Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5982

Pages:84

Published On:December 2025

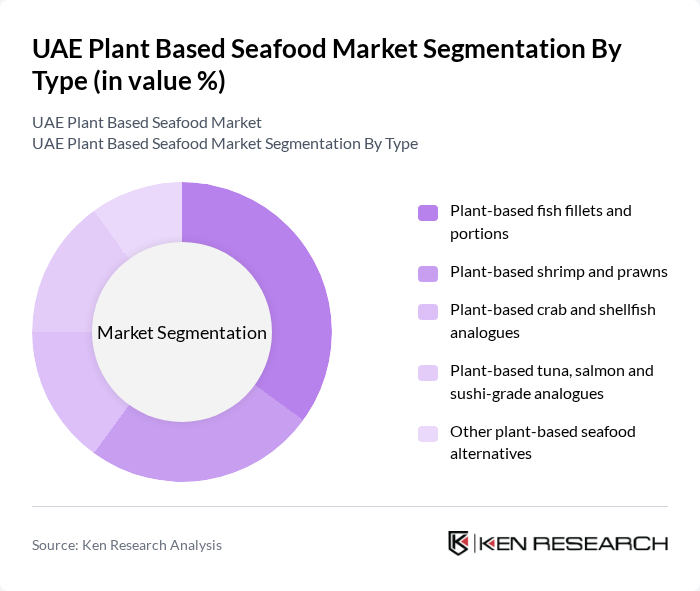

By Type:The market is segmented into various types of plant-based seafood alternatives, including plant-based fish fillets and portions, plant-based shrimp and prawns, plant-based crab and shellfish analogues, plant-based tuna, salmon and sushi-grade analogues, and other plant-based seafood alternatives. Among these, plant-based fish fillets and portions are leading the market due to their versatility and consumer preference for familiar textures and flavors. The increasing availability of these products in retail and foodservice channels has further fueled their popularity.

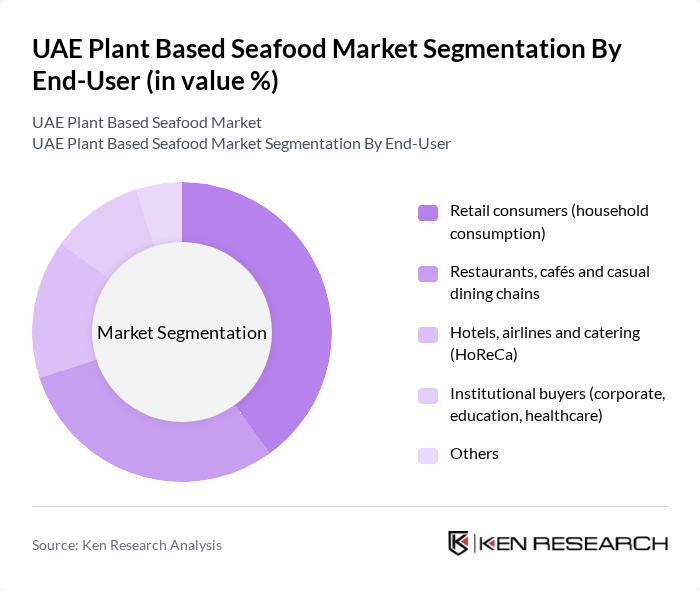

By End-User:The end-user segmentation includes retail consumers (household consumption), restaurants, cafés and casual dining chains, hotels, airlines and catering (HoReCa), institutional buyers (corporate, education, healthcare), and others. Retail consumers are the dominant segment, driven by the increasing trend of home cooking and the availability of plant-based seafood products in supermarkets. The growing health consciousness among consumers has led to a surge in demand for convenient and nutritious meal options.

