Region:Middle East

Author(s):Dev

Product Code:KRAB7060

Pages:87

Published On:October 2025

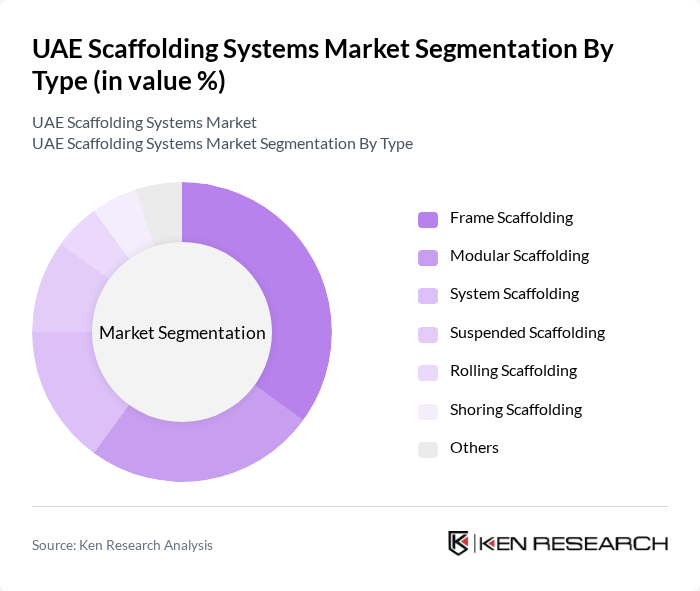

By Type:The scaffolding systems market can be segmented into various types, including Frame Scaffolding, Modular Scaffolding, System Scaffolding, Suspended Scaffolding, Rolling Scaffolding, Shoring Scaffolding, and Others. Among these, Frame Scaffolding is the most widely used due to its versatility and ease of assembly, making it a preferred choice for many construction projects. Modular Scaffolding is also gaining traction as it allows for quick adjustments and reconfigurations, catering to diverse project requirements.

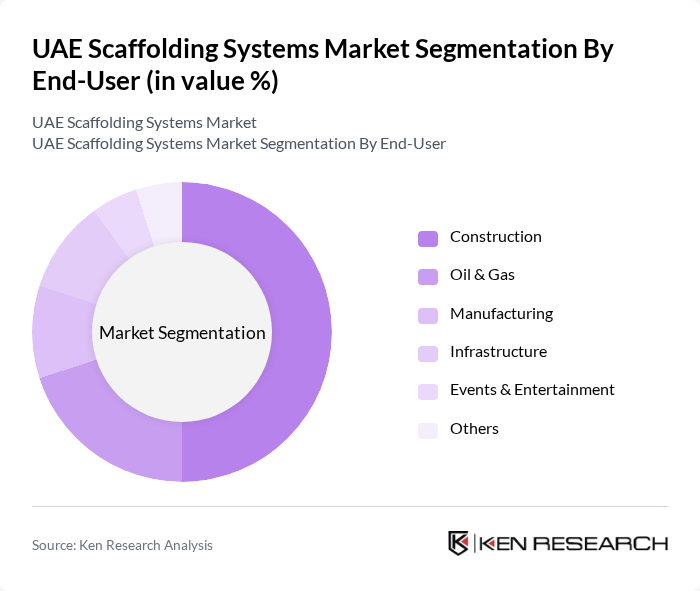

By End-User:The end-user segmentation of the scaffolding systems market includes Construction, Oil & Gas, Manufacturing, Infrastructure, Events & Entertainment, and Others. The Construction sector is the largest end-user, driven by the continuous demand for residential and commercial buildings. The Oil & Gas sector also contributes significantly, as scaffolding is essential for maintenance and construction activities in refineries and offshore platforms.

The UAE Scaffolding Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Altrad Group, Layher, PERI Group, BrandSafway, Bilfinger, Doka, SGB Group, ADTO Group, TUV Rheinland, Scafom-Rux, Sky Scaffolding, A-Scaffolding, A1 Scaffolding contribute to innovation, geographic expansion, and service delivery in this space.

The UAE scaffolding systems market is poised for significant growth, driven by ongoing infrastructure investments and a heightened focus on safety standards. As the government continues to prioritize construction projects, particularly in renewable energy and tourism, the demand for innovative scaffolding solutions will increase. Additionally, the trend towards digitalization and eco-friendly materials will shape the market landscape, encouraging companies to adopt sustainable practices and advanced technologies to remain competitive in this evolving environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Frame Scaffolding Modular Scaffolding System Scaffolding Suspended Scaffolding Rolling Scaffolding Shoring Scaffolding Others |

| By End-User | Construction Oil & Gas Manufacturing Infrastructure Events & Entertainment Others |

| By Application | Residential Construction Commercial Construction Industrial Construction Maintenance & Repair Renovation Projects Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Rental Services Others |

| By Material Type | Steel Aluminum Wood Composite Materials Others |

| By Price Range | Low Price Range Mid Price Range High Price Range |

| By Service Type | Installation Services Maintenance Services Rental Services Consulting Services Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Construction Projects | 100 | Project Managers, Site Engineers |

| Commercial Building Developments | 80 | Construction Supervisors, Safety Managers |

| Industrial Scaffolding Solutions | 70 | Procurement Managers, Operations Directors |

| Infrastructure Projects (Bridges, Roads) | 60 | Project Directors, Compliance Officers |

| Scaffolding Rental Services | 90 | Sales Managers, Business Development Executives |

The UAE Scaffolding Systems Market is valued at approximately USD 1.2 billion, driven by significant investments in infrastructure and real estate development, particularly in major cities like Dubai and Abu Dhabi.