Region:Middle East

Author(s):Dev

Product Code:KRAD5260

Pages:86

Published On:December 2025

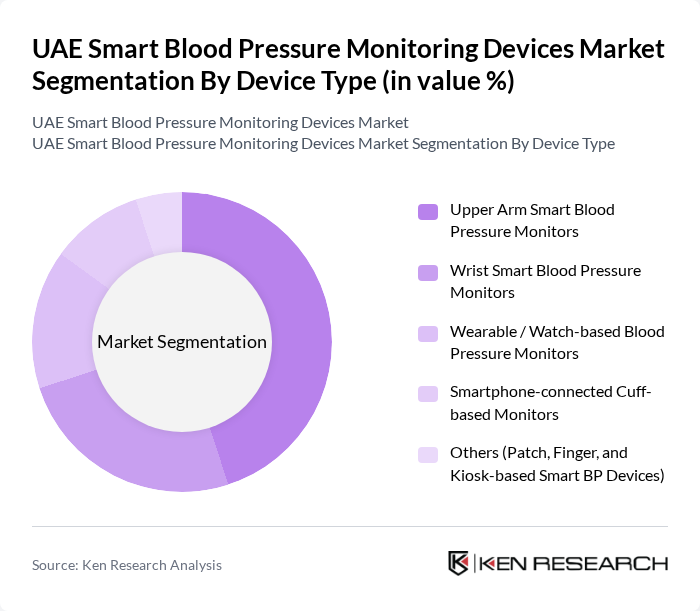

By Device Type:The device type segmentation includes various categories of smart blood pressure monitors. The leading sub-segment is the Upper Arm Smart Blood Pressure Monitors, which are favored for their accuracy and reliability. Wrist Smart Blood Pressure Monitors are also gaining traction due to their portability. Wearable / Watch-based Blood Pressure Monitors are emerging as a popular choice among fitness enthusiasts, while Smartphone-connected Cuff-based Monitors are increasingly used for their convenience. Other devices, such as patch and kiosk-based monitors, are also present but hold a smaller market share.

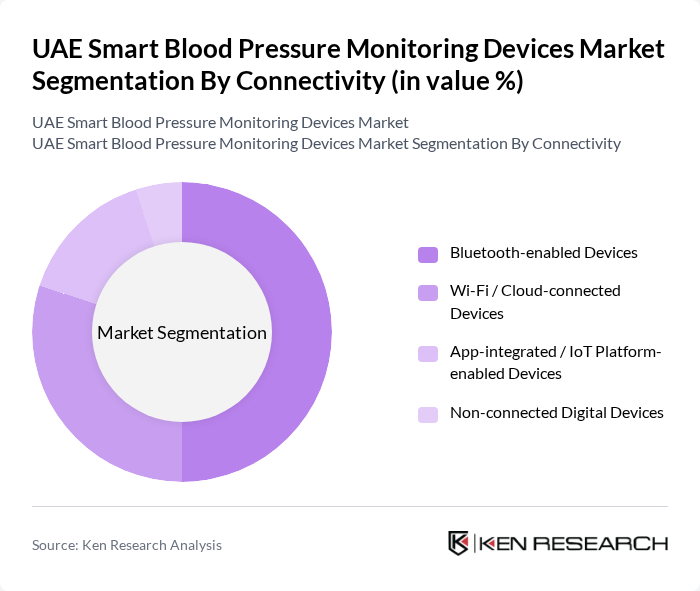

By Connectivity:The connectivity segmentation highlights the various technologies used in smart blood pressure monitors. Bluetooth-enabled Devices are the most popular due to their ease of use and compatibility with smartphones. Wi-Fi / Cloud-connected Devices are also gaining popularity as they allow for seamless data sharing with healthcare providers. App-integrated / IoT Platform-enabled Devices are increasingly sought after for their advanced features, while Non-connected Digital Devices still hold a niche market. The trend towards connected devices is driven by the demand for real-time health monitoring and data accessibility.

