Region:Middle East

Author(s):Rebecca

Product Code:KRAB8167

Pages:84

Published On:October 2025

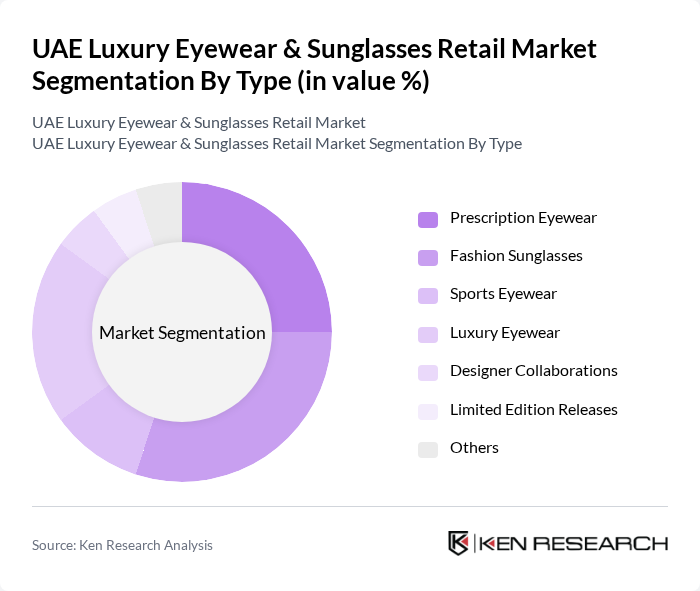

By Type:The market is segmented into various types of eyewear, including Prescription Eyewear, Fashion Sunglasses, Sports Eyewear, Luxury Eyewear, Designer Collaborations, Limited Edition Releases, and Others. Among these, Fashion Sunglasses and Luxury Eyewear are particularly popular due to their association with high fashion and celebrity endorsements. The demand for Prescription Eyewear is also significant, driven by the increasing prevalence of vision problems among the population.

By End-User:The end-user segmentation includes Men, Women, and Children. The market is predominantly driven by women, who are increasingly purchasing luxury eyewear as a fashion statement. Men also contribute significantly to the market, particularly in the luxury and sports eyewear segments. The children's segment is growing, driven by parents' willingness to invest in quality eyewear for their kids.

The UAE Luxury Eyewear & Sunglasses Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Luxottica Group S.p.A., Safilo Group S.p.A., Kering Eyewear, Marcolin S.p.A., Ray-Ban, Prada S.p.A., Chanel S.A., Dior S.A., Gucci, Fendi, Versace, Tom Ford, Oakley, Maui Jim, Bvlgari contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE luxury eyewear market appears promising, driven by evolving consumer preferences and technological advancements. As online shopping continues to rise, brands are expected to enhance their digital presence, catering to tech-savvy consumers. Additionally, the focus on UV protection and sustainable materials will likely shape product offerings, aligning with global trends towards health and environmental consciousness. This dynamic landscape presents opportunities for innovation and growth in the luxury eyewear sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Eyewear Fashion Sunglasses Sports Eyewear Luxury Eyewear Designer Collaborations Limited Edition Releases Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Luxury Boutiques Department Stores |

| By Price Range | Premium Mid-Range Budget |

| By Brand Positioning | High-End Luxury Brands Emerging Luxury Brands Mass Market Brands |

| By Material | Plastic Metal Wood |

| By Distribution Mode | Direct Sales Indirect Sales Franchise |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Eyewear Retailers | 100 | Store Managers, Brand Representatives |

| Affluent Consumers | 150 | High-income Individuals, Fashion Enthusiasts |

| Fashion Influencers | 50 | Stylists, Bloggers, Social Media Influencers |

| Market Analysts | 30 | Industry Experts, Market Researchers |

| Online Retail Platforms | 40 | E-commerce Managers, Digital Marketing Specialists |

The UAE Luxury Eyewear & Sunglasses Retail Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increasing disposable incomes and a rising trend in luxury fashion among consumers.