Region:Middle East

Author(s):Dev

Product Code:KRAD5224

Pages:83

Published On:December 2025

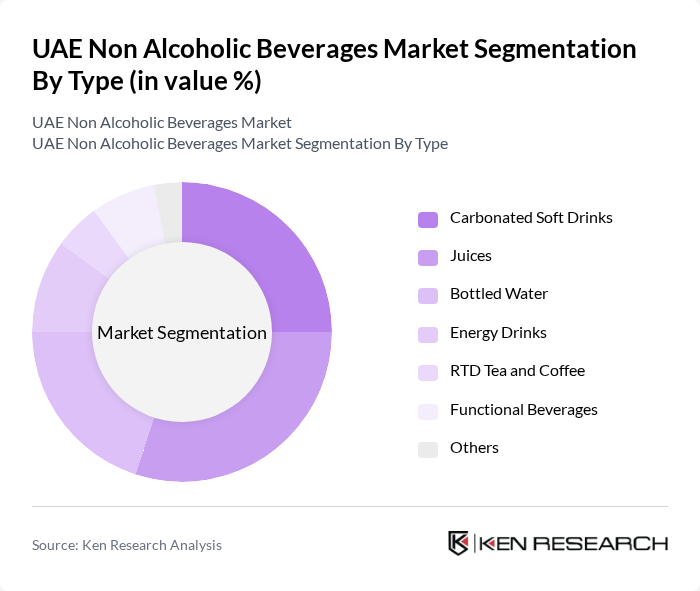

By Type:The non-alcoholic beverages market can be segmented into various types, including carbonated soft drinks, juices, bottled water, energy drinks, RTD tea and coffee, functional beverages, and others. Each of these segments caters to different consumer preferences and trends, with bottled water and juices currently leading the market in volume due to their health-oriented appeal, while low- and zero-sugar carbonated drinks and functional beverages are gaining traction as consumers seek better-for-you formulations and added benefits such as electrolytes, vitamins, and natural ingredients.

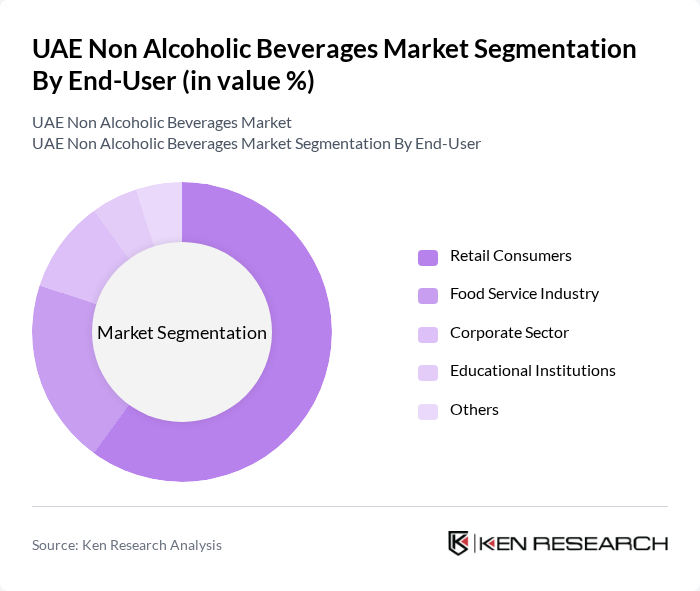

By End-User:The end-user segmentation includes retail consumers, the food service industry, the corporate sector, educational institutions, and others. Retail consumers dominate the market, driven by the increasing availability of non-alcoholic beverages in supermarkets, hypermarkets, convenience stores, and e?commerce platforms, as well as a growing trend towards health-conscious consumption and at?home indulgence. The food service industry, including hotels, restaurants, cafés, and catering, is also expanding its non-alcoholic offerings such as mocktails, zero?alcohol beers, and functional drinks to meet rising demand for premium and experiential beverage options.

The UAE Non Alcoholic Beverages Market is characterized by a dynamic mix of regional and international players. Leading participants such as PepsiCo, Coca-Cola (Aujan Coca-Cola Beverages Company), Nestlé, Al Ain Water, Masafi, Emirates Refreshments, Almarai, National Food Products Company (NFPC), Red Bull, Monster Beverage Corporation, Del Monte Foods, FrieslandCampina, Danone, Tropicana Products, Ribena contribute to innovation, geographic expansion, and service delivery in this space.

The UAE non-alcoholic beverages market is poised for dynamic growth, driven by evolving consumer preferences and innovative product offerings. As health consciousness continues to rise, brands are likely to focus on developing functional and plant-based beverages. Additionally, the expansion of e-commerce and retail channels will facilitate greater market penetration. Companies that adapt to these trends and invest in sustainable practices will likely gain a competitive edge, positioning themselves favorably in this rapidly changing landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Carbonated Soft Drinks Juices Bottled Water Energy Drinks RTD Tea and Coffee Functional Beverages Others |

| By End-User | Retail Consumers Food Service Industry Corporate Sector Educational Institutions Others |

| By Distribution Channel | Supermarkets and Hypermarkets Convenience Stores Online Retail Vending Machines Others |

| By Packaging Type | Glass Bottles Plastic Bottles Cans Tetra Packs Others |

| By Flavor | Citrus Berry Tropical Herbal Others |

| By Price Range | Economy Mid-Range Premium Others |

| By Region | Abu Dhabi Dubai Sharjah Ajman Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in Soft Drinks | 150 | Regular Consumers, Health-Conscious Shoppers |

| Market Insights from Beverage Retailers | 100 | Store Managers, Category Buyers |

| Trends in Juice Consumption | 80 | Health Enthusiasts, Parents |

| Functional Beverages Market Analysis | 70 | Fitness Trainers, Nutritionists |

| Impact of Marketing Strategies | 90 | Marketing Managers, Brand Strategists |

The UAE Non Alcoholic Beverages Market is valued at approximately USD 3.8 billion, reflecting significant growth driven by health consciousness and a shift towards healthier beverage options, including zero-alcohol and functional drinks.