Region:Middle East

Author(s):Rebecca

Product Code:KRAD6134

Pages:93

Published On:December 2025

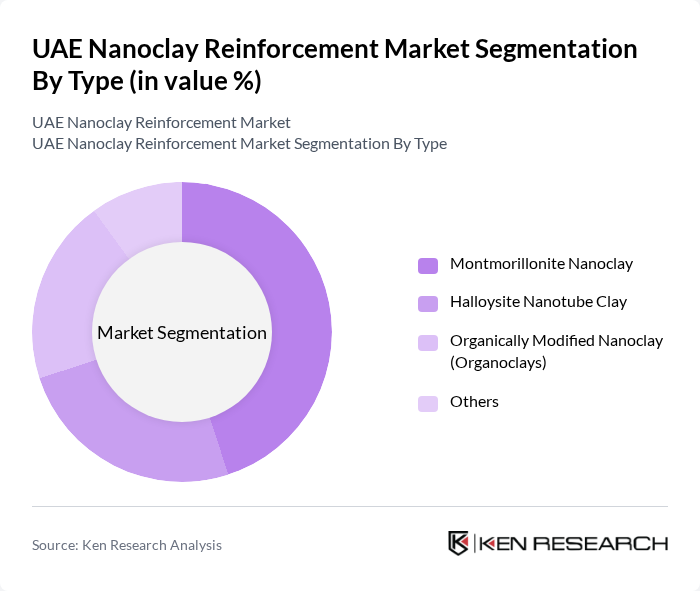

By Type:

The market is segmented into Montmorillonite Nanoclay, Halloysite Nanotube Clay, Organically Modified Nanoclay (Organoclays), and Others. Among these, Montmorillonite Nanoclay is the leading subsegment due to its widespread application in polymer nanocomposites for packaging films, automotive parts, coatings, and construction materials, in line with global nanoclay reinforcement usage patterns. Its unique properties, such as high surface area, cation?exchange capacity, and the ability to form intercalated and exfoliated structures in polymers, deliver excellent mechanical strength, thermal stability, and barrier performance, making it a preferred choice for manufacturers. The growing demand for lightweight, high?strength, and sustainable materials in the UAE’s automotive, packaging, and building sectors further drives the popularity of Montmorillonite Nanoclay as a cost?effective, low?loading additive that improves performance without major process changes.

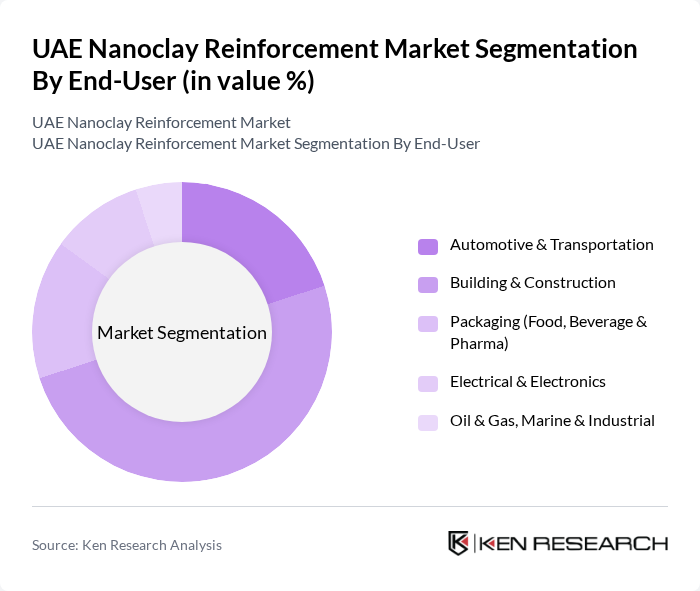

By End-User:

The end-user segmentation includes Automotive & Transportation, Building & Construction, Packaging (Food, Beverage & Pharma), Electrical & Electronics, and Oil & Gas, Marine & Industrial. The Building & Construction sector is a major segment, supported by sustained investment in infrastructure, residential, commercial, and industrial projects across the UAE and the growing integration of high?performance coatings, sealants, polymer-modified concrete, and composite panels that leverage nanoclays for improved durability, crack resistance, fire performance, and barrier properties. Rapid urbanization, smart city initiatives, and green building programs in Dubai and Abu Dhabi further contribute to the growth of this segment, as developers and contractors seek innovative, standards?compliant solutions to enhance energy efficiency, extend service life, and reduce maintenance of modern structures.

The UAE Nanoclay Reinforcement Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Imerys S.A., Clariant AG, Elementis PLC, BYK-Chemie GmbH (ALTANA Group), Arkema S.A., Nanocor, Inc., Nanophase Technologies Corporation, Evonik Industries AG, Merck KGaA, Sibelco NV, Cabot Corporation, AdMark International FZE (UAE), Ravago Middle East (UAE), BASF FZE (UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE nanoclay reinforcement market appears promising, driven by ongoing investments in sustainable construction practices and technological advancements. As the construction sector continues to expand, the demand for innovative materials that enhance performance and reduce environmental impact will grow. Additionally, the increasing focus on smart building technologies will likely create new applications for nanoclay, further solidifying its role in the evolving construction landscape of the UAE.

| Segment | Sub-Segments |

|---|---|

| By Type | Montmorillonite Nanoclay Halloysite Nanotube Clay Organically Modified Nanoclay (Organoclays) Others |

| By End-User | Automotive & Transportation Building & Construction Packaging (Food, Beverage & Pharma) Electrical & Electronics Oil & Gas, Marine & Industrial |

| By Application | Polymer Nanocomposites (Plastics & Elastomers) Coatings, Paints & Inks Adhesives & Sealants Others |

| By Distribution Channel | Direct Sales to OEMs & Compounders Specialty Chemical Distributors Online / E-Marketplace Sales Others |

| By Geography | Abu Dhabi Dubai Sharjah & Northern Emirates Others |

| By Product Form | Dry Powders Masterbatches & Concentrates Aqueous & Solvent-Based Dispersions Others |

| By Performance Characteristics | Mechanical Strength & Stiffness Enhancement Thermal & Fire Resistance Barrier & Corrosion-Resistance Properties Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Material Suppliers | 100 | Procurement Managers, Product Development Heads |

| Automotive Manufacturers | 80 | R&D Engineers, Materials Scientists |

| Packaging Industry Stakeholders | 70 | Operations Managers, Sustainability Officers |

| Research Institutions and Universities | 50 | Academic Researchers, Industry Collaborators |

| Government Regulatory Bodies | 30 | Policy Makers, Environmental Analysts |

The UAE Nanoclay Reinforcement Market is valued at approximately USD 30 million, driven by the increasing demand for lightweight and high-performance materials across various sectors, including automotive, construction, and packaging.