Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4792

Pages:84

Published On:December 2025

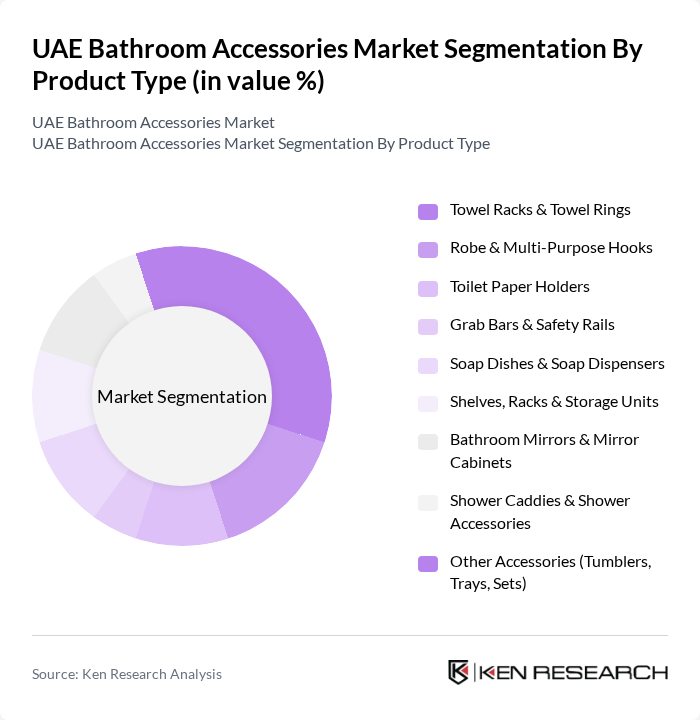

By Product Type:The product type segmentation includes various categories such as Towel Racks & Towel Rings, Robe & Multi-Purpose Hooks, Toilet Paper Holders, Grab Bars & Safety Rails, Soap Dishes & Soap Dispensers, Shelves, Racks & Storage Units, Bathroom Mirrors & Mirror Cabinets, Shower Caddies & Shower Accessories, and Other Accessories (Tumblers, Trays, Sets). Among these, Towel Racks & Towel Rings have a strong presence in the market due to their essential nature in every bathroom and their frequent use in both residential and hospitality projects, coupled with a growing trend towards stylish, coordinated, and functional hardware sets. The increasing focus on home aesthetics, storage optimization, and organized, clutter-free bathroom spaces drives consumer preference toward accessories that combine space-saving design, premium finishes, and compatibility with modern décor themes.

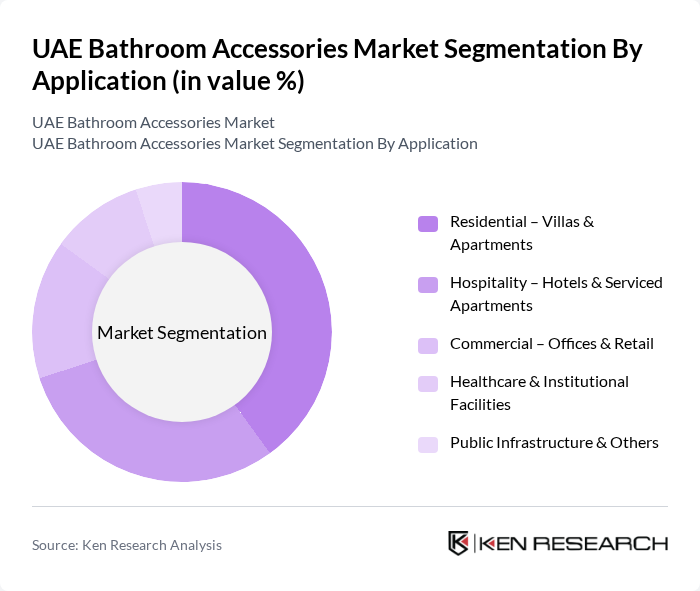

By Application:The application segmentation encompasses Residential (Villas & Apartments), Hospitality (Hotels & Serviced Apartments), Commercial (Offices & Retail), Healthcare & Institutional Facilities, and Public Infrastructure & Others. The residential segment, particularly villas and apartments, leads the market due to the increasing trend of home renovations, upgrade cycles in mid- to high-income housing, and the desire for modern bathroom aesthetics that align with smart-home and luxury-living concepts. The hospitality sector also plays a significant role, driven by the continuous growth in tourism, the development and refurbishment of upscale hotels, resorts, and serviced apartments, and the requirement for durable, design-forward, and water-efficient bathroom fittings to enhance guest experience.

The UAE Bathroom Accessories Market is characterized by a dynamic mix of regional and international players. Leading participants such as RAK Ceramics PJSC, Kohler Co., Grohe AG (LIXIL Corporation), Hansgrohe SE, TOTO Ltd., Ideal Standard International, Duravit AG, Villeroy & Boch AG, Jaquar Group, Roca Sanitario S.A., American Standard Brands, Moen Incorporated, Delta Faucet Company, KLUDI GmbH & Co. KG, Sanipex Group (BagnoDesign) contribute to innovation, geographic expansion, and service delivery in this space.

The UAE bathroom accessories market is expected to evolve significantly, driven by technological advancements and changing consumer preferences. The integration of smart technologies into bathroom products will enhance user experience, while sustainability trends will push manufacturers to adopt eco-friendly materials. Additionally, the rise of e-commerce will facilitate greater accessibility to a wider range of products, allowing consumers to make informed purchasing decisions. These factors will shape a dynamic market landscape, fostering innovation and growth opportunities.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Towel Racks & Towel Rings Robe & Multi-Purpose Hooks Toilet Paper Holders Grab Bars & Safety Rails Soap Dishes & Soap Dispensers Shelves, Racks & Storage Units Bathroom Mirrors & Mirror Cabinets Shower Caddies & Shower Accessories Other Accessories (Tumblers, Trays, Sets) |

| By Application | Residential – Villas & Apartments Hospitality – Hotels & Serviced Apartments Commercial – Offices & Retail Healthcare & Institutional Facilities Public Infrastructure & Others |

| By Material | Stainless Steel & Other Metals Brass & Chrome-Plated Alloys Plastic & Polymer Composites Glass Ceramic & Stoneware Wood & Bamboo Others |

| By Distribution Channel | Specialist Bathroom & Sanitaryware Showrooms Home Improvement & DIY Stores Hypermarkets & Supermarkets Online Retail & Marketplaces Project Sales / B2B & Direct Sales Others |

| By Design & Finish | Contemporary / Modern Classic / Traditional Minimalist Luxury & Designer Collections Others |

| By Price Range | Economy Mid-Range Premium Luxury Private Label / Value Packs |

| By Brand Origin | UAE & GCC Brands European Brands Asian Brands North American Brands Private Labels & Store Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 120 | Store Managers, Category Buyers |

| Consumer Preferences | 150 | Homeowners, Interior Designers |

| Supplier Feedback | 100 | Manufacturers, Distributors |

| Market Trends Analysis | 80 | Market Analysts, Industry Experts |

| Product Development Insights | 70 | Product Managers, R&D Specialists |

The UAE Bathroom Accessories Market is valued at approximately USD 170 million, driven by factors such as urbanization, rising disposable incomes, and a growing trend towards luxury bathroom fittings and home renovations.