Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4818

Pages:86

Published On:December 2025

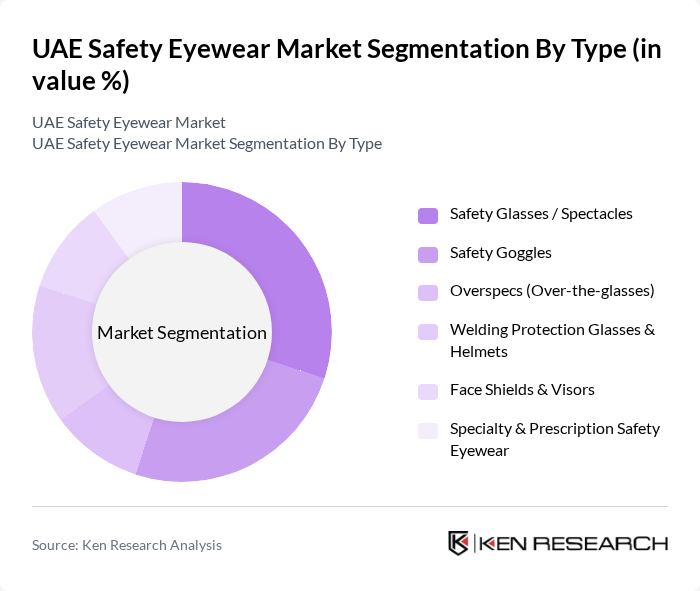

By Type:The market is segmented into various types of safety eyewear, including Safety Glasses / Spectacles, Safety Goggles, Overspecs (Over-the-glasses), Welding Protection Glasses & Helmets, Face Shields & Visors, and Specialty & Prescription Safety Eyewear. This structure aligns with the UAE protective eyewear segmentation that commonly distinguishes spectacles, overspecs, welding protection glasses, and goggles, with additional local demand for face shields and prescription safety eyewear in healthcare and high-precision industrial tasks. Each type serves specific needs and preferences of users across different industries.

The Safety Glasses / Spectacles segment dominates the market due to their versatility and widespread use across construction, manufacturing, logistics, and general industrial environments, mirroring the prominence of spectacles in UAE protective eyewear segmentation. They are favored for their comfort, lighter weight, and compatibility with other PPE such as helmets and respiratory protection, making them a popular choice among workers in construction, manufacturing, and healthcare. Safety Goggles also hold a significant share, particularly in environments where there is a high risk of chemical splashes, fine dust, or airborne particles, such as laboratories, pharmaceutical manufacturing, and chemical handling operations. The increasing focus on eye safety regulations, rising adoption of anti-fog and sealed goggles in hot and humid conditions, and the growing awareness of the importance of protective eyewear further bolster the demand for these products.

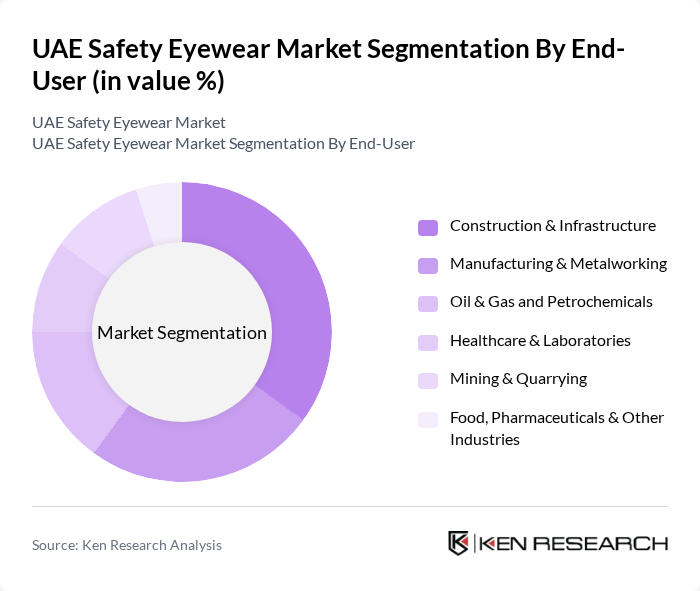

By End-User:The market is segmented by end-user industries, including Construction & Infrastructure, Manufacturing & Metalworking, Oil & Gas and Petrochemicals, Healthcare & Laboratories, Mining & Quarrying, and Food, Pharmaceuticals & Other Industries. These categories are consistent with UAE protective eyewear demand patterns, where construction, oil and gas, food, pharmaceutical, mining, and other industrial users represent key consuming sectors.

