UAE Luxury E-Commerce Platforms Market Overview

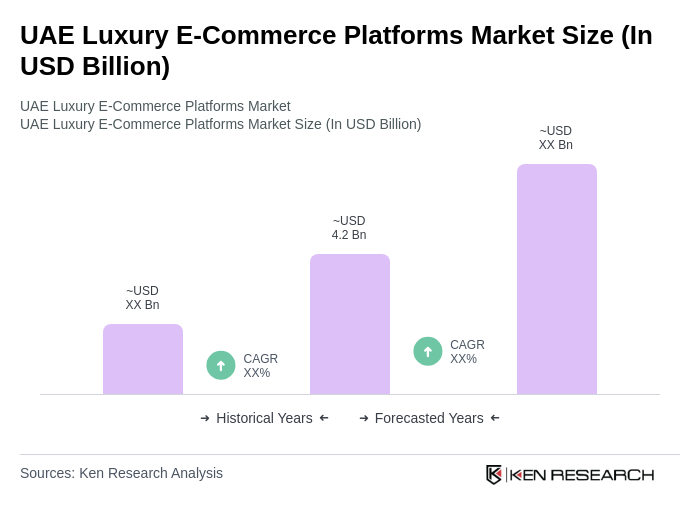

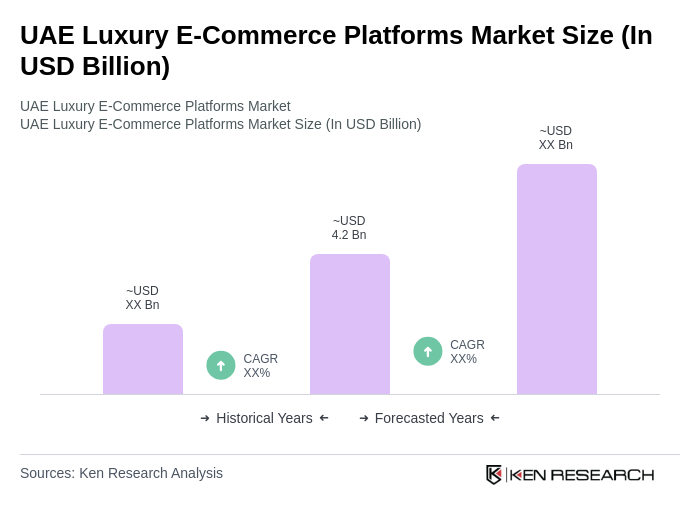

- The UAE Luxury E-Commerce Platforms Market is valued at USD 4.2 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable income, a strong trend toward premiumization, the rise of digital payment solutions, and the expansion of e-commerce platforms. The luxury segment has seen a significant shift towards online channels, with consumers seeking convenience, exclusive collections, and a wider selection of high-end products. The adoption of technologies such as augmented reality (AR) is further enhancing the online luxury shopping experience, contributing to market expansion .

- Dubai and Abu Dhabi are the dominant cities in the UAE Luxury E-Commerce Platforms Market. Dubai’s position as a global shopping hub, supported by a diverse expatriate population and high tourist influx, underpins its market leadership. Abu Dhabi, with its affluent residents and proactive government initiatives to promote digital commerce, also plays a pivotal role in driving market growth. Both cities benefit from robust tourism and a concentration of luxury retail infrastructure .

- In 2023, the UAE government strengthened consumer protection in e-commerce through theFederal Decree-Law No. 46 of 2021 on Electronic Transactions and Trust Services, issued by the Ministry of Economy. This law mandates online retailers to provide clear return policies, product authenticity guarantees, and transparent information to consumers, ensuring robust protection against fraud and enhancing trust in the online luxury shopping experience. Compliance requirements include secure digital transactions, clear disclosure of terms, and mechanisms for consumer redress .

