Region:Middle East

Author(s):Rebecca

Product Code:KRAD2805

Pages:87

Published On:November 2025

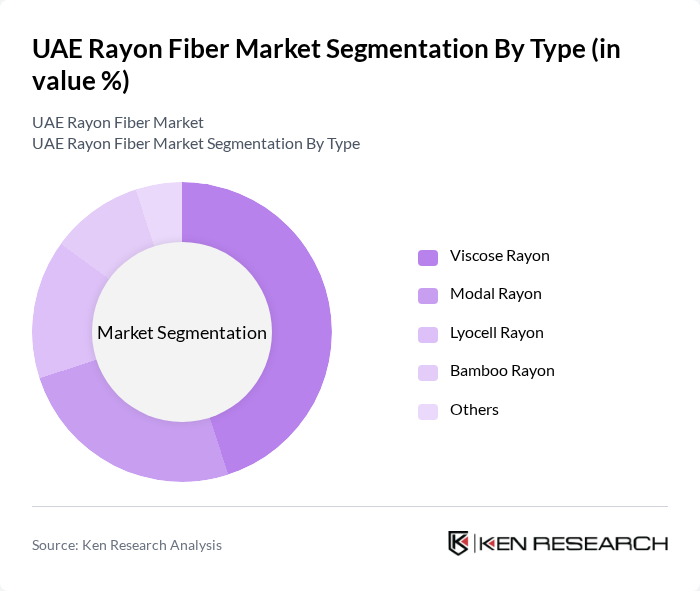

By Type:The market is segmented into various types of rayon fibers, including Viscose Rayon, Modal Rayon, Lyocell Rayon, Bamboo Rayon, and Others. Each type has unique properties and applications, catering to different consumer needs and preferences. Viscose Rayon is the most widely used due to its affordability and versatility, while Modal and Lyocell are gaining traction for their eco-friendly attributes .

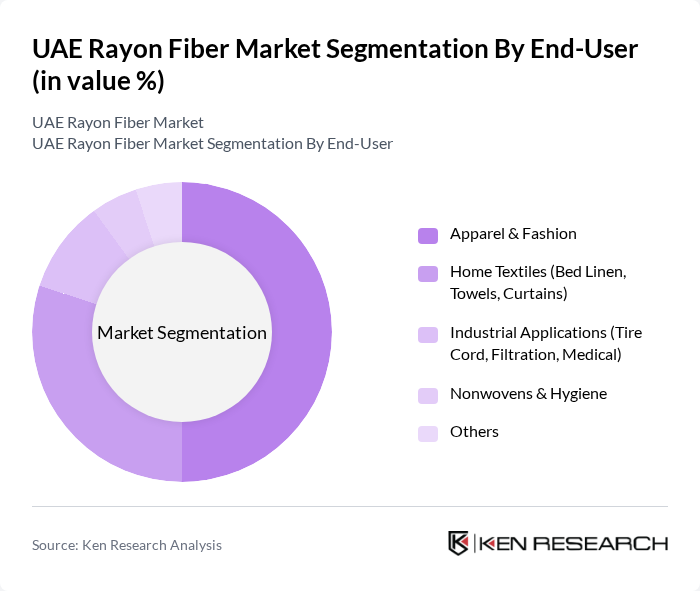

By End-User:The end-user segmentation includes Apparel & Fashion, Home Textiles (Bed Linen, Towels, Curtains), Industrial Applications (Tire Cord, Filtration, Medical), Nonwovens & Hygiene, and Others. The Apparel & Fashion segment is the largest consumer of rayon fibers, driven by the increasing demand for stylish and comfortable clothing options. Home textiles and industrial applications are also significant, with growing adoption in hygiene, automotive, and medical sectors .

The UAE Rayon Fiber Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aditya Birla Group, Lenzing AG, Sateri Holdings Limited, Ahlstrom-Munksjö Oyj, Eastman Chemical Company, Grasim Industries Limited, Rayonier Advanced Materials Inc., Solvay S.A., Asia Pacific Rayon Limited, Kelheim Fibres GmbH, Sappi Limited, TENCEL™ (Lenzing AG), Cordenka GmbH & Co. KG, Jaya Shree Textiles (Aditya Birla Group), Indo Bharat Rayon (Aditya Birla Group) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the UAE rayon fiber market appears promising, driven by a growing emphasis on sustainability and innovation in textile production. As consumer preferences shift towards eco-friendly materials, manufacturers are likely to invest in advanced production technologies that enhance the quality and sustainability of rayon. Additionally, collaborations with fashion brands focusing on sustainable practices will further propel market growth, positioning rayon as a preferred choice in both fashion and home textiles.

| Segment | Sub-Segments |

|---|---|

| By Type | Viscose Rayon Modal Rayon Lyocell Rayon Bamboo Rayon Others |

| By End-User | Apparel & Fashion Home Textiles (Bed Linen, Towels, Curtains) Industrial Applications (Tire Cord, Filtration, Medical) Nonwovens & Hygiene Others |

| By Application | Clothing Upholstery & Furnishings Non-Woven Fabrics (Wipes, Medical Textiles) Automotive Textiles Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales (B2B) Distributors/Importers Others |

| By Region | Abu Dhabi Dubai Sharjah Northern Emirates Others |

| By Fiber Blends | Cotton Blends Polyester Blends Wool Blends Others |

| By Sustainability Certification | OEKO-TEX Certified GOTS Certified FSC Certified PEFC Certified Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Rayon Fiber Manufacturers | 50 | Production Managers, Quality Control Supervisors |

| Textile Retailers | 50 | Merchandising Managers, Store Owners |

| Fashion Designers | 40 | Creative Directors, Product Development Leads |

| Textile Importers/Distributors | 40 | Supply Chain Managers, Procurement Specialists |

| End-Users in Home Textiles | 60 | Product Managers, Marketing Executives |

The UAE Rayon Fiber Market is valued at approximately USD 210 million, reflecting a significant growth trend driven by increasing demand for sustainable textiles and the popularity of rayon in the fashion and home textile industries.