The UAE Smart Blood Pressure Monitoring Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Omron Healthcare, Inc., Koninklijke Philips N.V., Withings SA, iHealth Labs Inc., A&D Company, Limited (A&D Medical), Beurer GmbH, Xiaomi Corporation, Huawei Technologies Co., Ltd., Garmin Ltd., Fitbit LLC (Google LLC), Microlife Corporation, Qardio, Inc., OMRON Healthcare Middle East & Africa FZE, Abbott Laboratories, Local & Regional Distributors (e.g., BinSina Pharmacy, Aster Pharmacy, Life Pharmacy Group) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE smart blood pressure monitoring devices market appears promising, driven by increasing health consciousness and technological innovations. As telehealth services expand, more consumers will likely seek remote monitoring solutions. Additionally, partnerships between device manufacturers and healthcare providers will enhance accessibility and education, fostering greater adoption. The integration of AI and user-friendly applications will further streamline health management, making smart devices indispensable tools for proactive healthcare in the UAE.

| Segment | Sub-Segments |

|---|---|

| By Device Type | Upper Arm Smart Blood Pressure Monitors Wrist Smart Blood Pressure Monitors Wearable / Watch-based Blood Pressure Monitors Smartphone?connected Cuff-based Monitors Others (Patch, Finger, and Kiosk-based Smart BP Devices) |

| By Connectivity | Bluetooth-enabled Devices Wi?Fi / Cloud-connected Devices App?integrated / IoT Platform?enabled Devices Non-connected Digital Devices |

| By End-User | Homecare Users Hospitals Specialist Cardiology & Multi-specialty Clinics Corporate Wellness & Occupational Health Programs Fitness & Wellness Centers Others (Remote Monitoring & Telehealth Platforms) |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies E-commerce Platforms Direct Tender & Institutional Sales Others |

| By Technology | Oscillometric Smart Monitors Wearable Sensor-based Monitors AI?enabled / Predictive Analytics-based Monitors Others |

| By Patient Profile | Hypertensive Patients High Cardiovascular Risk Patients (Diabetes, CKD, Obesity) Pregnant Women (Pre?eclampsia & High?risk Pregnancy) General Wellness & Preventive Health Users Others |

| By Region | Abu Dhabi Dubai Sharjah & Northern Emirates Others |

| By Price Range | Economy Mid-range Premium Enterprise / Institutional-grade Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Provider Insights | 90 | Cardiologists, General Practitioners |

| Patient User Feedback | 140 | Patients using smart blood pressure monitors |

| Manufacturer Perspectives | 70 | Product Managers, R&D Heads |

| Health Technology Experts | 60 | Health Tech Analysts, Consultants |

| Regulatory Insights | 50 | Health Policy Makers, Regulatory Affairs Specialists |

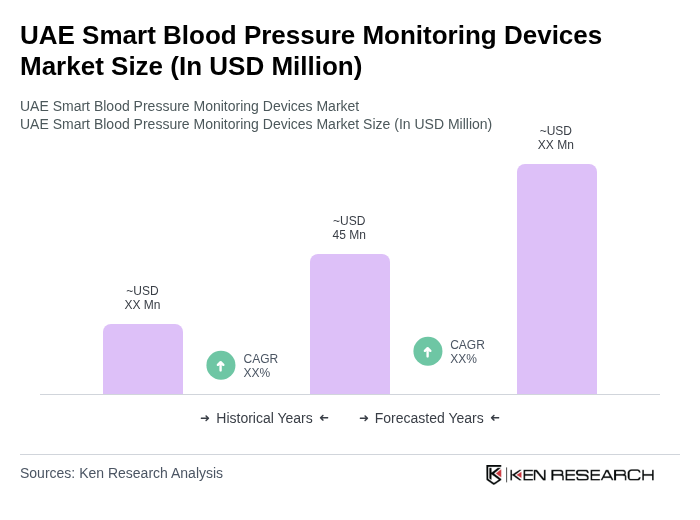

The UAE Smart Blood Pressure Monitoring Devices Market is valued at approximately USD 45 million, reflecting a significant growth driven by the rising prevalence of hypertension and increasing health awareness among consumers.