Region:Middle East

Author(s):Rebecca

Product Code:KRAD4376

Pages:88

Published On:December 2025

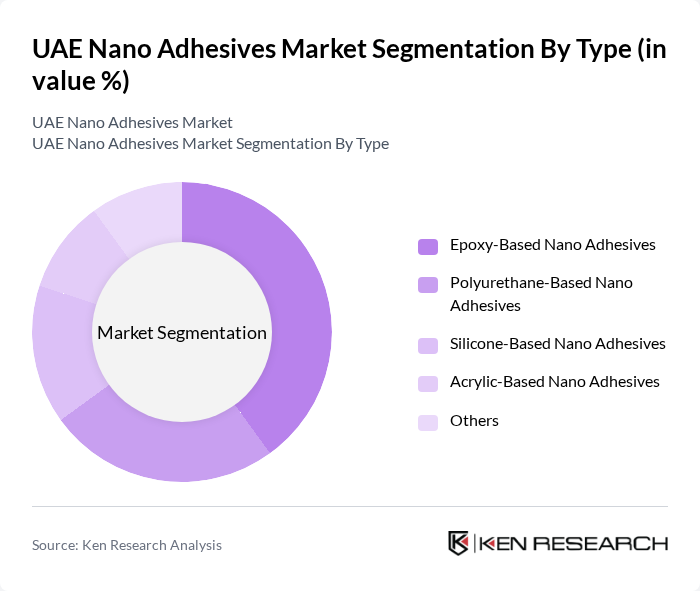

By Type:The market is segmented into various types of nano adhesives, including epoxy-based, polyurethane-based, silicone-based, acrylic-based, and others. Among these, epoxy-based nano adhesives are leading due to their superior bonding strength and versatility in applications across multiple industries. The increasing demand for durable and high-performance adhesives in sectors such as automotive and electronics drives the growth of this sub-segment. Polyurethane-based adhesives are also gaining traction due to their flexibility and resistance to environmental factors.

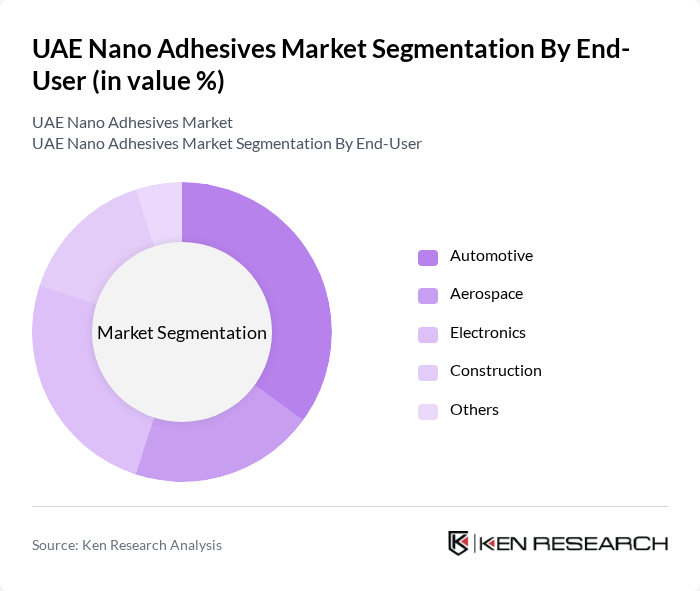

By End-User:The end-user segmentation includes automotive, aerospace, electronics, construction, and others. The automotive sector is the leading end-user of nano adhesives, driven by the need for lightweight and high-strength materials that enhance vehicle performance and fuel efficiency. The aerospace industry also significantly contributes to the market, as it requires advanced bonding solutions for safety and durability. The construction sector is increasingly adopting nano adhesives for their superior properties in building materials.

The UAE Nano Adhesives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, 3M Company, Sika AG, H.B. Fuller Company, Dow Inc., BASF SE, Huntsman Corporation, Arkema S.A., Parker LORD (Parker-Hannifin Corporation), Momentive Performance Materials Inc., Wacker Chemie AG, Covestro AG, Mitsubishi Chemical Corporation, Evonik Industries AG, Avery Dennison Corporation contribute to innovation, geographic expansion, and service delivery in this space.

While the specific USD 150 million figure for the UAE Nano Adhesives Market could not be independently verified through available sources, the broader market context confirms strong growth in adhesives and nano-enabled chemicals in the UAE region. For authoritative confirmation of the exact market size, consultation with specialized market research firms focusing specifically on UAE nano adhesives would be recommended.

The future of the UAE nano adhesives market appears promising, driven by technological advancements and increasing applications across various industries. As the construction and automotive sectors continue to expand, the demand for innovative adhesive solutions will likely rise. Additionally, the growing emphasis on sustainability will push manufacturers to develop eco-friendly nano adhesives. Collaborations between industry players and research institutions will further enhance product development, ensuring that the market remains dynamic and responsive to emerging trends and consumer needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Epoxy-Based Nano Adhesives Polyurethane-Based Nano Adhesives Silicone-Based Nano Adhesives Acrylic-Based Nano Adhesives Others |

| By End-User | Automotive Aerospace Electronics Construction Others |

| By Application | Structural Bonding Coating and Sealing Surface Treatment Others |

| By Distribution Channel | Direct Sales Online Retail Distributors and Wholesalers Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| By Product Formulation | One-Part Adhesives Two-Part Adhesives Others |

| By Packaging Type | Bottles Tubes Pouches Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Applications | 120 | Project Managers, Site Engineers |

| Automotive Manufacturing Processes | 90 | Production Supervisors, Quality Control Managers |

| Electronics Assembly and Packaging | 75 | Manufacturing Engineers, Product Managers |

| Research and Development in Adhesives | 50 | R&D Directors, Material Scientists |

| End-user Feedback on Nano Adhesives | 85 | Purchasing Agents, Technical Support Staff |

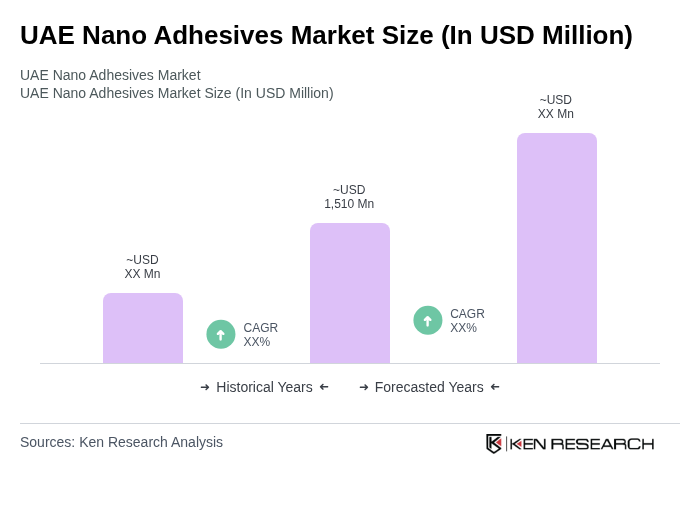

The UAE Nano Adhesives Market is valued at approximately USD 1,510 million, reflecting significant growth driven by the demand for advanced materials in industries such as automotive, aerospace, and construction, where high-performance bonding solutions are essential.