Region:Middle East

Author(s):Shubham

Product Code:KRAA8682

Pages:87

Published On:November 2025

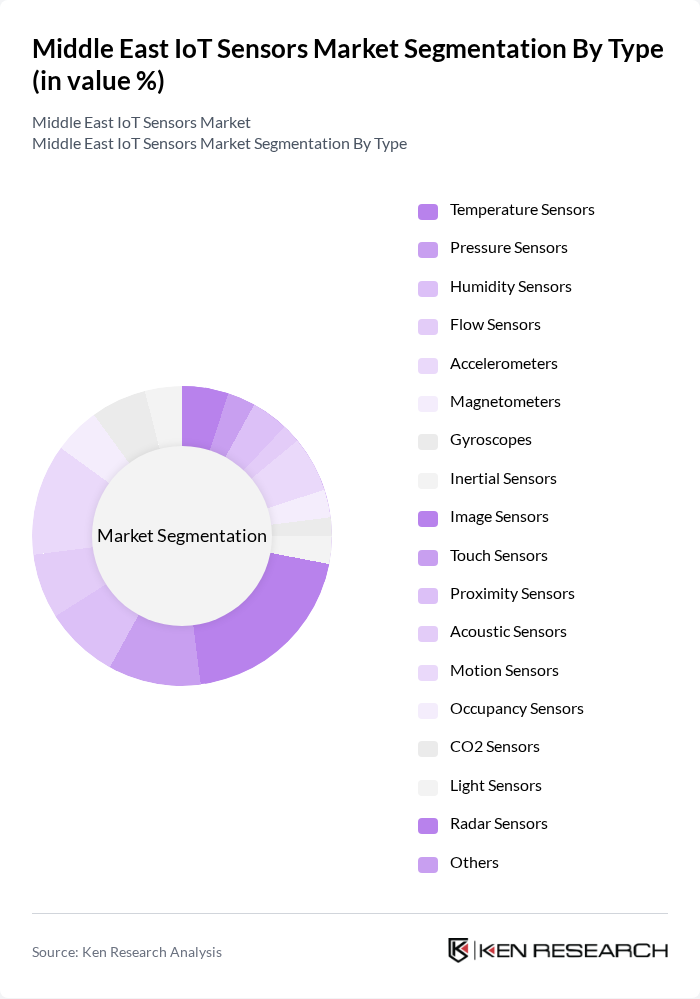

By Type:The market is segmented into various types of sensors, including Temperature Sensors, Pressure Sensors, Humidity Sensors, Flow Sensors, Accelerometers, Magnetometers, Gyroscopes, Inertial Sensors, Image Sensors, Touch Sensors, Proximity Sensors, Acoustic Sensors, Motion Sensors, Occupancy Sensors, CO2 Sensors, Light Sensors, Radar Sensors, and Others.Temperature Sensorshold the largest market share, driven by their widespread use in industrial automation, smart homes, and healthcare applications. Other sensor types serve specific applications across industries, such as predictive maintenance, environmental monitoring, and security systems .

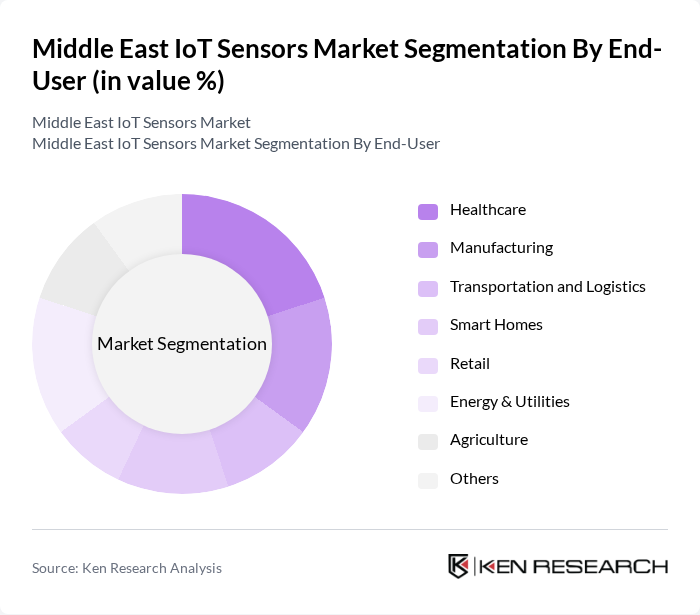

By End-User:The end-user segmentation includes Healthcare, Manufacturing, Transportation and Logistics, Smart Homes, Retail, Energy & Utilities, Agriculture, and Others.HealthcareandEnergy & Utilitiesare among the largest end-users, leveraging IoT sensors for patient monitoring, asset tracking, predictive maintenance, and energy management. Manufacturing and transportation sectors are rapidly integrating IoT sensors for automation, supply chain optimization, and safety improvements. Smart homes and agriculture are also significant contributors, using sensors for security, automation, and precision farming .