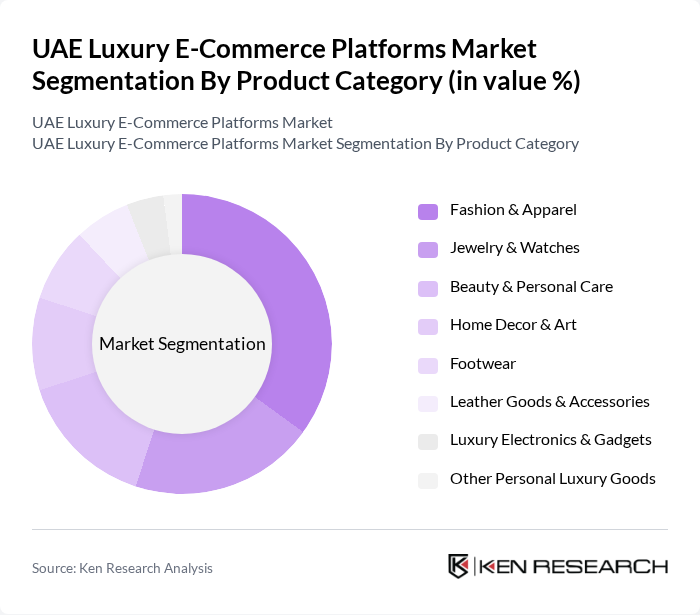

UAE Luxury E-Commerce Platforms Market Segmentation

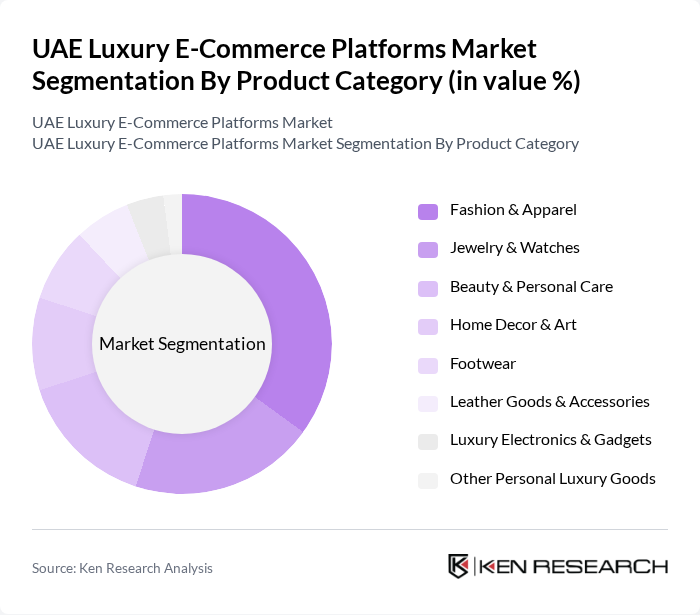

By Product Category:The product categories in the UAE Luxury E-Commerce Platforms Market include Fashion & Apparel, Jewelry & Watches, Beauty & Personal Care, Home Decor & Art, Footwear, Leather Goods & Accessories, Luxury Electronics & Gadgets, and Other Personal Luxury Goods. Among these,Fashion & Apparelis the leading sub-segment, driven by high demand for designer clothing and accessories. The trend of online shopping for fashion items has surged, with consumers increasingly seeking the latest styles, exclusive collections, and personalized luxury experiences from both global and regional brands .

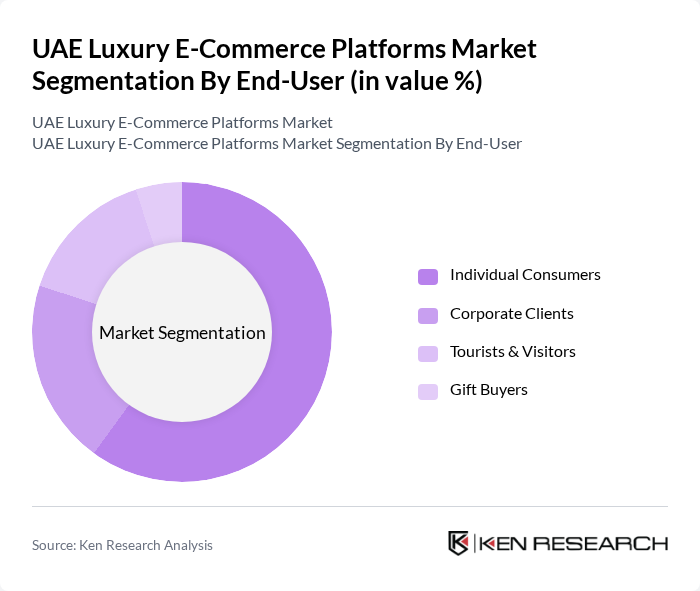

By End-User:The end-user segments in the UAE Luxury E-Commerce Platforms Market include Individual Consumers, Corporate Clients, Tourists & Visitors, and Gift Buyers.Individual Consumersdominate the market, accounting for the majority of online luxury purchases. The increasing trend of personal luxury shopping, coupled with the convenience of e-commerce and the availability of exclusive online offerings, has driven higher spending among individual consumers .

