Region:Middle East

Author(s):Rebecca

Product Code:KRAB7772

Pages:98

Published On:October 2025

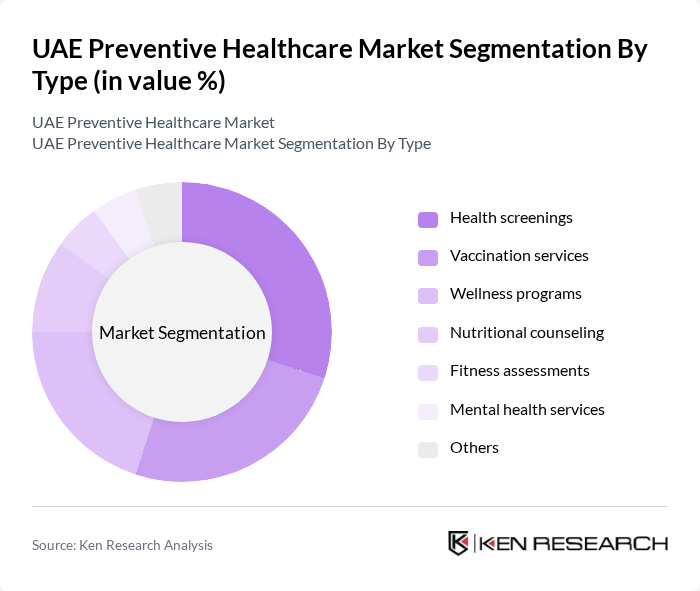

By Type:The market is segmented into various types, including health screenings, vaccination services, wellness programs, nutritional counseling, fitness assessments, mental health services, and others. Health screenings are gaining traction due to increased awareness of early disease detection, while vaccination services are crucial for public health initiatives. Wellness programs are also becoming popular as individuals seek holistic approaches to health.

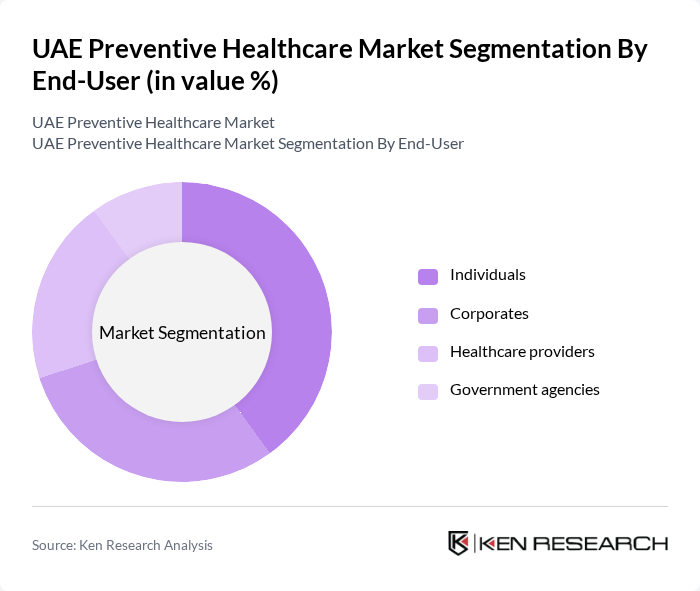

By End-User:The end-user segmentation includes individuals, corporates, healthcare providers, and government agencies. Individuals are increasingly seeking preventive healthcare services for personal health management, while corporates are investing in employee wellness programs to enhance productivity. Healthcare providers and government agencies play a crucial role in delivering and promoting preventive healthcare services.

The UAE Preventive Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Mediclinic International, NMC Health, Al Zahra Hospital, Aster DM Healthcare, VPS Healthcare, Cleveland Clinic Abu Dhabi, Dubai Health Authority, Abu Dhabi Health Services Company (SEHA), HealthPlus Network of Specialty Centers, Mediclinic City Hospital, Emirates Healthcare, Lifecare Hospital, Burjeel Hospital, Al Noor Hospitals Group, Thumbay Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE preventive healthcare market appears promising, driven by technological advancements and a growing emphasis on holistic health. As digital health solutions gain traction, more individuals are expected to engage in preventive measures through telehealth platforms and mobile health applications. Additionally, the integration of artificial intelligence in healthcare will enhance personalized treatment plans, further encouraging proactive health management among the population, ultimately leading to improved health outcomes and reduced healthcare costs.

| Segment | Sub-Segments |

|---|---|

| By Type | Health screenings Vaccination services Wellness programs Nutritional counseling Fitness assessments Mental health services Others |

| By End-User | Individuals Corporates Healthcare providers Government agencies |

| By Service Delivery Mode | In-person consultations Telehealth services Mobile health units |

| By Demographics | Age groups Gender Socioeconomic status |

| By Geographic Coverage | Urban areas Rural areas |

| By Insurance Coverage | Public insurance Private insurance Out-of-pocket payments |

| By Policy Support | Government subsidies Tax incentives Health promotion campaigns |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Preventive Health Screenings | 150 | Healthcare Providers, Clinic Managers |

| Vaccination Programs | 100 | Public Health Officials, Immunization Coordinators |

| Wellness and Lifestyle Programs | 80 | Wellness Coaches, Fitness Program Directors |

| Chronic Disease Management Initiatives | 70 | Chronic Care Managers, Patient Advocates |

| Health Education and Awareness Campaigns | 90 | Health Educators, Community Outreach Coordinators |

The UAE Preventive Healthcare Market is valued at approximately USD 5 billion, reflecting a significant growth trend driven by increased health awareness, government initiatives, and the rising prevalence of chronic diseases among the population.