Region:Middle East

Author(s):Shubham

Product Code:KRAD6811

Pages:86

Published On:December 2025

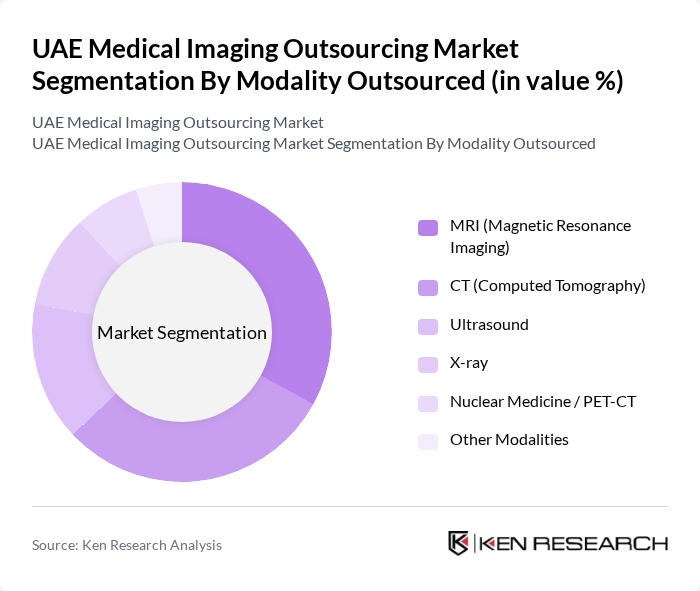

By Modality Outsourced:The modalities outsourced in the UAE Medical Imaging Outsourcing Market include various imaging techniques that cater to different diagnostic needs. The primary modalities are MRI, CT, Ultrasound, X-ray, Nuclear Medicine/PET-CT, and other modalities, which is consistent with the country-level segmentation used in major industry databooks. Each modality serves specific clinical requirements, with MRI and CT being the most commonly outsourced due to their advanced imaging capabilities, higher procedure costs, and high demand in complex diagnostic and emergency procedures.

The MRI (Magnetic Resonance Imaging) modality dominates the market, in line with UAE market data where MRI accounts for the largest revenue share among outsourced modalities, owing to its non-invasive nature and ability to provide detailed images of soft tissues for neuro, musculoskeletal, and oncology indications. CT (Computed Tomography) follows closely and is identified as the most lucrative and fastest-growing product segment, favored for its speed and accuracy in trauma, cardiac, and emergency settings. The increasing prevalence of chronic diseases, expansion of cancer and cardiac screening programs, and the need for precise, cross-sectional diagnostics drive the demand for these modalities, leading to a significant share in the outsourcing market.

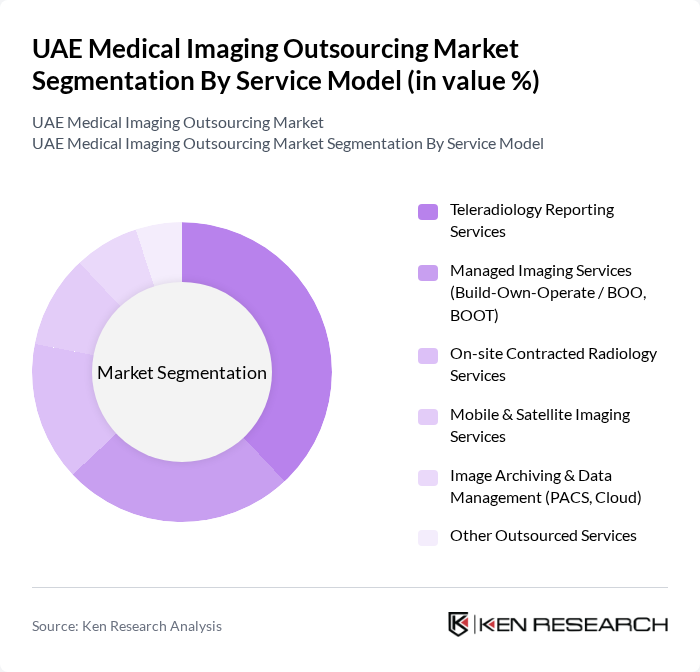

By Service Model:The service models in the UAE Medical Imaging Outsourcing Market include Teleradiology Reporting Services, Managed Imaging Services (Build-Own-Operate / BOO, BOOT), On-site Contracted Radiology Services, Mobile & Satellite Imaging Services, Image Archiving & Data Management (PACS, Cloud), and Other Outsourced Services. Each model offers unique advantages, catering to the diverse needs of healthcare providers and enhancing operational efficiency; this structure aligns with global practice where teleradiology and managed services dominate outsourced imaging value chains.

