Region:Middle East

Author(s):Dev

Product Code:KRAB7400

Pages:80

Published On:October 2025

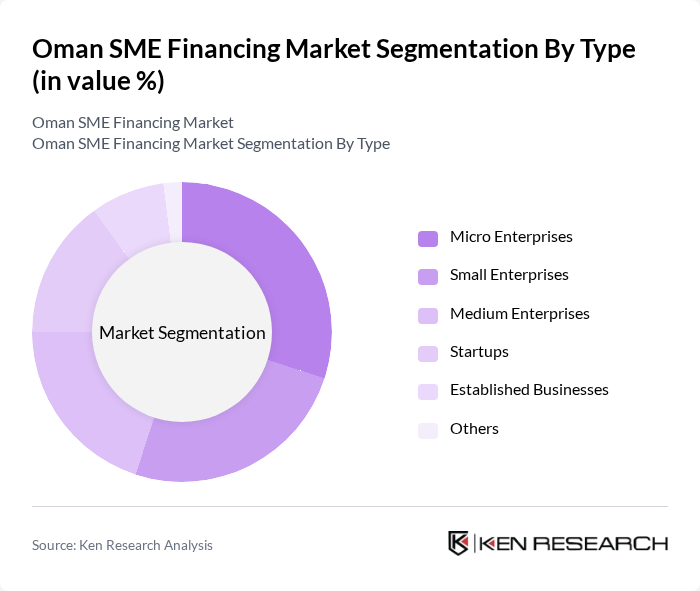

By Type:The market is segmented into various types of enterprises, including micro, small, medium, startups, established businesses, and others. Micro enterprises are often the most prevalent due to their lower capital requirements and the ability to cater to local markets. Small and medium enterprises also play a significant role, driven by their capacity to scale operations and contribute to economic growth. Startups are gaining traction, particularly in technology and innovation sectors, while established businesses leverage their market presence to secure financing for expansion.

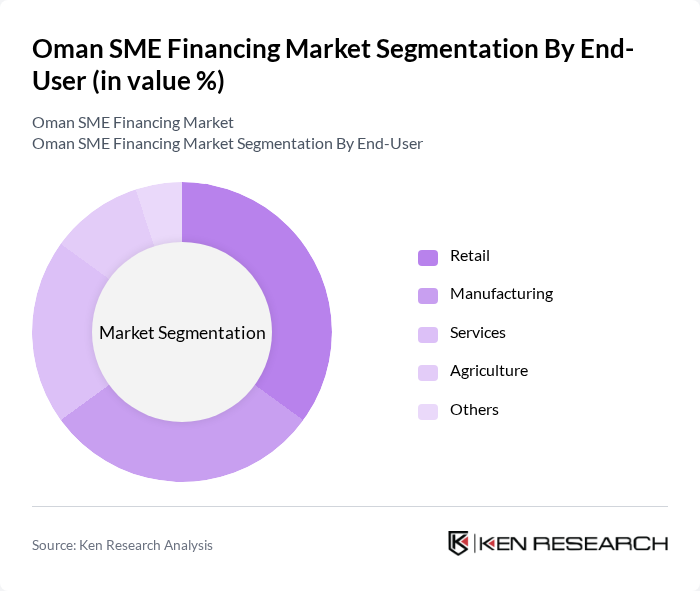

By End-User:The end-user segmentation includes retail, manufacturing, services, agriculture, and others. The retail sector is the largest end-user of SME financing, driven by the growing consumer market and demand for diverse products. The manufacturing sector follows closely, benefiting from government initiatives aimed at boosting local production. The services sector, including hospitality and IT, is also expanding rapidly, while agriculture remains a vital area for financing due to its importance in food security and rural development.

The Oman SME Financing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Bank Muscat, Oman Arab Bank, National Bank of Oman, Dhofar Insurance Company, Oman Development Bank, Alizz Islamic Bank, Bank Sohar, Muscat Finance, Oman International Bank, Oman Investment Authority, Al Izz Islamic Bank, Oman National Investments Development Company, Al Maha Financial Services, Al Batinah Development Company, Oman Oil Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman SME financing market appears promising, driven by increasing government initiatives and a growing emphasis on digital solutions. As the government continues to implement supportive policies, including credit guarantee schemes and tax incentives, SMEs are likely to experience improved access to financing. Additionally, the rise of fintech solutions will further enhance financial inclusion, enabling more entrepreneurs to secure funding and contribute to economic growth in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Micro Enterprises Small Enterprises Medium Enterprises Startups Established Businesses Others |

| By End-User | Retail Manufacturing Services Agriculture Others |

| By Investment Source | Bank Loans Venture Capital Government Grants Private Equity Others |

| By Financing Type | Equity Financing Debt Financing Hybrid Financing Microfinancing Others |

| By Business Sector | Technology Healthcare Tourism Construction Others |

| By Loan Size | Small Loans Medium Loans Large Loans Others |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing SMEs | 100 | Business Owners, Financial Managers |

| Service Sector SMEs | 80 | Entrepreneurs, Operations Managers |

| Retail SMEs | 70 | Store Managers, Financial Analysts |

| Technology Startups | 60 | Founders, CTOs, Financial Advisors |

| Microfinance Institutions | 50 | Loan Officers, Branch Managers |

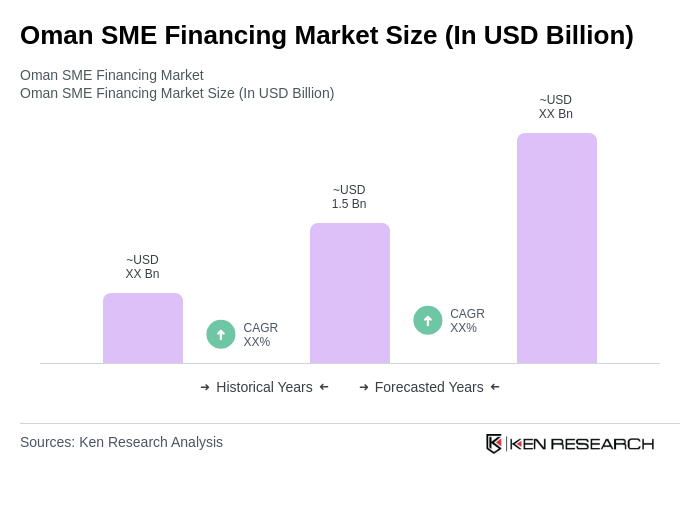

The Oman SME Financing Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the recognition of SMEs as essential for economic diversification and job creation, along with supportive government initiatives.