The Middle East IoT Sensors Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, Honeywell International Inc., Bosch Sensortec GmbH, STMicroelectronics N.V., Texas Instruments Incorporated, Analog Devices, Inc., NXP Semiconductors N.V., Infineon Technologies AG, Qualcomm Technologies, Inc., Schneider Electric SE, ABB Ltd., Emerson Electric Co., General Electric Company, Cisco Systems, Inc., Huawei Technologies Co., Ltd., Libelium Comunicaciones Distribuidas S.L., Sensirion AG, OMRON Corporation, Yokogawa Electric Corporation, Gulf Data International (GDI), Saudi Telecom Company (STC), Etisalat Group, Telit Communications PLC, SAP Middle East & North Africa, Schneider Electric Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East IoT sensors market appears promising, driven by technological advancements and increasing government support. As countries in the region continue to invest in digital infrastructure, the integration of AI and machine learning into IoT solutions will enhance operational efficiencies. Additionally, the expansion of 5G networks will facilitate faster data transmission, enabling real-time analytics and smarter applications across various sectors, including healthcare and agriculture, thereby fostering innovation and growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Temperature Sensors Pressure Sensors Humidity Sensors Flow Sensors Accelerometers Magnetometers Gyroscopes Inertial Sensors Image Sensors Touch Sensors Proximity Sensors Acoustic Sensors Motion Sensors Occupancy Sensors CO2 Sensors Light Sensors Radar Sensors Others |

| By End-User | Healthcare Manufacturing Transportation and Logistics Smart Homes Retail Energy & Utilities Agriculture Others |

| By Application | Smart Buildings Industrial Automation Environmental Monitoring Asset Tracking Smart Agriculture Intelligent Transport Systems Smart Grid & Energy Management Others |

| By Connectivity Technology | Cellular (3G/4G/5G) LPWAN (LoRaWAN, Sigfox, NB-IoT) Wi-Fi Bluetooth/BLE Zigbee Wired (Ethernet, Modbus, CAN) Others |

| By Industry Vertical | Healthcare Manufacturing Transportation Agriculture Energy and Utilities Oil & Gas Smart Cities Others |

| By Region | Saudi Arabia United Arab Emirates (UAE) Qatar Kuwait Oman Bahrain Levant Region North Africa Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Edge Deployment Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare IoT Applications | 100 | Healthcare IT Managers, Medical Device Manufacturers |

| Agricultural IoT Solutions | 60 | Agronomists, Farm Operations Managers |

| Industrial IoT Implementations | 90 | Manufacturing Engineers, Plant Managers |

| Smart City Initiatives | 70 | Urban Planners, City Officials |

| Retail IoT Innovations | 85 | Retail Managers, Supply Chain Analysts |

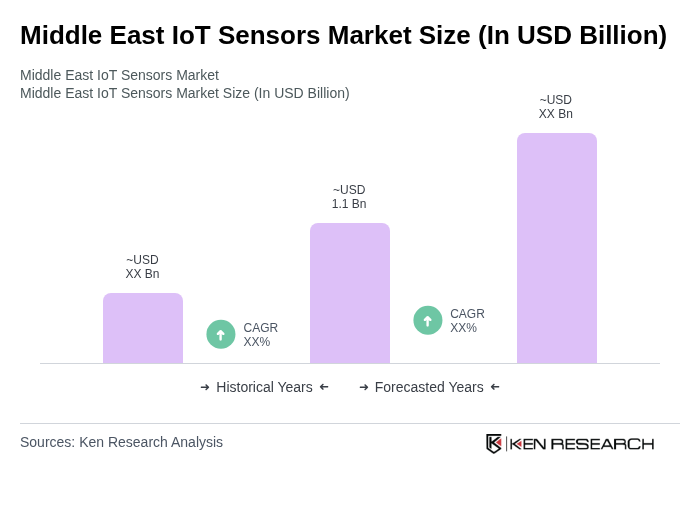

The Middle East IoT Sensors Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by the adoption of smart technologies across various sectors, including healthcare, manufacturing, and smart cities.