Region:Middle East

Author(s):Dev

Product Code:KRAB4282

Pages:92

Published On:October 2025

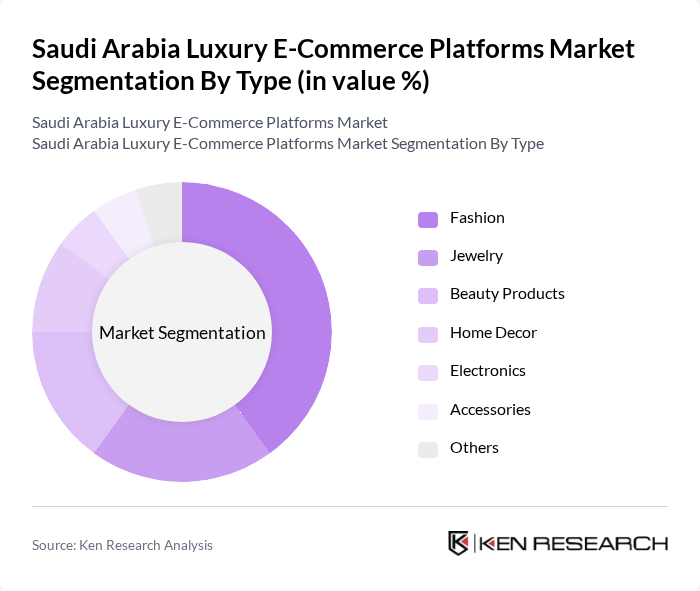

By Type:The luxury e-commerce market is segmented into various types, including Fashion, Jewelry, Beauty Products, Home Decor, Electronics, Accessories, and Others. Among these, the Fashion segment is the most dominant, driven by the increasing trend of online shopping for apparel and accessories. Consumers are increasingly drawn to luxury fashion brands, which offer exclusive collections and personalized shopping experiences online. The Jewelry segment also shows significant growth, as consumers invest in high-value items that signify status and wealth.

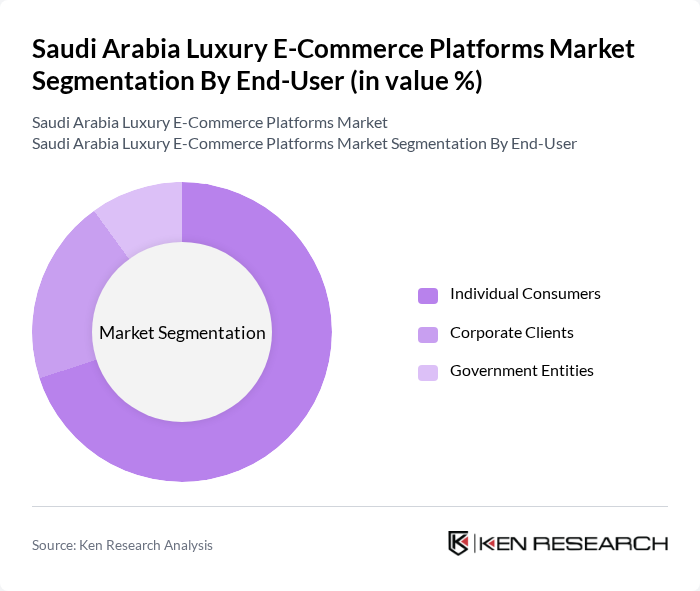

By End-User:The market is segmented into Individual Consumers, Corporate Clients, and Government Entities. Individual Consumers represent the largest segment, as they are the primary drivers of luxury e-commerce growth. The increasing trend of personal luxury consumption, especially among millennials and Gen Z, has led to a surge in online purchases. Corporate Clients and Government Entities also contribute to the market, but to a lesser extent, primarily through bulk purchases and gifting.

The Saudi Arabia Luxury E-Commerce Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Namshi, Ounass, Farfetch, Moda Operandi, Bloomingdale's, Saks Fifth Avenue, Harvey Nichols, LuisaViaRoma, The Luxury Closet, 6thStreet, Shopbop, Net-a-Porter, ASOS, Zalora, Jumia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury e-commerce market in Saudi Arabia appears promising, driven by technological advancements and changing consumer behaviors. As mobile commerce continues to grow, platforms that optimize their mobile interfaces will likely see increased engagement. Additionally, the integration of AI and personalized shopping experiences will enhance customer satisfaction, making luxury shopping more accessible and tailored. The focus on sustainability will also shape product offerings, aligning with consumer values and preferences in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fashion Jewelry Beauty Products Home Decor Electronics Accessories Others |

| By End-User | Individual Consumers Corporate Clients Government Entities |

| By Sales Channel | Direct-to-Consumer Third-Party Marketplaces Social Media Platforms |

| By Price Range | Premium Mid-Range Budget |

| By Payment Method | Credit/Debit Cards Cash on Delivery Digital Wallets |

| By Delivery Method | Standard Delivery Express Delivery Click and Collect |

| By Customer Demographics | Age Group Gender Income Level |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Fashion Purchases | 150 | Affluent Consumers, Fashion Enthusiasts |

| Luxury Electronics Sales | 100 | Tech Savvy Consumers, Gadget Buyers |

| High-End Accessories Market | 80 | Luxury Brand Loyalists, Accessory Collectors |

| Luxury Travel and Experiences | 70 | Frequent Travelers, Experience Seekers |

| Online Shopping Behavior | 120 | eCommerce Shoppers, Digital Natives |

The Saudi Arabia Luxury E-Commerce Platforms Market is valued at approximately USD 5 billion, driven by increasing disposable income, a shift towards online shopping, and rising demand for luxury goods among affluent consumers.