Region:Middle East

Author(s):Dev

Product Code:KRAD7681

Pages:94

Published On:December 2025

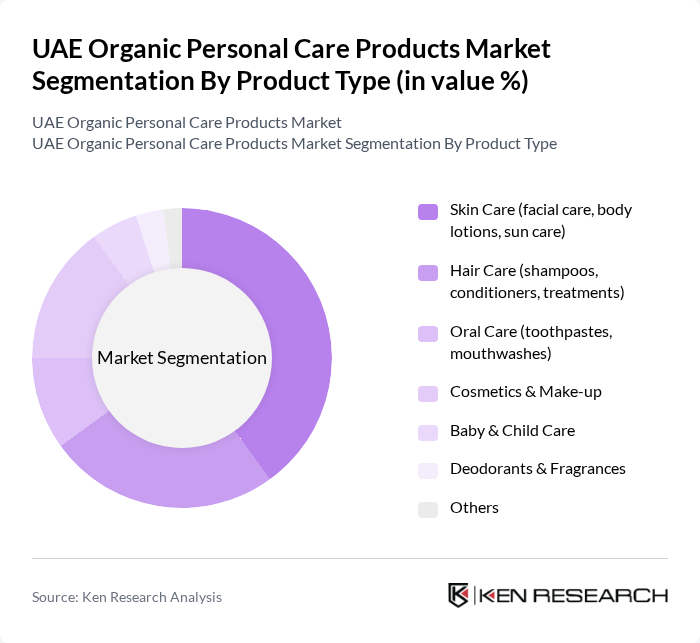

By Product Type:The product type segmentation includes various categories such as Skin Care, Hair Care, Oral Care, Cosmetics & Make-up, Baby & Child Care, Deodorants & Fragrances, and Others. Among these, Skin Care products, which encompass facial care, body lotions, and sun care, dominate the market due to the increasing focus on skincare routines and the rising awareness of skin health. Consumers are increasingly opting for organic formulations that promise fewer chemicals and more natural ingredients, driving the growth of this segment.

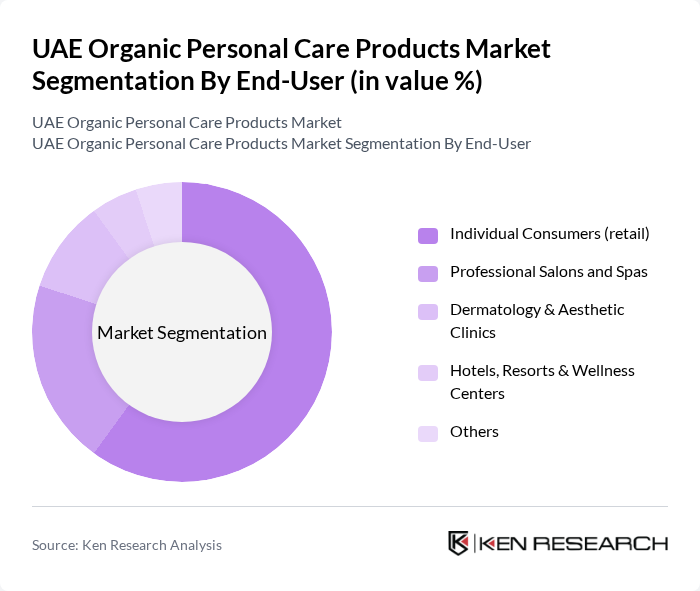

By End-User:The end-user segmentation includes Individual Consumers (retail), Professional Salons and Spas, Dermatology & Aesthetic Clinics, Hotels, Resorts & Wellness Centers, and Others. Individual Consumers dominate the market, driven by the increasing trend of self-care and personal grooming. The rise of e-commerce has also facilitated access to organic personal care products, allowing consumers to explore and purchase a wide range of options conveniently.

