Region:Middle East

Author(s):Shubham

Product Code:KRAB1334

Pages:99

Published On:October 2025

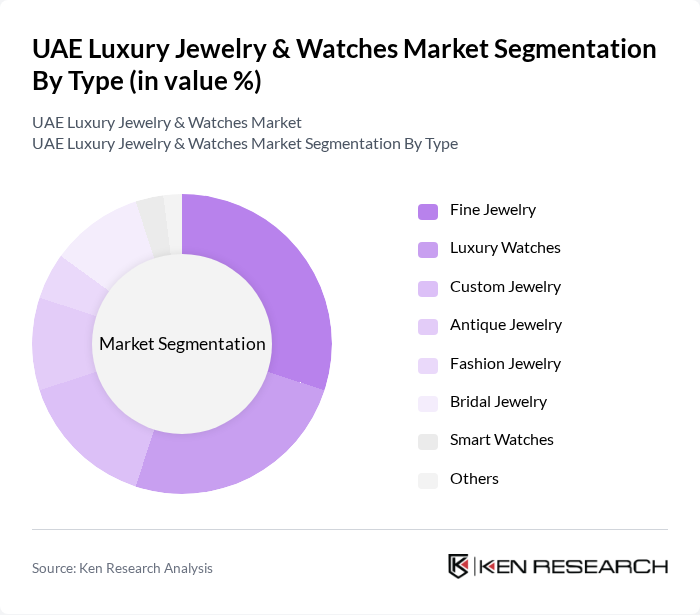

By Type:The market is segmented into Fine Jewelry, Luxury Watches, Custom Jewelry, Antique Jewelry, Fashion Jewelry, Bridal Jewelry, Smart Watches, and Others. Each sub-segment addresses distinct consumer preferences and occasions, with Fine Jewelry and Luxury Watches accounting for the largest shares due to their association with status, investment value, and gifting. The rising demand for Smart Watches and Custom Jewelry reflects evolving consumer tastes and the influence of technology and personalization .

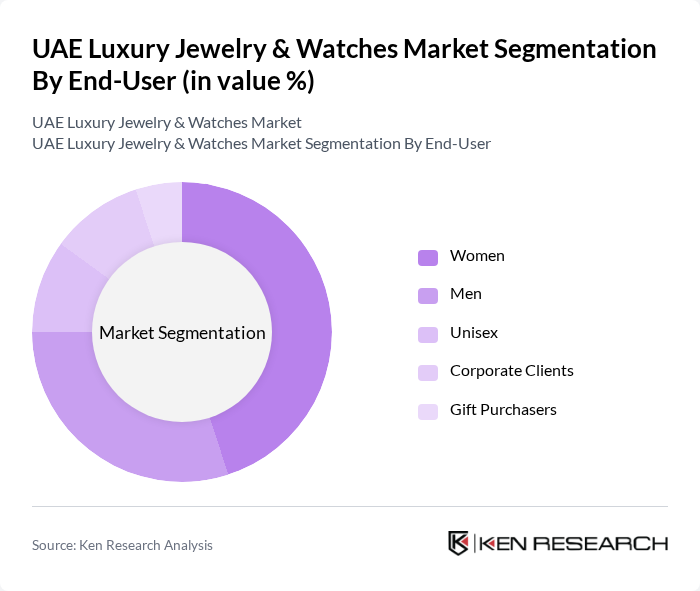

By End-User:The end-user segmentation includes Women, Men, Unisex, Corporate Clients, and Gift Purchasers. This segmentation reflects the diverse consumer base and varying preferences in luxury jewelry and watches. Women constitute the largest segment, followed by men, with unisex and corporate gifting segments also showing notable growth due to changing social and gifting trends .

The UAE Luxury Jewelry & Watches Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Jewellery, Damas Jewellery, Ahmed Seddiqi & Sons, Tiffany & Co., Cartier, Bulgari, Chopard, Van Cleef & Arpels, Graff, Piaget, Rolex, Patek Philippe, Audemars Piguet, Omega, Jaeger-LeCoultre contribute to innovation, geographic expansion, and service delivery in this space.

The UAE luxury jewelry and watches market is poised for continued growth, driven by rising disposable incomes and a robust tourism sector. As consumers increasingly seek personalized and sustainable options, brands that adapt to these preferences will thrive. The integration of digital technologies in retail will further enhance customer experiences, making luxury shopping more accessible. Additionally, the focus on ethical sourcing and sustainability will shape future product offerings, aligning with global consumer trends and expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Fine Jewelry Luxury Watches Custom Jewelry Antique Jewelry Fashion Jewelry Bridal Jewelry Smart Watches Others |

| By End-User | Women Men Unisex Corporate Clients Gift Purchasers |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Luxury Boutiques Department Stores Auction Houses |

| By Price Range | High-End Luxury Mid-Range Luxury Affordable Luxury |

| By Material | Gold Silver Platinum Diamonds Gemstones Others |

| By Occasion | Weddings Anniversaries Birthdays Corporate Events Festivals |

| By Brand Loyalty | Brand-Conscious Consumers Value-Seeking Consumers Trend-Focused Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Jewelry Retailers | 60 | Store Managers, Brand Representatives |

| High-End Watch Distributors | 50 | Sales Directors, Product Managers |

| Affluent Consumer Insights | 100 | Luxury Shoppers, High Net-Worth Individuals |

| Online Luxury Marketplaces | 40 | E-commerce Managers, Digital Marketing Heads |

| Luxury Event Organizers | 40 | Event Coordinators, Brand Marketing Executives |

The UAE Luxury Jewelry & Watches Market is valued at approximately USD 6.3 billion, which includes around USD 4.7 billion for jewelry and USD 1.6 billion for luxury watches, reflecting significant growth driven by rising disposable incomes and a robust tourism sector.