UK Luxury Jewelry & Watches Market Overview

- The UK Luxury Jewelry & Watches Market is valued at approximately GBP 8.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable incomes, a rising number of affluent consumers, and a growing trend towards luxury goods as status symbols. The market has seen a significant uptick in demand for high-end jewelry and watches, particularly among millennials and Gen Z consumers who prioritize luxury experiences.

- London stands out as the dominant city in the UK Luxury Jewelry & Watches Market, attributed to its status as a global financial hub and a center for luxury retail. Other notable cities include Manchester and Birmingham, which have also seen growth in luxury retail spaces. The presence of prestigious brands and a strong tourism sector further bolster the market in these regions, attracting both local and international consumers.

- In 2023, the UK government implemented regulations aimed at enhancing consumer protection in the luxury goods sector. This includes stricter guidelines on the authenticity and provenance of luxury jewelry and watches, ensuring that consumers are well-informed about their purchases. The regulations are designed to combat counterfeit products and promote transparency in the luxury market, thereby fostering consumer trust.

UK Luxury Jewelry & Watches Market Segmentation

By Type:The market is segmented into various types, including Fine Jewelry, Luxury Watches, Designer Jewelry, Custom-Made Jewelry, Antique Jewelry, Fashion Jewelry, and Others. Fine Jewelry and Luxury Watches are the leading segments, driven by consumer preferences for high-quality materials and craftsmanship. Designer and Custom-Made Jewelry are gaining traction as consumers seek personalized and unique pieces, while Antique Jewelry appeals to collectors and those interested in heritage pieces.

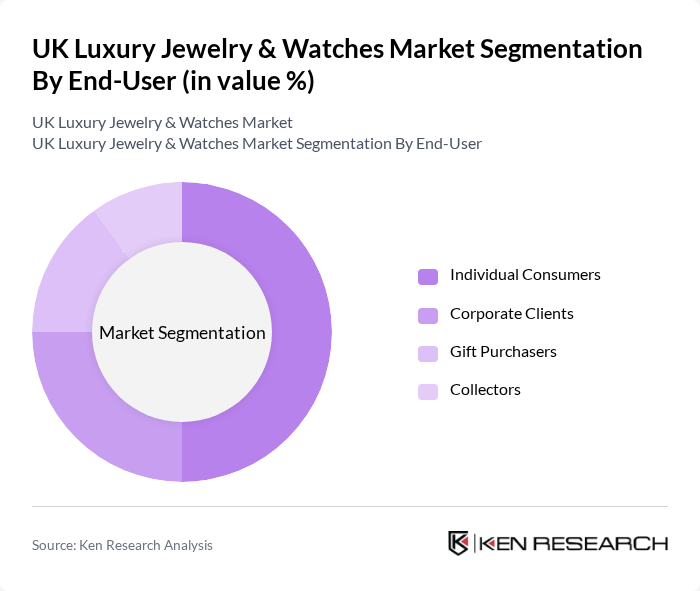

By End-User:The end-user segmentation includes Individual Consumers, Corporate Clients, Gift Purchasers, and Collectors. Individual Consumers dominate the market, driven by personal purchases and gifting occasions. Corporate Clients contribute significantly through bulk purchases for employee rewards and client gifts. Gift Purchasers are also a vital segment, particularly during holidays and special occasions, while Collectors focus on unique and high-value pieces, often driving trends in the luxury market.

UK Luxury Jewelry & Watches Market Competitive Landscape

The UK Luxury Jewelry & Watches Market is characterized by a dynamic mix of regional and international players. Leading participants such as Cartier, Tiffany & Co., Bulgari, Rolex, Chopard, Van Cleef & Arpels, Graff, Patek Philippe, Hermès, Boucheron, David Yurman, Piaget, Jaeger-LeCoultre, Audemars Piguet, Fendi contribute to innovation, geographic expansion, and service delivery in this space.

UK Luxury Jewelry & Watches Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The UK has seen a steady rise in disposable income, with the Office for National Statistics reporting an increase to £31,000 in future. This growth enables consumers to allocate more funds towards luxury items, including jewelry and watches. As disposable income rises, the demand for high-end products is expected to increase, driving sales in the luxury jewelry sector. This trend is particularly evident among millennials and affluent consumers who prioritize luxury purchases.

- Rising Demand for Customization:The luxury jewelry market is experiencing a significant shift towards personalization, with 62% of consumers expressing a preference for customized products. This trend is driven by the desire for unique pieces that reflect individual identity. Retailers are responding by offering bespoke services, which not only enhance customer satisfaction but also command higher price points. The customization trend is expected to continue growing, as brands invest in technology to facilitate personalized shopping experiences.

- Growth of E-commerce Platforms:E-commerce sales in the UK luxury jewelry sector are projected to reach £2.7 billion in future, reflecting a 16% increase from the previous year. The convenience of online shopping, coupled with enhanced digital marketing strategies, has made luxury jewelry more accessible to a broader audience. Brands are increasingly investing in their online presence, utilizing social media and targeted advertising to attract consumers, thus driving overall market growth.

Market Challenges

- Economic Uncertainty:The UK economy faces challenges, including inflation rates projected at 5.0% in future, which may impact consumer spending on luxury goods. Economic uncertainty can lead to cautious spending behavior, particularly among high-income consumers who may prioritize savings over luxury purchases. This trend poses a significant challenge for luxury jewelry brands, as they must navigate fluctuating consumer confidence and adapt their strategies accordingly.

- Counterfeit Products:The luxury jewelry market is increasingly threatened by counterfeit products, with estimates suggesting that counterfeit goods account for approximately £1.3 billion in losses annually in the UK. This issue undermines brand integrity and consumer trust, as counterfeit items can be difficult to distinguish from genuine products. Brands must invest in anti-counterfeiting measures and educate consumers to mitigate this challenge and protect their market share.

UK Luxury Jewelry & Watches Market Future Outlook

The UK luxury jewelry market is poised for growth, driven by evolving consumer preferences and technological advancements. As personalization becomes a key focus, brands will likely enhance their offerings to meet the demand for unique products. Additionally, the rise of e-commerce will continue to reshape the retail landscape, providing opportunities for brands to reach a wider audience. Sustainability will also play a crucial role, as consumers increasingly seek ethically sourced materials and transparent supply chains in their luxury purchases.

Market Opportunities

- Expansion into Emerging Markets:Luxury jewelry brands have significant opportunities to expand into emerging markets, where rising middle classes are increasingly seeking luxury products. Countries like India and Brazil are projected to see a 12% annual growth in luxury spending, presenting a lucrative avenue for brands to tap into new customer bases and diversify their revenue streams.

- Collaborations with Influencers:Collaborating with social media influencers can enhance brand visibility and attract younger consumers. With over 75% of millennials influenced by social media in their purchasing decisions, strategic partnerships can drive engagement and sales. Brands that leverage influencer marketing effectively can create authentic connections with their target audience, boosting brand loyalty and market presence.