Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7324

Pages:94

Published On:October 2025

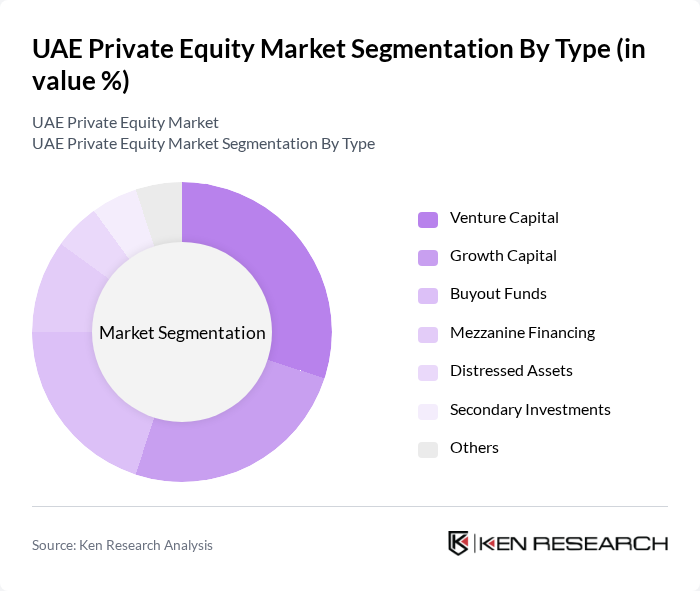

By Type:The UAE Private Equity Market is segmented into various types, including Venture Capital, Growth Capital, Buyout Funds, Mezzanine Financing, Distressed Assets, Secondary Investments, and Others. Each of these subsegments plays a crucial role in catering to different investment needs and risk appetites of investors. Venture Capital is particularly prominent due to the rise of startups and innovation-driven enterprises in the region.

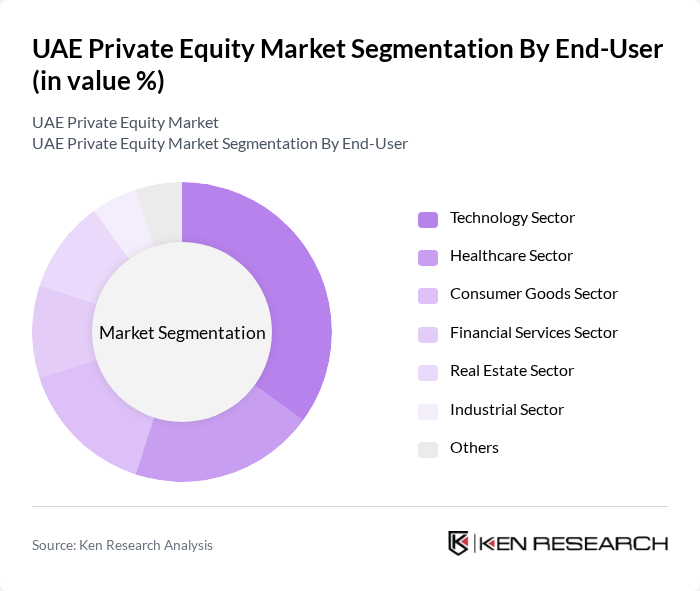

By End-User:The end-user segmentation of the UAE Private Equity Market includes sectors such as Technology, Healthcare, Consumer Goods, Financial Services, Real Estate, Industrial, and Others. The technology sector is currently leading the market due to the rapid digital transformation and innovation initiatives being undertaken by various startups and established companies in the region.

The UAE Private Equity Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Investment Authority, Mubadala Investment Company, Dubai Investments PJSC, Gulf Capital, Fajr Capital, Waha Capital, Al Habtoor Group, Shuaa Capital, Ithmar Capital, ADFG (Abu Dhabi Financial Group), Arqaam Capital, Al Qudra Holding, Al-Futtaim Group, Emirates Investment Authority, Noor Investment Group contribute to innovation, geographic expansion, and service delivery in this space.

The UAE private equity market is poised for significant growth, driven by increasing foreign investments and a strong focus on economic diversification. As the government continues to implement supportive policies, the market is expected to attract more capital, particularly in technology and sustainable sectors. Additionally, the rise of impact investing and sector-specific funds will likely create new avenues for investment, enhancing the overall attractiveness of the UAE as a private equity hub in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Venture Capital Growth Capital Buyout Funds Mezzanine Financing Distressed Assets Secondary Investments Others |

| By End-User | Technology Sector Healthcare Sector Consumer Goods Sector Financial Services Sector Real Estate Sector Industrial Sector Others |

| By Investment Stage | Seed Stage Early Stage Late Stage Expansion Stage Others |

| By Fund Size | Small Funds Medium Funds Large Funds Mega Funds |

| By Geographic Focus | Domestic Investments Regional Investments International Investments Others |

| By Exit Strategy | IPO M&A Secondary Sale Buyback |

| By Investment Source | Institutional Investors High Net-Worth Individuals Family Offices Sovereign Wealth Funds |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Private Equity Fund Managers | 100 | Managing Partners, Investment Directors |

| Corporate Finance Professionals | 80 | Financial Analysts, CFOs |

| Venture Capitalists | 70 | Investment Associates, Fund Analysts |

| Entrepreneurs Engaged with PE | 60 | Startup Founders, Business Development Managers |

| Regulatory Experts | 50 | Compliance Officers, Legal Advisors |

The UAE Private Equity Market is valued at approximately USD 15 billion, driven by significant investments in sectors such as technology, healthcare, and real estate, alongside a favorable regulatory environment that attracts foreign investments.