Region:Middle East

Author(s):Dev

Product Code:KRAA5148

Pages:89

Published On:September 2025

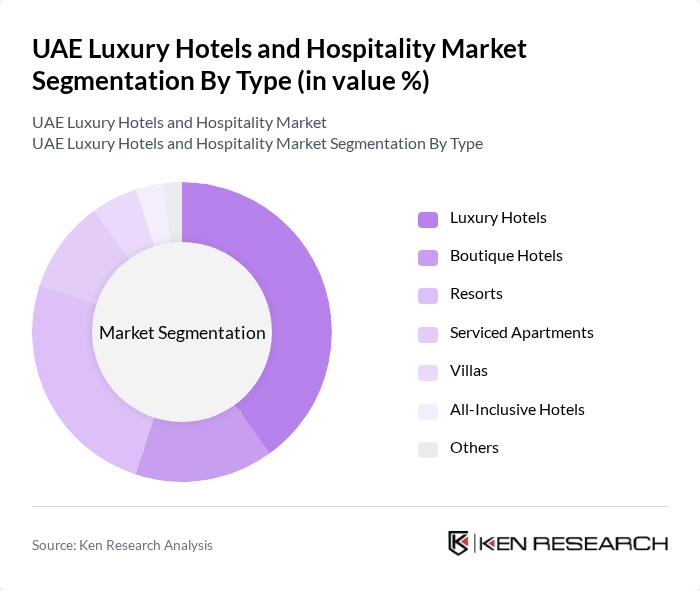

By Type:The market is segmented into various types, including Luxury Hotels, Boutique Hotels, Resorts, Serviced Apartments, Villas, All-Inclusive Hotels, and Others. Each type caters to different consumer preferences and travel purposes, with Luxury Hotels and Resorts being particularly popular among affluent travelers seeking premium experiences.

The Luxury Hotels segment dominates the market due to the high demand for premium accommodations among international tourists and business travelers. These hotels offer extensive amenities, personalized services, and unique experiences that cater to affluent clientele. The trend towards experiential travel has further fueled the growth of luxury hotels, as travelers seek distinctive and memorable stays. Resorts also hold a significant share, appealing to leisure travelers looking for relaxation and recreational activities.

By End-User:The market is segmented by end-user into Leisure Travelers, Business Travelers, Government Officials, Event Organizers, Tour Operators, and Others. Each segment has distinct needs and preferences, influencing the types of accommodations and services they seek.

Leisure Travelers represent the largest segment, driven by the UAE's appeal as a vacation destination. The influx of tourists seeking luxury experiences, coupled with the growing trend of wellness and adventure tourism, has significantly boosted this segment. Business Travelers also contribute substantially, as the UAE is a major hub for international conferences and corporate events, necessitating high-quality accommodations and services.

The UAE Luxury Hotels and Hospitality Market is characterized by a dynamic mix of regional and international players. Leading participants such as Jumeirah Group, Marriott International, Hilton Worldwide, Accor Hotels, Four Seasons Hotels and Resorts, Ritz-Carlton Hotel Company, InterContinental Hotels Group (IHG), Hyatt Hotels Corporation, Rosewood Hotels & Resorts, Anantara Hotels, Resorts & Spas, Address Hotels + Resorts, Waldorf Astoria Hotels & Resorts, Shangri-La Hotels and Resorts, Raffles Hotels and Resorts, Taj Hotels contribute to innovation, geographic expansion, and service delivery in this space.

The UAE luxury hotels and hospitality market is poised for continued growth, driven by increasing tourism and a focus on unique guest experiences. With the government’s commitment to enhancing tourism infrastructure and promoting events, the sector is expected to attract a diverse range of visitors. Additionally, the integration of technology and sustainability practices will likely shape the future landscape, ensuring that luxury hotels remain competitive and appealing to environmentally conscious travelers.

| Segment | Sub-Segments |

|---|---|

| By Type | Luxury Hotels Boutique Hotels Resorts Serviced Apartments Villas All-Inclusive Hotels Others |

| By End-User | Leisure Travelers Business Travelers Government Officials Event Organizers Tour Operators Others |

| By Price Range | Premium Luxury Ultra-Luxury Budget Luxury Others |

| By Location | Urban Areas Coastal Areas Desert Resorts Airport Proximity Others |

| By Service Type | Room Services Dining Services Spa and Wellness Services Event Hosting Services Concierge Services Others |

| By Customer Segment | Families Couples Solo Travelers Corporate Groups Others |

| By Booking Channel | Direct Booking Online Travel Agencies (OTAs) Travel Agents Corporate Bookings Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Hotel Guests | 150 | Frequent Travelers, Business Executives |

| Hotel Management Professionals | 100 | General Managers, Operations Directors |

| Travel Agents Specializing in Luxury | 80 | Luxury Travel Advisors, Agency Owners |

| Hospitality Industry Experts | 60 | Consultants, Market Analysts |

| Event Planners for Luxury Venues | 70 | Corporate Event Managers, Wedding Planners |

The UAE Luxury Hotels and Hospitality Market is valued at approximately USD 7 billion, reflecting significant growth driven by increased tourism and a rising demand for high-end experiences among travelers.