Region:Middle East

Author(s):Dev

Product Code:KRAC8808

Pages:84

Published On:November 2025

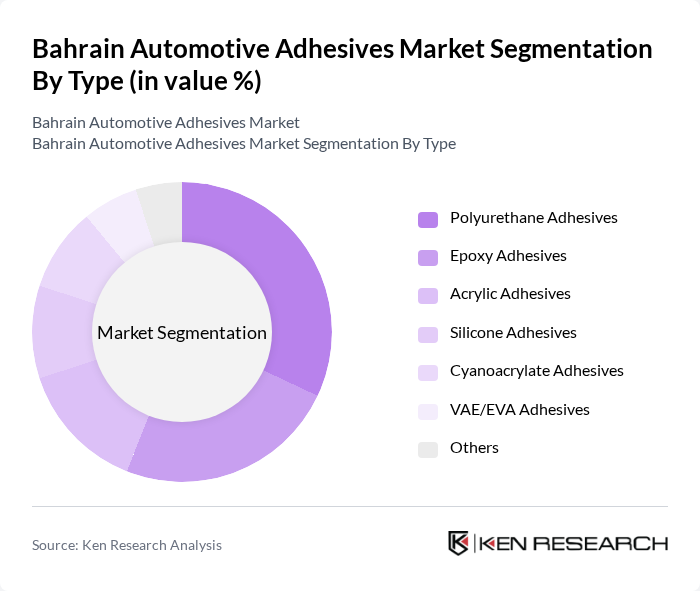

By Type:The automotive adhesives market can be segmented into various types, including Polyurethane Adhesives, Epoxy Adhesives, Acrylic Adhesives, Silicone Adhesives, Cyanoacrylate Adhesives, VAE/EVA Adhesives, and Others. Among these, Polyurethane Adhesives are gaining traction due to their excellent bonding properties and versatility in various automotive applications. Epoxy Adhesives are also popular for their high strength and durability, making them suitable for critical structural applications. The demand for these adhesives is driven by the increasing need for lightweight materials, enhanced vehicle performance, and the adoption of advanced manufacturing processes such as battery assembly for electric vehicles .

By Technology:The market can also be segmented based on technology into Hot Melt Adhesives, Solvent-Borne Adhesives, Water-Borne Adhesives, Reactive Adhesives, Pressure-Sensitive Adhesives, UV-Cured Adhesives, and Others. Hot Melt Adhesives are particularly favored for their quick bonding capabilities and ease of application, making them ideal for high-speed production lines. Water-Borne Adhesives are gaining popularity due to their eco-friendly properties and compliance with regional VOC emission standards, aligning with the industry's shift towards sustainability and regulatory requirements .

The Bahrain Automotive Adhesives Market is characterized by a dynamic mix of regional and international players. Leading participants such as Henkel AG & Co. KGaA, 3M Company, Sika AG, H.B. Fuller Company, PPG Industries, Inc., BASF SE, Dow Inc., Arkema S.A., RPM International Inc., Illinois Tool Works Inc. (ITW), Momentive Performance Materials Inc., Lord Corporation (Parker Hannifin Corporation), Covestro AG, Jowat SE, Franklin International contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive adhesives market in Bahrain appears promising, driven by the increasing focus on sustainability and technological innovation. As the automotive industry transitions towards electric vehicles, the demand for specialized adhesives that support lightweight and eco-friendly materials is expected to rise. Additionally, advancements in smart adhesive technologies will likely enhance product offerings, enabling manufacturers to meet the evolving needs of automotive OEMs and consumers alike, fostering a dynamic market environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyurethane Adhesives Epoxy Adhesives Acrylic Adhesives Silicone Adhesives Cyanoacrylate Adhesives VAE/EVA Adhesives Others |

| By Technology | Hot Melt Adhesives Solvent-Borne Adhesives Water-Borne Adhesives Reactive Adhesives Pressure-Sensitive Adhesives UV-Cured Adhesives Others |

| By Application | Body Panel Bonding Interior Trim Attachment Exterior Trim Attachment Glass Bonding Powertrain Applications Sealing Sound and Vibration Damping Others |

| By End-User | Passenger Vehicles Commercial Vehicles Two-Wheelers OEMs Aftermarket Others |

| By Packaging Type | Bulk Packaging Cartridge Packaging Sachet Packaging Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing Adhesives | 100 | Production Managers, Quality Control Engineers |

| Adhesive Suppliers to Automotive Sector | 80 | Sales Directors, Product Development Managers |

| Automotive Aftermarket Adhesives | 70 | Retail Managers, Product Line Managers |

| Research & Development in Adhesives | 60 | R&D Scientists, Technical Managers |

| Regulatory Compliance in Adhesives | 50 | Compliance Officers, Regulatory Affairs Managers |

The Bahrain Automotive Adhesives Market is valued at approximately USD 20 million, reflecting a five-year historical analysis and regional market share within the Middle East & Africa. This valuation highlights the growing demand for innovative adhesive solutions in the automotive sector.