Region:Middle East

Author(s):Dev

Product Code:KRAB7427

Pages:98

Published On:October 2025

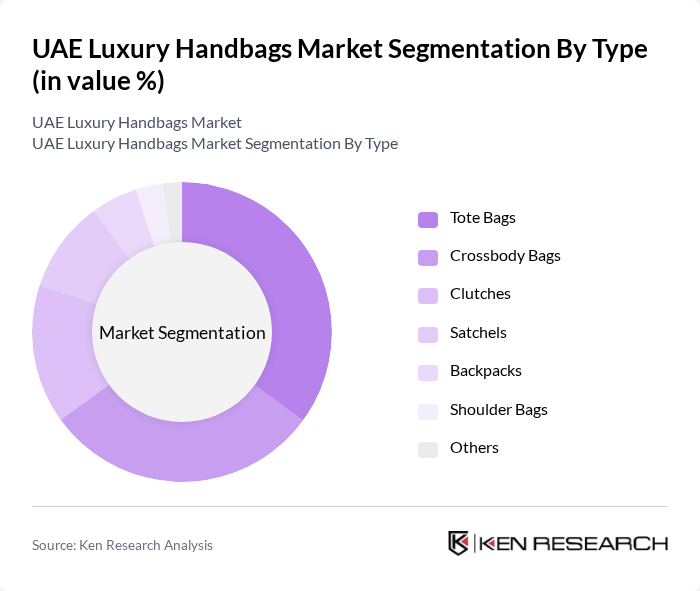

By Type:The luxury handbags market is segmented into various types, including Tote Bags, Crossbody Bags, Clutches, Satchels, Backpacks, Shoulder Bags, and Others. Among these, Tote Bags and Crossbody Bags are particularly popular due to their versatility and practicality. Tote Bags are favored for their spaciousness, making them ideal for daily use, while Crossbody Bags appeal to consumers seeking convenience and style. The demand for these types reflects changing consumer preferences towards functional yet fashionable accessories.

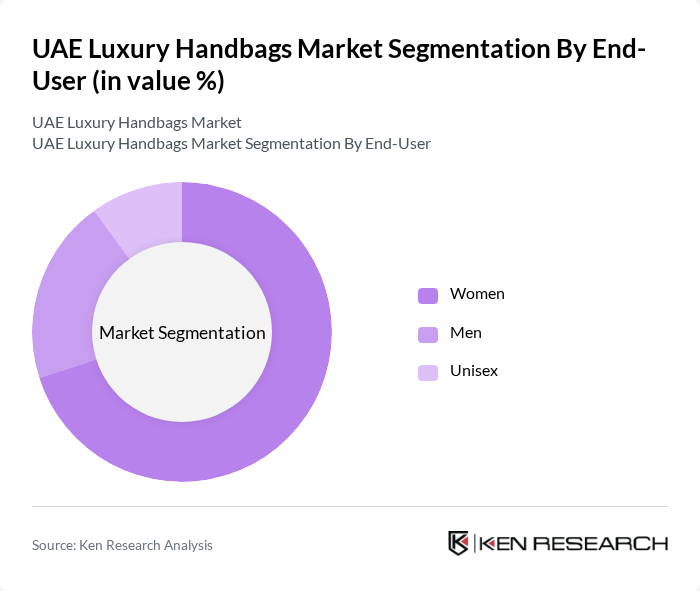

By End-User:The market is segmented by end-user into Women, Men, and Unisex. Women represent the largest segment, driven by a strong inclination towards luxury fashion and accessories. The increasing number of working women and their desire for stylish yet functional handbags contribute to this dominance. Men’s luxury handbags are gaining traction, but the overall market remains predominantly female-oriented, reflecting traditional consumer behavior in the luxury sector.

The UAE Luxury Handbags Market is characterized by a dynamic mix of regional and international players. Leading participants such as Louis Vuitton, Gucci, Chanel, Prada, Hermès, Fendi, Burberry, Dior, Michael Kors, Versace, Bottega Veneta, Salvatore Ferragamo, Balenciaga, Valentino, Celine contribute to innovation, geographic expansion, and service delivery in this space.

The UAE luxury handbags market is poised for significant evolution, driven by changing consumer preferences and technological advancements. As sustainability becomes a priority, brands are expected to innovate with eco-friendly materials and practices. Additionally, the integration of augmented reality and artificial intelligence in retail experiences will enhance customer engagement. These trends indicate a shift towards a more personalized and responsible luxury shopping experience, aligning with the values of the modern consumer.

| Segment | Sub-Segments |

|---|---|

| By Type | Tote Bags Crossbody Bags Clutches Satchels Backpacks Shoulder Bags Others |

| By End-User | Women Men Unisex |

| By Price Range | Below AED 1,000 AED 1,000 - AED 3,000 AED 3,000 - AED 5,000 Above AED 5,000 |

| By Distribution Channel | Online Retail Department Stores Specialty Stores Luxury Boutiques Others |

| By Material | Leather Synthetic Fabric Others |

| By Brand Positioning | High-End Luxury Affordable Luxury Premium |

| By Occasion | Casual Formal Travel Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Handbag Retailers | 100 | Store Managers, Sales Executives |

| High-Income Consumers | 150 | Affluent Shoppers, Fashion Enthusiasts |

| Luxury Brand Executives | 80 | Brand Managers, Marketing Directors |

| Fashion Influencers | 50 | Social Media Influencers, Fashion Bloggers |

| Market Analysts | 60 | Industry Analysts, Research Consultants |

The UAE Luxury Handbags Market is valued at approximately AED 3.5 billion, reflecting a significant growth trend driven by increasing disposable income and a rising preference for luxury goods among consumers.