Region:Asia

Author(s):Rebecca

Product Code:KRAA6606

Pages:96

Published On:January 2026

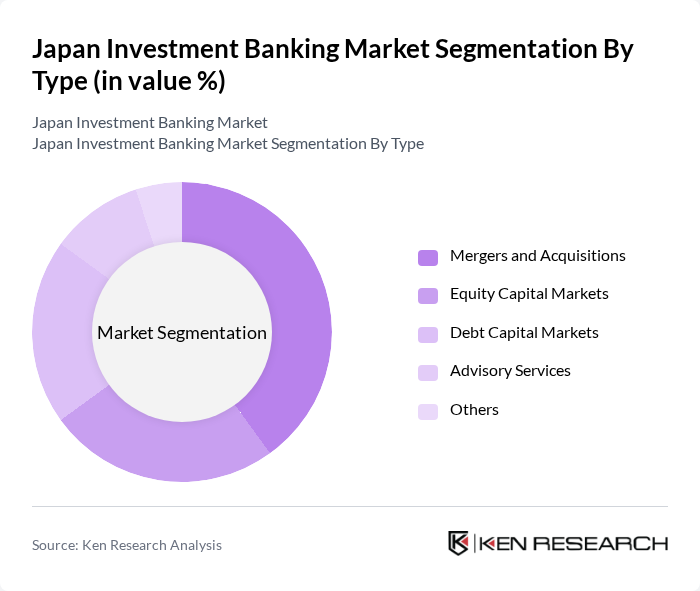

By Type:The market can be segmented into various types, including Mergers and Acquisitions, Equity Capital Markets, Debt Capital Markets, Advisory Services, and Others. Each of these segments plays a crucial role in the overall market dynamics, with Mergers and Acquisitions being particularly prominent due to the increasing trend of corporate consolidation and private equity activity driving deal volumes.

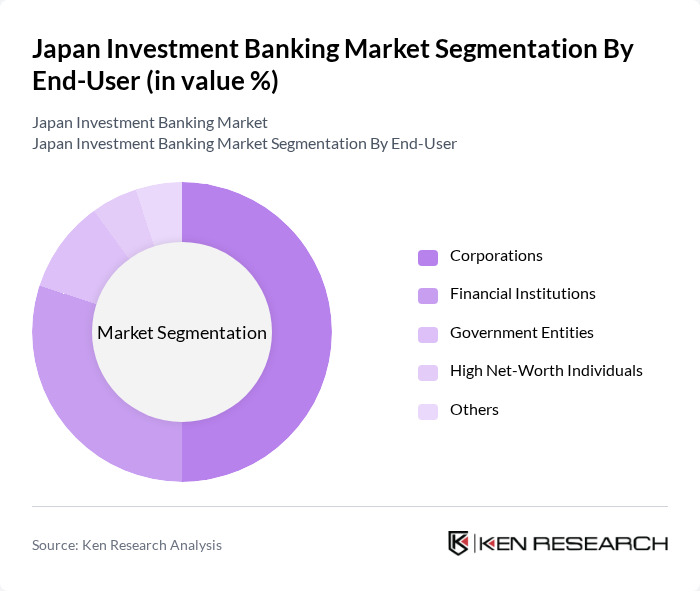

By End-User:The end-user segmentation includes Corporations, Financial Institutions, Government Entities, High Net-Worth Individuals, and Others. Corporations are the leading end-users, driven by their need for capital raising and strategic financial advice to navigate complex market conditions.

The Japan Investment Banking Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nomura Holdings, Inc., Daiwa Securities Group Inc., Mitsubishi UFJ Financial Group, Inc., Sumitomo Mitsui Trust Holdings, Inc., Mizuho Financial Group, Inc., SBI Holdings, Inc., Japan Post Bank Co., Ltd., Resona Holdings, Inc., Tokai Tokyo Financial Holdings, Inc., ORIX Corporation, Aizawa Securities Co., Ltd., Ichiyoshi Securities Co., Ltd., Matsui Securities Co., Ltd., Monex Group, Inc., Tokai Tokyo Research Institute contribute to innovation, geographic expansion, and service delivery in this space. Japan's leading investment banking firms including Mizuho Securities, Mitsubishi UFJ Financial Group, Nomura, Daiwa Securities, and SMBC Nikko Securities dominate Japan's league tables in M&A advisory, equity and bond underwriting, and capital markets, with many maintaining strong global footprints across Asia Pacific, Europe, and the Americas.

The Japan investment banking market is poised for significant evolution, driven by technological advancements and a shift towards sustainable finance. As firms increasingly adopt digital banking solutions, operational efficiencies are expected to improve, enhancing client service delivery. Additionally, the focus on environmental, social, and governance (ESG) criteria will likely reshape investment strategies, attracting a new wave of investors. These trends indicate a dynamic future for the sector, with opportunities for growth and innovation on the horizon.

| Segment | Sub-Segments |

|---|---|

| By Type | Mergers and Acquisitions Equity Capital Markets Debt Capital Markets Advisory Services Others |

| By End-User | Corporations Financial Institutions Government Entities High Net-Worth Individuals Others |

| By Service Offering | Investment Advisory Risk Management Research and Analysis Wealth Management Others |

| By Client Type | Institutional Clients Retail Clients Corporate Clients Government Clients Others |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions Mega Transactions Others |

| By Geographic Focus | Domestic Market International Markets Cross-Border Transactions Regional Focus Others |

| By Regulatory Environment | Compliant Transactions Non-Compliant Transactions Regulated Markets Unregulated Markets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| M&A Advisory Services | 45 | Investment Bankers, Corporate Development Executives |

| Equity Underwriting | 38 | Equity Analysts, Capital Markets Specialists |

| Debt Financing Solutions | 35 | Debt Capital Market Managers, Financial Advisors |

| Asset Management Trends | 42 | Portfolio Managers, Wealth Management Advisors |

| Regulatory Compliance in Investment Banking | 28 | Compliance Officers, Risk Management Executives |

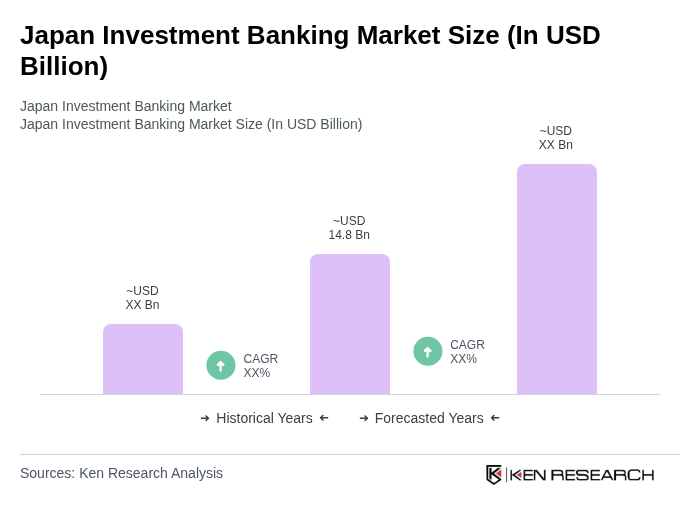

The Japan Investment Banking Market is valued at approximately USD 14.8 billion, reflecting a robust growth driven by increasing corporate mergers and acquisitions, a strong equity capital market, and heightened demand for advisory services.