Region:Middle East

Author(s):Rebecca

Product Code:KRAC3894

Pages:98

Published On:October 2025

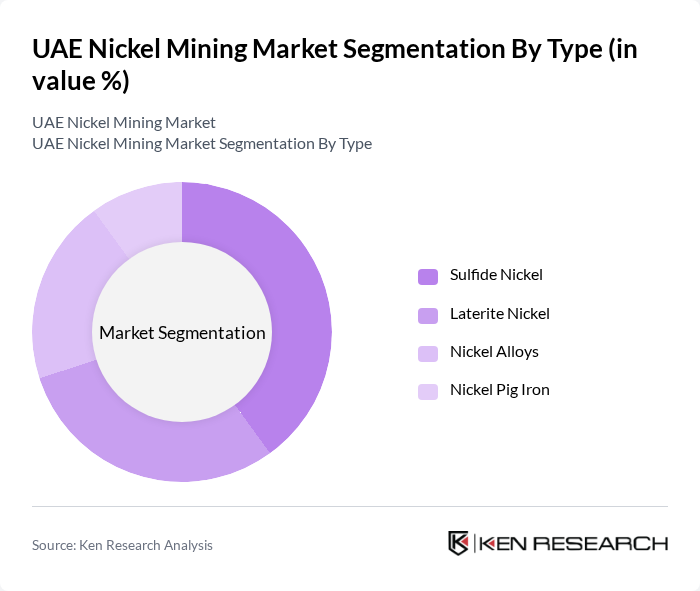

By Type:The nickel mining market is segmented into four main types: Sulfide Nickel, Laterite Nickel, Nickel Alloys, and Nickel Pig Iron. Each type has distinct characteristics and applications, influencing their market dynamics. Sulfide Nickel is primarily used in the production of stainless steel and batteries due to its high purity, while Laterite Nickel is favored for its abundance and suitability for large-scale extraction. Nickel Alloys are essential in high-performance applications such as aerospace and energy, and Nickel Pig Iron serves as a cost-effective alternative in steel production .

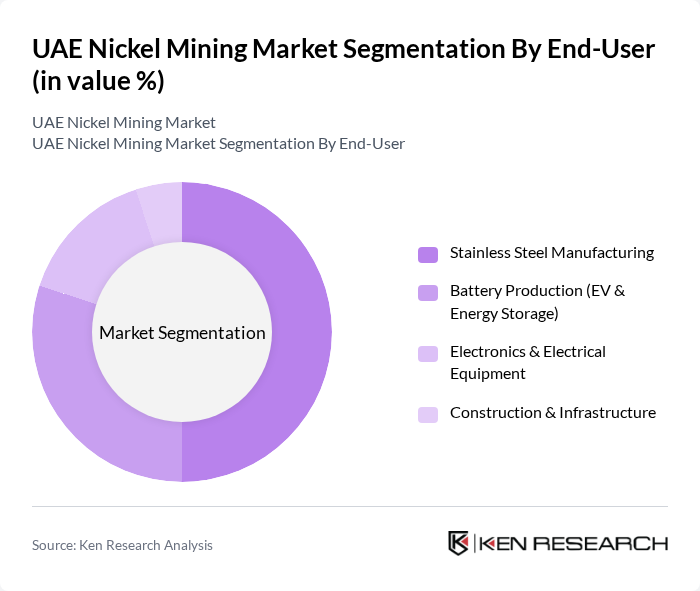

By End-User:The end-user segmentation includes Stainless Steel Manufacturing, Battery Production (EV & Energy Storage), Electronics & Electrical Equipment, and Construction & Infrastructure. Stainless Steel Manufacturing is the largest segment, driven by robust infrastructure projects and automotive sector demand. Battery Production is rapidly expanding due to the rise of electric vehicles and renewable energy storage, while Electronics & Electrical Equipment and Construction & Infrastructure also contribute significantly to the market .

The UAE Nickel Mining Market is characterized by a dynamic mix of regional and international players. Leading participants such as International Resources Holding (IRH), Orion Resource Partners, Jinchuan Group International Resources Co. Ltd., Sherritt International Corporation, BHP Group Ltd., Anglo American plc, Glencore plc, Eramet S.A., Vale S.A., Sumitomo Metal Mining Co., Ltd., MMC Norilsk Nickel PJSC, Tsingshan Holding Group Co., Ltd., Terrafame Ltd., IGO Limited, and Lundin Mining Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The UAE nickel mining market is poised for significant growth, driven by increasing demand from the stainless steel and electric vehicle sectors. With government initiatives aimed at enhancing mining infrastructure and attracting foreign investment, the market is expected to expand. However, companies must navigate challenges such as environmental compliance and price volatility. The focus on sustainable practices and technological advancements will likely shape the industry's future, creating a more resilient and competitive market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Sulfide Nickel Laterite Nickel Nickel Alloys Nickel Pig Iron |

| By End-User | Stainless Steel Manufacturing Battery Production (EV & Energy Storage) Electronics & Electrical Equipment Construction & Infrastructure |

| By Application | Battery Manufacturing Stainless Steel Production Plating and Coating Chemical Production |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Pricing Strategy | Premium Pricing Competitive Pricing Value-Based Pricing |

| By Others | Niche Applications Emerging Markets |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mining Operations | 60 | Mining Engineers, Operations Managers |

| Regulatory Compliance | 50 | Compliance Officers, Environmental Managers |

| Supply Chain Management | 50 | Logistics Coordinators, Procurement Managers |

| Market Research & Analysis | 40 | Market Analysts, Business Development Managers |

| Investment & Financing | 40 | Financial Analysts, Investment Managers |

The UAE Nickel Mining Market is valued at approximately USD 2.3 billion, driven by increasing demand for nickel in stainless steel production and battery manufacturing for electric vehicles.