Region:Middle East

Author(s):Rebecca

Product Code:KRAC9711

Pages:95

Published On:November 2025

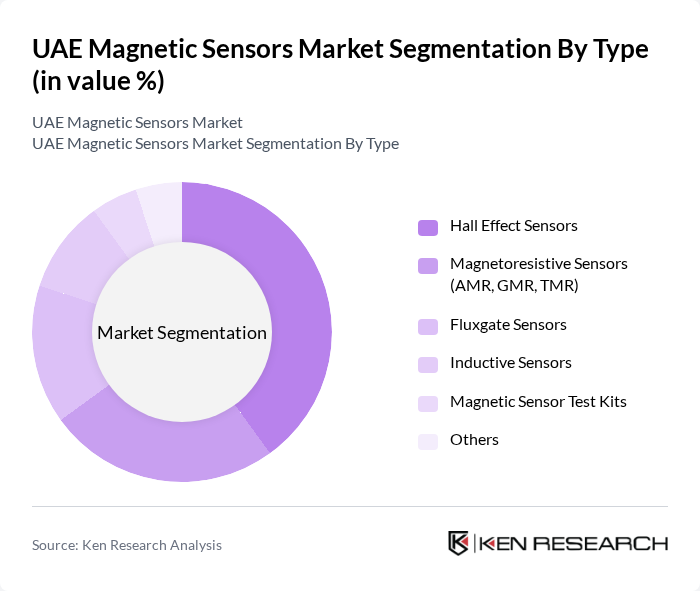

By Type:The market is segmented into various types of magnetic sensors, including Hall Effect Sensors, Magnetoresistive Sensors (AMR, GMR, TMR), Fluxgate Sensors, Inductive Sensors, Magnetic Sensor Test Kits, and Others. Among these, Hall Effect Sensors are the most widely used due to their versatility and reliability in various applications, particularly in automotive and industrial sectors. The increasing demand for precise position and speed sensing in vehicles and machinery has significantly contributed to the dominance of Hall Effect Sensors in the market.

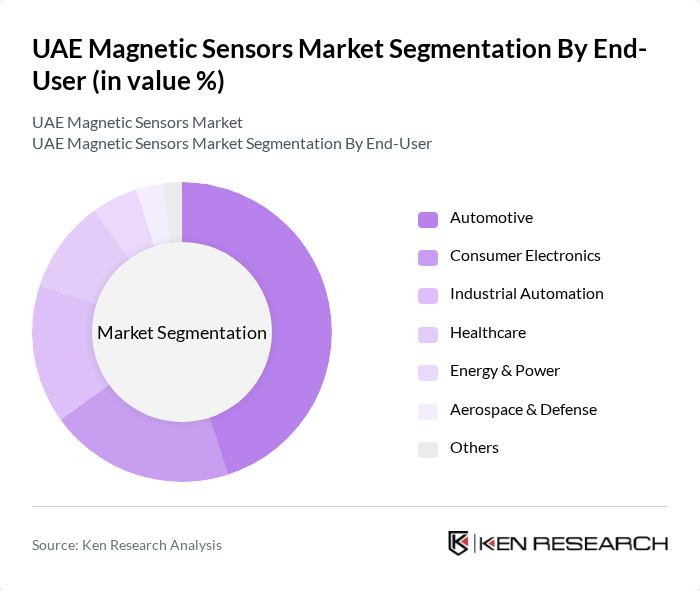

By End-User:The end-user segmentation includes Automotive, Consumer Electronics, Industrial Automation, Healthcare, Energy & Power, Aerospace & Defense, and Others. The automotive sector is the leading end-user of magnetic sensors, driven by the increasing integration of advanced driver-assistance systems (ADAS) and electric vehicles (EVs). The growing focus on vehicle safety and efficiency has led to a surge in demand for magnetic sensors in this sector, making it a key driver of market growth.

The UAE Magnetic Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., Siemens AG, Texas Instruments Incorporated, NXP Semiconductors N.V., STMicroelectronics N.V., Infineon Technologies AG, Analog Devices, Inc., Bosch Sensortec GmbH, TDK Corporation, Asahi Kasei Microdevices Corporation, Allegro Microsystems, LLC, Microchip Technology Inc., ams OSRAM AG, ON Semiconductor Corporation, Vishay Intertechnology, Inc., Schneider Electric SE, TE Connectivity Ltd., Omron Corporation, Melexis NV, Murata Manufacturing Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The UAE magnetic sensors market is poised for significant growth, driven by technological advancements and increasing integration into various sectors. The trend towards miniaturization and wireless sensor networks is expected to enhance the functionality and appeal of magnetic sensors. Additionally, the growing emphasis on sustainability and energy efficiency will likely lead to innovative applications in renewable energy systems, positioning the UAE as a leader in smart technology adoption and environmental stewardship in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Hall Effect Sensors Magnetoresistive Sensors (AMR, GMR, TMR) Fluxgate Sensors Inductive Sensors Magnetic Sensor Test Kits Others |

| By End-User | Automotive Consumer Electronics Industrial Automation Healthcare Energy & Power Aerospace & Defense Others |

| By Application | Position Sensing Speed Detection Current Sensing Navigation Systems Transmission & Steering Systems Robotics Medical Devices Electronic Appliances Others |

| By Technology | Analog Sensors Digital Sensors Integrated Sensors Others |

| By Industry Vertical | Automotive Consumer Electronics Industrial Automation Healthcare Energy & Power Aerospace & Defense Telecommunications Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Magnetic Sensors | 100 | Product Managers, Automotive Engineers |

| Industrial Applications of Magnetic Sensors | 80 | Operations Managers, Plant Engineers |

| Consumer Electronics Integration | 90 | Product Development Managers, Electronics Designers |

| Healthcare Device Sensors | 70 | Biomedical Engineers, Regulatory Affairs Specialists |

| Research and Development Insights | 60 | R&D Directors, Innovation Managers |

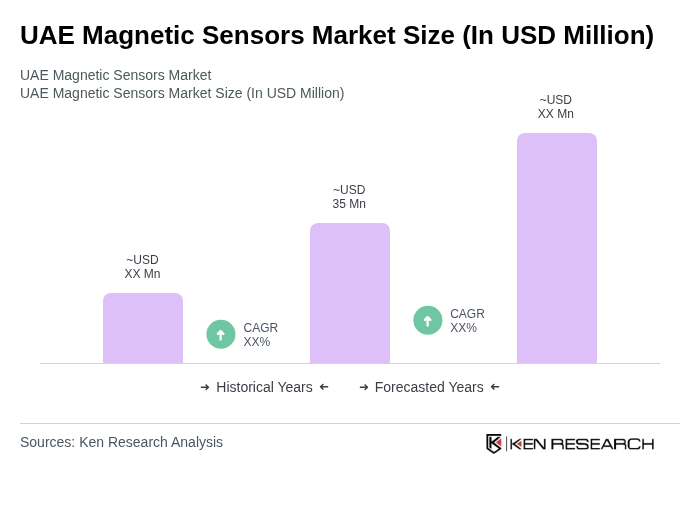

The UAE Magnetic Sensors Market is valued at approximately USD 35 million, reflecting a five-year historical analysis. This growth is driven by increasing automation demands across various sectors, including automotive and industrial applications, as well as consumer electronics.