The UAE Plant Based Seafood Market is characterized by a dynamic mix of regional and international players. Leading participants such as OmniFoods (OmniSeafood), Good Catch (Gathered Foods), The Plant Based Seafood Co., New Wave Foods, Hooked Foods, Nestlé S.A. (Garden Gourmet / Vrimp, Vrimp Scampi), Unilever PLC (The Vegetarian Butcher), Vegan Finest Foods (Vegan Zeastar), Future Farm (Futuro Burger & seafood analogues), Oddlygood Global, Veganz Group AG, Quorn Foods, locally distributed private labels of Carrefour UAE (e.g., Carrefour Plant-Based range), Spinneys / Waitrose UAE private label plant-based seafood range, Regional foodservice distributors active in plant-based seafood (e.g., Bidfood UAE) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE plant-based seafood market appears promising, driven by increasing consumer awareness and a growing emphasis on sustainability. As the government continues to support plant-based initiatives, the market is likely to see enhanced product offerings and improved distribution channels in future. Innovations in flavor and texture will attract a broader consumer base, while partnerships with food service providers will facilitate market penetration. Overall, the market is poised for significant growth as consumer preferences evolve towards healthier and more sustainable options.

| Segment | Sub-Segments |

|---|---|

| By Type | Plant-based fish fillets and portions Plant-based shrimp and prawns Plant-based crab and shellfish analogues Plant-based tuna, salmon and sushi-grade analogues Other plant-based seafood alternatives |

| By End-User | Retail consumers (household consumption) Restaurants, cafés and casual dining chains Hotels, airlines and catering (HoReCa) Institutional buyers (corporate, education, healthcare) Others |

| By Distribution Channel | Supermarkets and hypermarkets Online retail and quick-commerce platforms Specialty vegan and health-food stores Foodservice distributors and wholesalers Others |

| By Packaging Type | Frozen retail packs Chilled ready-to-cook / ready-to-heat packs Bulk foodservice packaging Eco-friendly and recyclable packaging Others |

| By Price Range | Premium Mid-range Budget / private label Others |

| By Flavor Profile | Traditional Gulf and Middle Eastern flavors Asian-inspired flavors Western and international flavors Others |

| By Region | Abu Dhabi Dubai Sharjah and Northern Emirates Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Plant-Based Seafood | 120 | Health-conscious Consumers, Flexitarians |

| Retailer Insights on Plant-Based Seafood Sales | 80 | Store Managers, Category Buyers |

| Food Service Industry Adoption Rates | 60 | Restaurant Owners, Menu Planners |

| Nutritionist Perspectives on Plant-Based Seafood | 50 | Registered Dietitians, Nutrition Consultants |

| Manufacturers' Views on Market Challenges | 50 | Product Development Managers, Operations Directors |

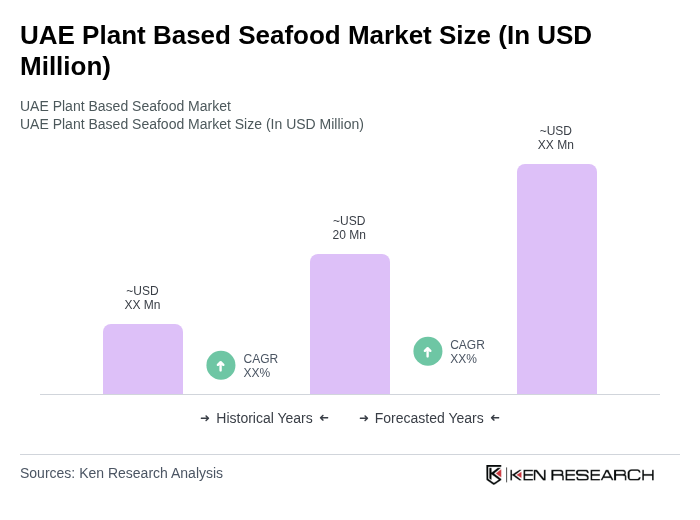

The UAE Plant Based Seafood Market is valued at approximately USD 20 million, reflecting a growing trend towards sustainable and health-conscious food options among consumers in the region.