Region:Middle East

Author(s):Geetanshi

Product Code:KRAD7897

Pages:86

Published On:December 2025

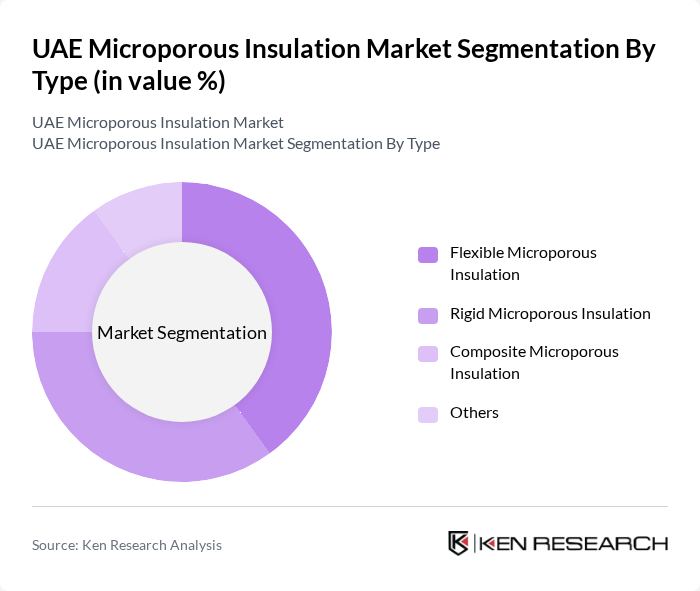

By Type:The market is segmented into various types of microporous insulation materials, including flexible panels, rigid boards and panels, composite, and others. Each type serves different applications and industries, catering to specific insulation needs.

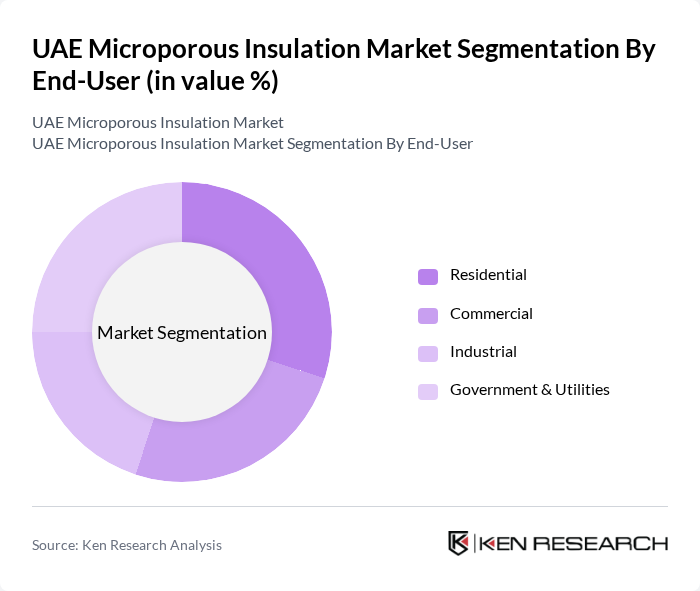

By End-User:The end-user segmentation includes residential, commercial, industrial, and government & utilities sectors. Each segment has unique requirements and contributes differently to the overall market dynamics.

The UAE Microporous Insulation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Owens Corning, Saint-Gobain, Rockwool International, Kingspan Group, Armacell International, BASF SE, Knauf Insulation, Johns Manville, Isolatek International, Unifrax, Thermafiber, Insulcon, Morgan Advanced Materials, Cellofoam, K-Flex contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE microporous insulation market appears promising, driven by ongoing government support for sustainable construction and increasing energy efficiency standards. As the construction sector continues to expand, particularly in urban areas, the demand for advanced insulation solutions is expected to rise. Additionally, the integration of smart building technologies will further enhance the appeal of microporous insulation, positioning it as a key player in the UAE's transition towards greener building practices and energy conservation.

| Segment | Sub-Segments |

|---|---|

| By Type | Flexible Microporous Insulation Rigid Microporous Insulation Composite Microporous Insulation Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Thermal Insulation Acoustic Insulation Fire Protection Others |

| By Material Composition | Silica-based Microporous Insulation Alumina-based Microporous Insulation Others |

| By Installation Method | Pre-Installed Post-Installed Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Building Projects | 100 | Architects, Project Managers |

| Commercial Construction Firms | 80 | Construction Managers, Procurement Officers |

| Industrial Applications of Insulation | 70 | Facility Managers, Operations Directors |

| Energy Efficiency Consultants | 60 | Energy Auditors, Sustainability Experts |

| Government Regulatory Bodies | 50 | Policy Makers, Regulatory Affairs Managers |

The UAE Microporous Insulation Market is valued at approximately USD 15 million, reflecting a growing demand for energy-efficient building materials and compliance with stringent energy consumption regulations in both residential and commercial sectors.