Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4871

Pages:100

Published On:December 2025

By Product Type:The product type segmentation includes various categories such as Audio Baby Monitors, Video Baby Monitors, Multi-functional / Smart App-enabled Monitors, Movement and Wearable Monitors, and Others. Among these, Video Baby Monitors are currently leading the market, in line with regional and global patterns where combined audio & video devices account for the majority of revenue, due to features like high-definition video, night vision, and remote access capabilities. Parents are increasingly opting for video and app-connected monitors to keep a close eye on their infants, with demand reinforced by the growing prevalence of dual-income households and the need for reliable real-time monitoring while away from home.

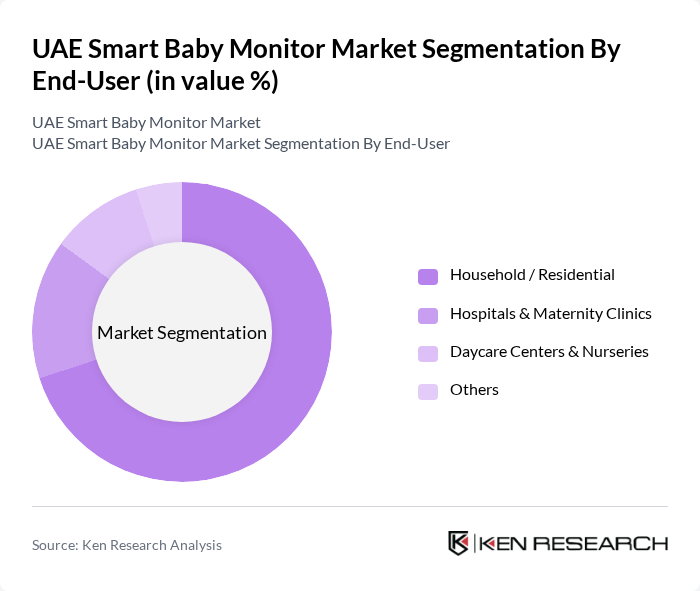

By End-User:The end-user segmentation comprises Household / Residential, Hospitals & Maternity Clinics, Daycare Centers & Nurseries, and Others. The Household / Residential segment is the most significant contributor to the market, consistent with global and regional data showing households as the primary user group for smart baby monitors, supported by the increasing number of tech-savvy parents who prioritize child safety and convenience. The trend of dual-income households and high female workforce participation in the UAE has also led to a higher demand for baby monitoring solutions, as parents seek reliable ways to monitor their children while managing their busy schedules.

The UAE Smart Baby Monitor Market is characterized by a dynamic mix of regional and international players. Leading participants such as VTech Holdings Limited, Motorola Solutions, Inc. (Motorola Baby Monitors), Philips Avent (Koninklijke Philips N.V.), Samsung Electronics Co., Ltd. (SmartThings-compatible Cameras), Arlo Technologies, Inc., Dorel Industries Inc. (Safety 1st), Summer Infant, Inc., Owlet Baby Care, Inc., Nanit Inc., iBaby Labs, Inc., Angelcare Monitors Inc., Miku, Inc., Lollipop Smart Baby Camera (Masterwork Aoitek Co., Ltd.), Xiaomi Corporation (Mi Home / Xiaomi Smart Cameras), TP-Link Technologies Co., Ltd. (Tapo & Kasa Smart Cameras) contribute to innovation, geographic expansion, and service delivery in this space.

The UAE smart baby monitor market is poised for significant growth, driven by technological advancements and increasing consumer awareness. As more parents embrace smart home technologies, the integration of features like AI and mobile applications will enhance user experience. Additionally, the rise of e-commerce platforms will facilitate easier access to these products, expanding market reach. Manufacturers that prioritize data security and affordability will likely capture a larger share of the market, catering to the evolving needs of modern parents.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Audio Baby Monitors Video Baby Monitors Multi-functional / Smart App-enabled Monitors Movement and Wearable Monitors Others |

| By End-User | Household / Residential Hospitals & Maternity Clinics Daycare Centers & Nurseries Others |

| By Emirate | Abu Dhabi Dubai Sharjah Other Emirates |

| By Connectivity / Technology | Wi-Fi / Wireless Monitors Bluetooth-enabled Monitors Wired / Digital Monitors Others |

| By Distribution Channel | Online Retail (E-commerce Platforms) Hypermarkets & Supermarkets Specialty Baby & Electronics Stores Others |

| By Price Range | Economy Mid-range Premium Luxury |

| By Smart Home Integration Level | Standalone Monitors Smart Home-integrated Monitors (e.g., Alexa, Google Home) App-only / Camera-based Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Smart Baby Monitors | 120 | Retail Managers, Sales Executives |

| Consumer Insights on Baby Monitor Usage | 140 | Parents, Caregivers |

| Expert Opinions from Pediatricians | 50 | Pediatricians, Child Care Specialists |

| Market Trends from E-commerce Platforms | 100 | E-commerce Managers, Digital Marketing Specialists |

| Feedback from Product Development Teams | 75 | Product Managers, R&D Engineers |

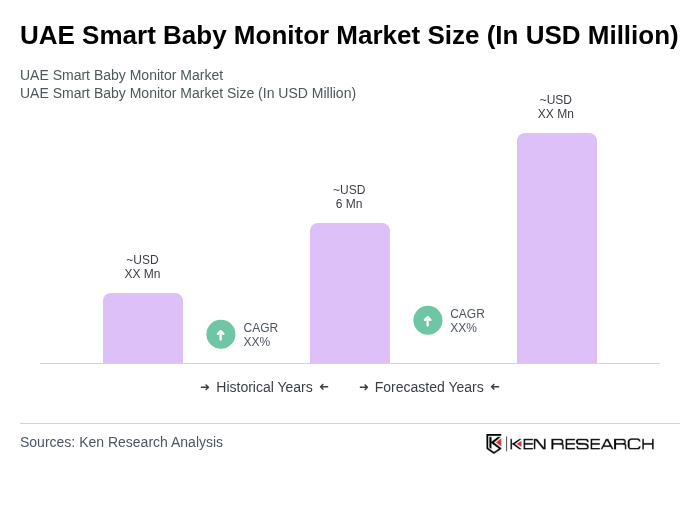

The UAE Smart Baby Monitor Market is valued at approximately USD 6 million, reflecting a five-year historical analysis of revenues normalized against regional trends in the Middle East and Africa.