The Construction & Infrastructure sector is the leading end-user of safety eyewear, driven by the high volume of infrastructure and real estate projects and the mandatory application of occupational safety rules on building sites in the UAE. The Manufacturing & Metalworking sector also significantly contributes to the market, as workers are often exposed to hazardous materials, flying debris, and high-temperature processes that necessitate impact- and heat-resistant eyewear. The Oil & Gas and Petrochemicals sector follows closely, where safety eyewear is essential for protecting workers from chemical splashes, pressurized fluids, and particulates in onshore and offshore operations, supported by strict HSE frameworks adopted by national and international operators. In addition, Healthcare & Laboratories and Food and Pharmaceutical industries maintain stable demand for goggles, face shields, and prescription safety eyewear to comply with hygiene, contamination-control, and biosafety protocols.

The UAE Safety Eyewear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Honeywell International Inc., 3M Company, MSA Safety Incorporated, uvex Safety Group GmbH & Co. KG, Bollé Safety, JSP Ltd., Radians, Inc., Delta Plus Group, Pyramex Safety Products LLC, Drägerwerk AG & Co. KGaA, Kimberly-Clark Corporation, Medpick FZE (UAE), Al Bahar Safety & Security LLC (UAE), Al Asayel Health & Safety FZCO (UAE), Red Wing Shoe Company, Inc. (Including PPE & Safety Eyewear in UAE) contribute to innovation, geographic expansion, and service delivery in this space, in line with their recognized roles as key brands in the global and regional protective eyewear and PPE markets.

The UAE safety eyewear market is poised for significant growth, driven by ongoing regulatory changes and an increasing focus on workplace safety. As the construction and manufacturing sectors expand, the demand for high-quality safety eyewear will likely rise. Additionally, the integration of smart technology and eco-friendly materials into eyewear products will attract a broader consumer base. Companies that adapt to these trends and invest in employee safety will be well-positioned to capitalize on emerging opportunities in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Safety Glasses / Spectacles Safety Goggles Overspecs (Over-the-glasses) Welding Protection Glasses & Helmets Face Shields & Visors Specialty & Prescription Safety Eyewear |

| By End-User | Construction & Infrastructure Manufacturing & Metalworking Oil & Gas and Petrochemicals Healthcare & Laboratories Mining & Quarrying Food, Pharmaceuticals & Other Industries |

| By Distribution Channel | Industrial Distributors & Safety Specialists B2B / Direct Institutional Sales Offline Retail (Tools, Hardware & PPE Stores) Online Retail & E-commerce Platforms Others |

| By Material | Polycarbonate Trivex & Other High-Impact Plastics Glass Standard Plastic (CR-39 and others) Others (Coated & Specialty Materials) |

| By Region | Abu Dhabi Dubai Sharjah Ajman Ras Al Khaimah Fujairah & Umm Al Quwain |

| By Compliance Standard | ANSI Z87.1 EN 166 / EN 170 / EN 172 ISO and Local UAE / GCC Standards Others |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Safety Managers | 120 | Safety Officers, Site Managers |

| Manufacturing Sector Procurement Officers | 90 | Procurement Managers, Operations Directors |

| Retail Eyewear Distributors | 70 | Retail Managers, Sales Executives |

| Healthcare Sector Safety Compliance Officers | 60 | Compliance Managers, Safety Coordinators |

| Government Regulatory Bodies | 50 | Policy Makers, Safety Inspectors |

The UAE Safety Eyewear Market is valued at approximately USD 140 million, reflecting its significant role within the broader Middle East and Africa safety eyewear market, which generates around USD 370 million in revenue regionally.