobil, Chevron, Gazprom, Petronas, ENI, Cheniere Energy, Woodside Petroleum, Equinor, Kinder Morgan, Mitsui & Co., JERA Co., Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The UAE LNG market is poised for significant transformation, driven by increasing energy demands and strategic government initiatives. In the future, the focus on cleaner fuels and technological advancements will likely enhance LNG's role in the energy mix. Additionally, the development of floating LNG facilities and improved storage solutions will facilitate greater export capabilities. As the market evolves, collaboration between public and private sectors will be essential to address challenges and capitalize on emerging opportunities in the LNG landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Conventional LNG Small-Scale LNG LNG as a Fuel Others |

| By End-User | Power Generation Industrial Applications Transportation Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| By Application | Power Plants Industrial Heating Marine Fuel Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Others |

| By Policy Support | Subsidies Tax Incentives Regulatory Support Others |

| By Technology | LNG Processing Technology LNG Transportation Technology LNG Storage Technology Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Power Generation Sector | 100 | Energy Managers, Utility Executives |

| Industrial LNG Consumption | 80 | Plant Managers, Operations Directors |

| Export and Trade Analysis | 70 | Trade Analysts, Export Managers |

| Regasification Terminal Operations | 60 | Terminal Managers, Safety Officers |

| Policy and Regulatory Insights | 50 | Government Officials, Regulatory Advisors |

The UAE Liquefied Natural Gas (LNG) market is valued at approximately USD 15 billion, reflecting a significant growth driven by the demand for cleaner energy sources and the UAE's initiatives to diversify its energy portfolio.