UAE Luxury E-Commerce Platforms Market Competitive Landscape

The UAE Luxury E-Commerce Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Namshi, Ounass, Farfetch, Bloomingdale's UAE, Saks Fifth Avenue UAE, Moda Operandi, The Luxury Closet, 6thStreet.com, Shopbop, Harvey Nichols Dubai, Level Shoes, Dior UAE, Gucci UAE, Louis Vuitton UAE, Chanel UAE, Net-A-Porter, Galeries Lafayette Dubai, Cartier UAE, Valentino UAE, Hermes UAE contribute to innovation, geographic expansion, and service delivery in this space.

UAE Luxury E-Commerce Platforms Market Industry Analysis

Growth Drivers

- Increasing Disposable Income Among Consumers:The UAE's GDP per capita is projected to reach approximately $47,000, reflecting a robust economic environment. This increase in disposable income allows consumers to allocate more funds towards luxury goods. The affluent population, which constitutes about 20% of the UAE's total population, is expected to drive luxury e-commerce sales significantly, as they seek high-end products online, enhancing the overall market growth.

- Rising Demand for Luxury Goods:The luxury goods market in the UAE is anticipated to grow to $7.6 billion, driven by a growing appetite for premium brands. Factors such as tourism, with over 14 million visitors expected annually, contribute to this demand. Additionally, the increasing number of high-net-worth individuals (HNWIs), which reached approximately 68,400, further fuels the desire for luxury products, making e-commerce platforms essential for accessibility.

- Expansion of Digital Payment Solutions:The UAE's digital payment market is projected to exceed $18 billion, driven by innovations in fintech and increased smartphone penetration, which is expected to reach approximately 99% of the population. This growth facilitates seamless transactions on luxury e-commerce platforms, enhancing consumer confidence and encouraging online purchases. The rise of contactless payments and digital wallets also supports the shift towards online luxury shopping, making it more convenient for consumers.

Market Challenges

- Intense Competition Among Platforms:The UAE luxury e-commerce market is characterized by fierce competition, with over 50 platforms vying for market share. Major players like Namshi and Ounass are investing heavily in marketing and technology to attract consumers. This competitive landscape can lead to price wars and reduced profit margins, making it challenging for new entrants to establish themselves and for existing platforms to maintain profitability.

- Logistics and Delivery Issues:The logistics sector in the UAE faces challenges, with delivery times averaging 2-4 days for e-commerce orders. This can be problematic for luxury goods, where consumers expect prompt and reliable service. Additionally, the cost of last-mile delivery can be high, impacting overall profitability for e-commerce platforms. Addressing these logistical hurdles is crucial for enhancing customer satisfaction and retaining clientele in the competitive luxury market.

UAE Luxury E-Commerce Platforms Market Future Outlook

The future of the UAE luxury e-commerce market appears promising, driven by technological advancements and changing consumer behaviors. As more consumers embrace online shopping, platforms are likely to invest in enhanced user experiences, including personalized services and augmented reality features. Additionally, the integration of sustainable practices in luxury offerings will resonate with environmentally conscious consumers, further shaping the market landscape. The focus on omnichannel strategies will also facilitate seamless shopping experiences across various platforms.

Market Opportunities

- Expansion into Untapped Markets:There is significant potential for luxury e-commerce platforms to expand into emerging markets within the GCC region. Countries like Oman and Bahrain, with growing affluent populations, present opportunities for luxury brands to establish a presence. Targeting these markets can lead to increased sales and brand loyalty, as consumers seek high-quality products that are not readily available locally.

- Collaborations with Luxury Brands:Strategic partnerships with established luxury brands can enhance the credibility and appeal of e-commerce platforms. Collaborations can lead to exclusive product launches and limited-edition collections, attracting high-end consumers. Such partnerships not only boost sales but also enhance brand visibility, positioning platforms as key players in the luxury market and fostering long-term customer relationships.