The UAE Organic Personal Care Products Market is characterized by a dynamic mix of regional and international players. Leading participants such as Neal’s Yard Remedies (UAE), Lush Fresh Handmade Cosmetics (UAE), The Body Shop (UAE), Weleda AG, Dr. Hauschka (WALA Heilmittel GmbH), Aesop (Natura &Co), Herbline Essentials LLC (Dubai), Shiffa Dubai Skincare, Juicy Chemistry (UAE distribution), Sukin (UAE distribution), Neal’s Yard Remedies Dubai Franchise Partners, Green Bar (regional clean beauty brand), Ixora Organic Beauty (Dubai), Organic Harvest (UAE distribution), Faith In Nature (UAE distribution) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE organic personal care products market appears promising, driven by evolving consumer preferences and increasing environmental consciousness. As the market adapts to trends such as veganism and cruelty-free products, brands are likely to innovate and diversify their offerings. Additionally, the rise of e-commerce platforms will facilitate greater accessibility, allowing consumers to explore a wider range of organic products. This dynamic landscape presents opportunities for growth and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Skin Care (facial care, body lotions, sun care) Hair Care (shampoos, conditioners, treatments) Oral Care (toothpastes, mouthwashes) Cosmetics & Make-up Baby & Child Care Deodorants & Fragrances Others |

| By End-User | Individual Consumers (retail) Professional Salons and Spas Dermatology & Aesthetic Clinics Hotels, Resorts & Wellness Centers Others |

| By Distribution Channel | Online (brand e-shops & marketplaces) Supermarkets/Hypermarkets Specialty Beauty & Organic Stores Pharmacies & Drugstores Department Stores & Duty-Free Others |

| By Ingredient & Certification | Certified Organic (e.g., COSMOS, USDA, Ecocert) Natural / Clean-Label (non-certified) Vegan & Cruelty-Free Halal-certified Organic Others |

| By Packaging Type | Recyclable Packaging (glass, PET, paper) Biodegradable / Compostable Packaging Refillable / Reusable Packaging Minimal & Plastic-free Packaging Others |

| By Price Range | Premium / Luxury Mass Premium / Mid-range Mass / Economy Value Packs & Promotions |

| By Consumer Demographics | Age Group (Gen Z, Millennials, Gen X, Others) Gender (Women, Men, Unisex) Income Level (High, Upper-Mid, Mid, Value) Expat vs Emirati Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Organic Skincare | 120 | Female Consumers, Ages 18-45 |

| Retail Insights on Organic Haircare Products | 90 | Store Managers, Beauty Advisors |

| Market Trends in Organic Cosmetics | 80 | Makeup Artists, Beauty Influencers |

| Distribution Channel Effectiveness for Organic Products | 70 | Distributors, Retail Buyers |

| Regulatory Impact on Organic Personal Care | 60 | Regulatory Experts, Industry Analysts |

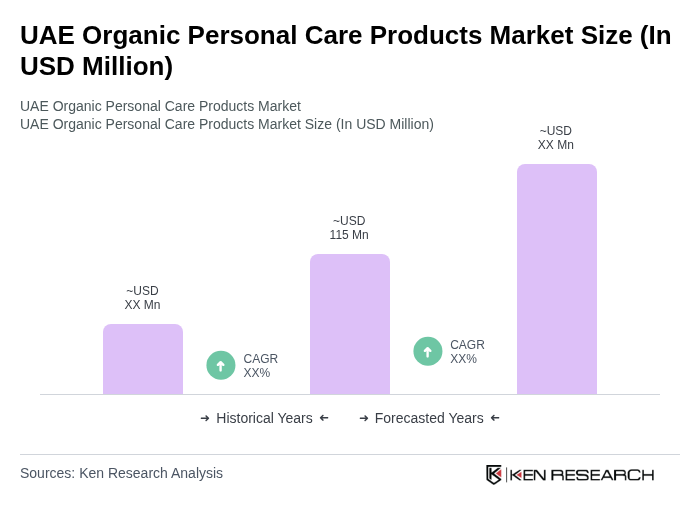

The UAE Organic Personal Care Products Market is valued at approximately USD 115 million, reflecting a significant growth trend driven by increasing consumer awareness of organic ingredients and a rising demand for sustainable products.