Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7309

Pages:93

Published On:October 2025

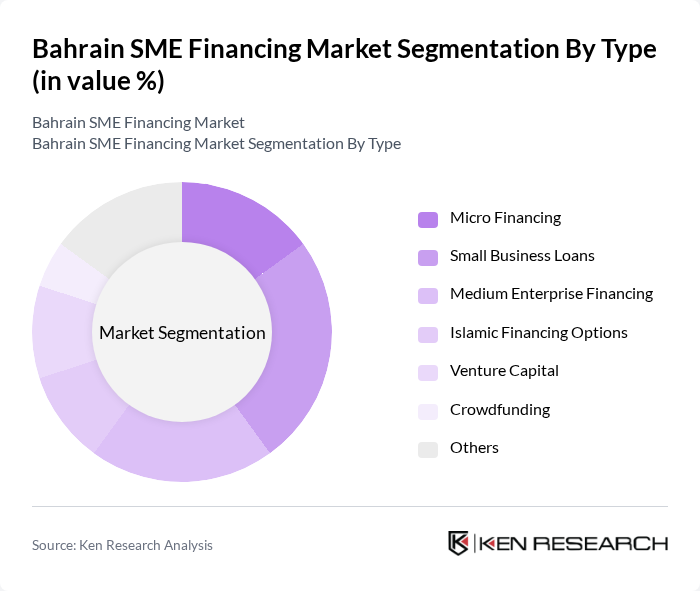

By Type:The market can be segmented into various types of financing options available for SMEs. These include Micro Financing, Small Business Loans, Medium Enterprise Financing, Islamic Financing Options, Venture Capital, Crowdfunding, and Others. Each of these sub-segments caters to different business needs and sizes, providing tailored financial solutions to support the growth of SMEs in Bahrain.

The Small Business Loans segment is currently dominating the market due to the increasing number of small enterprises seeking financial support for operational costs and expansion. This segment is favored by banks and financial institutions as it presents a lower risk compared to micro financing. Additionally, the growing trend of entrepreneurship in Bahrain has led to a surge in demand for small business loans, making it a critical component of the SME financing landscape.

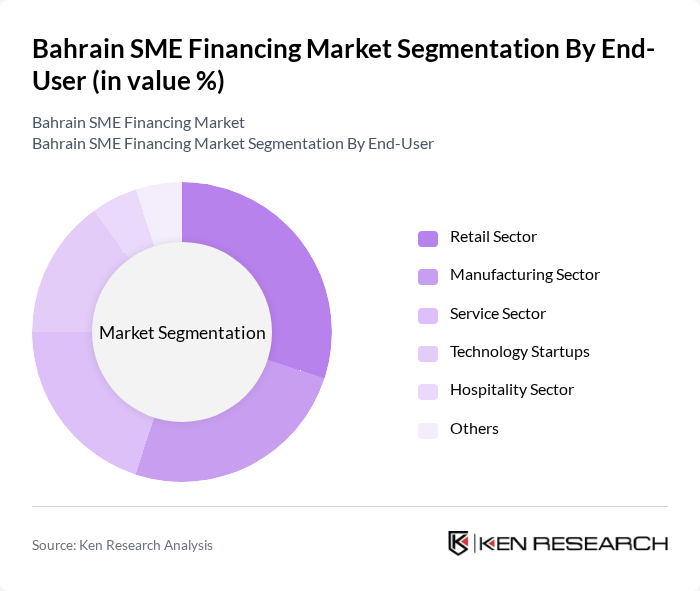

By End-User:The SME financing market can also be segmented by end-user categories, which include the Retail Sector, Manufacturing Sector, Service Sector, Technology Startups, Hospitality Sector, and Others. Each of these sectors has unique financing needs and contributes differently to the overall market dynamics.

The Retail Sector is the leading end-user segment, driven by the increasing consumer demand and the growth of e-commerce platforms. Retailers are actively seeking financing to enhance their inventory and expand their operations, making this sector a significant contributor to the SME financing market. The rise of digital payment solutions and online shopping has further fueled the need for financial support in this sector.

The Bahrain SME Financing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Baraka Banking Group, Bahrain Development Bank, Gulf International Bank, Bank of Bahrain and Kuwait, National Bank of Bahrain, Bahrain Islamic Bank, Ahli United Bank, Kuwait Finance House, Abu Dhabi Islamic Bank, Qatar National Bank, Emirates NBD, Mashreq Bank, Standard Chartered Bank, HSBC Bank Middle East, Arab Banking Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the SME financing market in Bahrain appears promising, driven by ongoing government support and the increasing adoption of digital financing solutions. As the entrepreneurial landscape evolves, more SMEs are expected to leverage innovative financing options. Additionally, the collaboration between financial institutions and government initiatives will likely enhance access to capital, fostering a more vibrant business ecosystem. The focus on sustainable financing and financial literacy will further empower SMEs, ensuring their resilience and growth in a competitive market.

| Segment | Sub-Segments |

|---|---|

| By Type | Micro Financing Small Business Loans Medium Enterprise Financing Islamic Financing Options Venture Capital Crowdfunding Others |

| By End-User | Retail Sector Manufacturing Sector Service Sector Technology Startups Hospitality Sector Others |

| By Investment Source | Bank Loans Government Grants Private Equity Angel Investors Microfinance Institutions Others |

| By Financing Purpose | Working Capital Equipment Purchase Business Expansion Research and Development Marketing and Sales Others |

| By Loan Size | Micro Loans (up to BHD 5,000) Small Loans (BHD 5,001 - BHD 20,000) Medium Loans (BHD 20,001 - BHD 100,000) Large Loans (over BHD 100,000) Others |

| By Duration | Short-term Financing (up to 1 year) Medium-term Financing (1-5 years) Long-term Financing (over 5 years) Others |

| By Policy Support | Subsidies Tax Exemptions Credit Guarantees Training Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing SMEs Financing | 100 | Owners, Financial Managers |

| Service Sector SMEs Financing | 80 | Business Development Managers, CFOs |

| Retail SMEs Financing | 70 | Store Managers, Financial Analysts |

| Technology Startups Financing | 60 | Founders, Venture Capitalists |

| Microfinance Impact on SMEs | 50 | Microfinance Officers, SME Owners |

The Bahrain SME Financing Market is valued at approximately BHD 1.2 billion, reflecting its growth as SMEs are recognized as essential contributors to economic diversification and job creation in the country.