Region:Middle East

Author(s):Shubham

Product Code:KRAB7441

Pages:89

Published On:October 2025

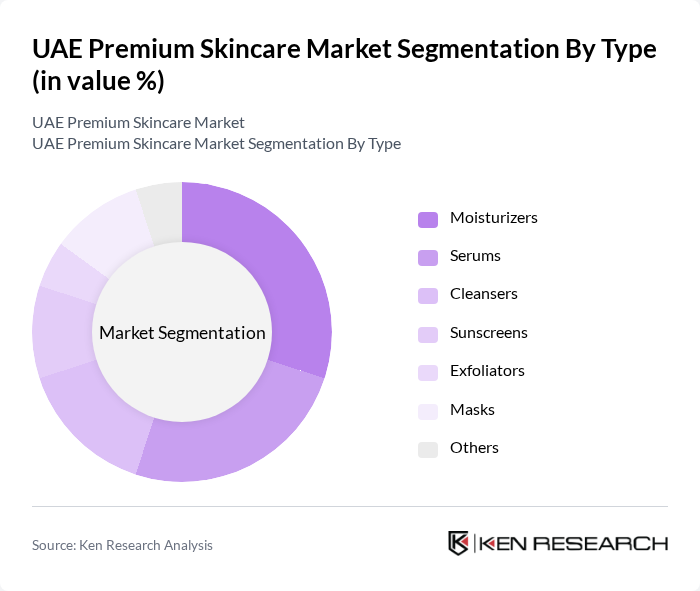

By Type:The premium skincare market can be segmented into various types, including moisturizers, serums, cleansers, sunscreens, exfoliators, masks, and others. Among these, moisturizers and serums are particularly popular due to their essential roles in daily skincare routines. Consumers are increasingly seeking products that offer hydration and targeted treatment for specific skin concerns, driving the demand for these subsegments.

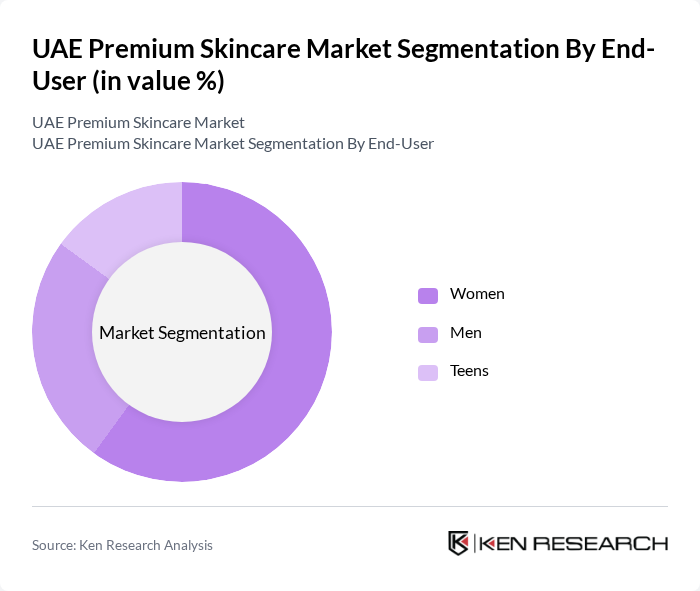

By End-User:The end-user segmentation includes women, men, and teens. Women represent the largest segment, driven by a strong focus on skincare and beauty routines. The increasing awareness of skincare benefits among men and teens is also contributing to the growth of these segments, with brands increasingly targeting these demographics with tailored products.

The UAE Premium Skincare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Estée Lauder Companies Inc., L'Oréal S.A., Procter & Gamble Co., Shiseido Company, Limited, Coty Inc., Unilever PLC, Johnson & Johnson, Beiersdorf AG, Amway Corporation, Mary Kay Inc., Oriflame Cosmetics S.A., Avon Products, Inc., Clarins Group, Kiehl's Since 1851, Drunk Elephant contribute to innovation, geographic expansion, and service delivery in this space.

The UAE premium skincare market is poised for continued growth, driven by evolving consumer preferences and increasing health consciousness. As consumers become more discerning, brands that emphasize transparency, sustainability, and product efficacy are likely to thrive. The integration of technology in skincare, such as AI-driven personalized solutions, is expected to gain traction. Additionally, the rise of social media will continue to influence purchasing decisions, making digital marketing strategies essential for brand visibility and consumer engagement.

| Segment | Sub-Segments |

|---|---|

| By Type | Moisturizers Serums Cleansers Sunscreens Exfoliators Masks Others |

| By End-User | Women Men Teens |

| By Distribution Channel | Online Retail Department Stores Specialty Stores Pharmacies Direct Sales Others |

| By Price Range | Premium Super Premium Affordable Luxury |

| By Ingredient Type | Natural Ingredients Synthetic Ingredients Organic Ingredients |

| By Packaging Type | Bottles Tubes Jars |

| By Brand Positioning | Luxury Brands Niche Brands Mass Market Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Urban Consumer Preferences | 150 | Skincare Users, Beauty Enthusiasts |

| Dermatologist Insights | 30 | Dermatologists, Skincare Specialists |

| Retailer Feedback | 50 | Store Managers, Beauty Advisors |

| Online Shopping Behavior | 100 | eCommerce Shoppers, Digital Marketing Experts |

| Focus Group Discussions | 40 | Skincare Product Users, Brand Loyalists |

The UAE Premium Skincare Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by increased consumer awareness, a rise in e-commerce, and a preference for high-quality products.