Teleradiology Reporting Services lead the market, reflecting global trends where remote reporting is the largest and fastest-growing outsourcing model due to its ability to provide timely and efficient diagnostic services across time zones and sites, especially where there is a shortage of radiologists. This model is particularly beneficial for healthcare facilities with limited in-house radiology staff and for after-hours and subspecialty reads. Managed Imaging Services also show significant growth as healthcare providers in the UAE and globally seek comprehensive solutions covering equipment procurement, lifecycle management, staffing, and performance guarantees under BOO/BOOT structures. The flexibility and cost-effectiveness of these service models, combined with the adoption of cloud-based PACS and AI-assisted workflows, contribute to their dominance in the outsourcing landscape.

The UAE Medical Imaging Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Health Services (EHS), Abu Dhabi Health Services Company (SEHA), Dubai Health Authority (DHA), Mediclinic Middle East, NMC Healthcare, Aster DM Healthcare (UAE Operations), VPS Healthcare (Burjeel, Medeor, LLH Hospitals), American Hospital Dubai, Saudi German Hospital Dubai, Cleveland Clinic Abu Dhabi, Sheikh Khalifa Medical City, Mediclinic City Hospital, Al Zahra Hospital Dubai, Prime Healthcare Group, Emirates Hospitals Group contribute to innovation, geographic expansion, and service delivery in this space, often leveraging teleradiology partnerships, integrated PACS platforms, and multi-site imaging networks across the UAE.

The future of the UAE medical imaging outsourcing market appears promising, driven by ongoing advancements in technology and increasing healthcare investments. As healthcare providers seek to enhance service delivery while managing costs, outsourcing is likely to become a strategic priority. The integration of artificial intelligence in imaging analysis and the expansion of telemedicine services will further reshape the landscape, enabling more efficient and accessible diagnostic solutions for patients across the region.

| Segment | Sub-Segments |

|---|---|

| By Modality Outsourced | MRI (Magnetic Resonance Imaging) CT (Computed Tomography) Ultrasound X?ray Nuclear Medicine / PET?CT Other Modalities |

| By Service Model | Teleradiology Reporting Services Managed Imaging Services (Build?Own?Operate / BOO, BOOT) On?site Contracted Radiology Services Mobile & Satellite Imaging Services Image Archiving & Data Management (PACS, Cloud) Other Outsourced Services |

| By End?User | Public Hospitals & Health Systems Private Hospitals Stand?alone Diagnostic Imaging Centers Specialty Clinics & Day Surgery Centers Research & Academic Institutions Others |

| By Application | Diagnostic Imaging Interventional / Procedural Imaging Support Second?Opinion & Sub?specialty Reporting Screening Programs (e.g., Oncology, Cardiology) Research & Clinical Trials Others |

| By Contract Type | Long?term Managed Service Contracts Short?term / Per?study Contracts Pay?per?use / Transactional Models Risk?sharing & Outcome?based Contracts Others |

| By Geographic Distribution | Abu Dhabi Dubai Sharjah Northern Emirates (Ajman, Umm Al Quwain, Ras Al Khaimah, Fujairah) |

| By Payer Mix | Government & Public Insurance Schemes Private Health Insurance Corporate / Self?funded Schemes Out?of?Pocket Payments |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Radiology Departments | 90 | Radiology Directors, Chief Medical Officers |

| Outsourced Imaging Service Providers | 70 | Business Development Managers, Operations Directors |

| Healthcare Consultants | 50 | Healthcare Strategy Advisors, Market Analysts |

| Medical Imaging Equipment Suppliers | 60 | Sales Managers, Product Specialists |

| Telemedicine Service Providers | 40 | Telehealth Coordinators, IT Managers |

The UAE Medical Imaging Outsourcing Market is valued at approximately USD 85 million, reflecting a significant growth driven by the increasing demand for advanced imaging technologies and the rising prevalence of chronic diseases.