UAE Specialty Oleochemicals Market Overview

- The UAE Specialty Oleochemicals Market is valued at USD 180 million, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for bio-based products, rising consumer awareness regarding sustainability, the expansion of the personal care and cosmetics industry, and advancements in enzymatic production technologies for greater efficiency. The market is also supported by the government's initiatives to promote green chemistry and reduce reliance on petrochemicals.

- Key players in this market include Dubai and Abu Dhabi, which dominate due to their strategic locations, advanced infrastructure, and strong industrial bases. These cities serve as hubs for manufacturing and distribution, attracting investments and fostering innovation in the oleochemicals sector. The presence of major companies and research institutions further enhances their competitive edge.

- The Federal Law No. 24 of 1999 on the Protection and Development of the Environment, issued by the UAE Ministry of Climate Change and Environment, mandates that all specialty oleochemicals produced in the country must meet specific environmental standards including emission limits and waste management requirements for industrial facilities exceeding 100 tons annual production. This regulation requires manufacturers to obtain environmental permits, conduct impact assessments, and implement pollution control measures to ensure products are derived from sustainable sources and encourages adoption of eco-friendly practices, thereby enhancing the overall sustainability of the industry.

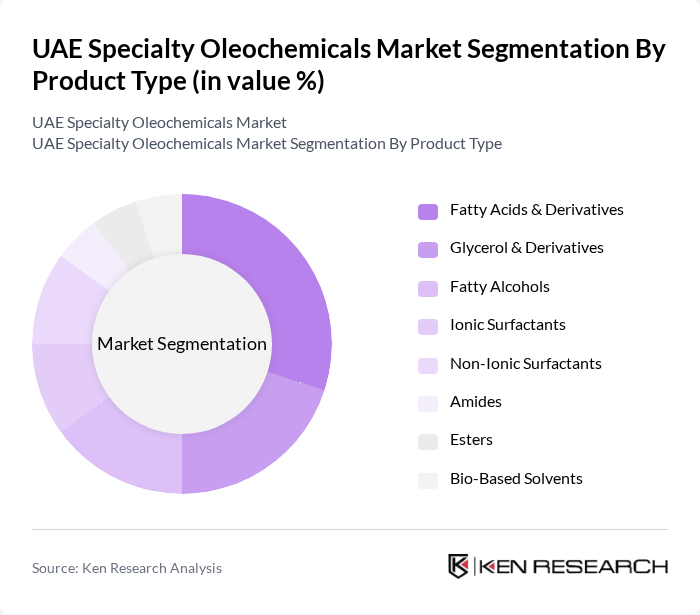

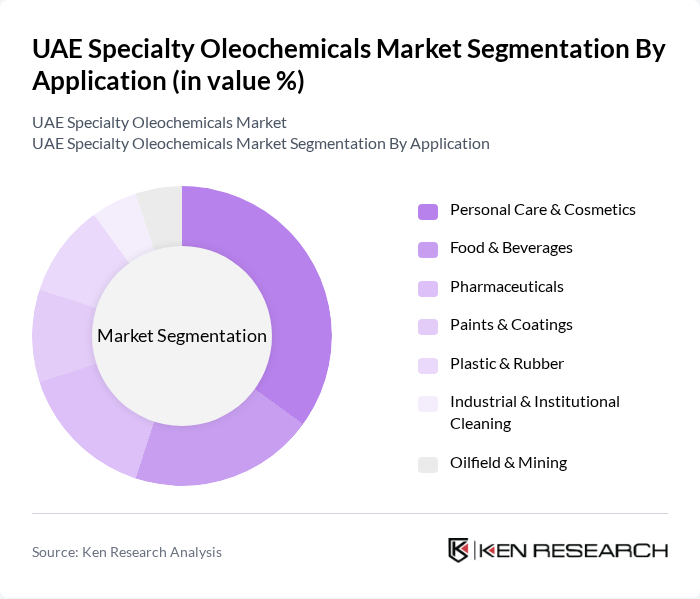

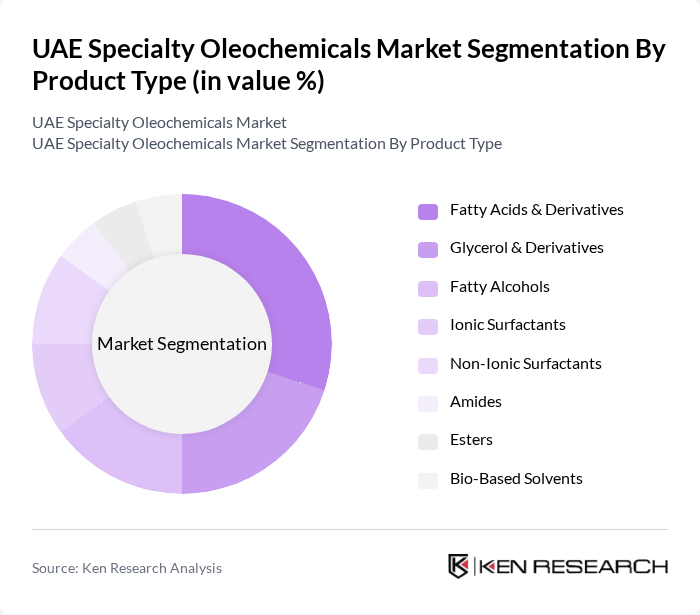

UAE Specialty Oleochemicals Market Segmentation

By Product Type:The product type segmentation includes various categories such as Fatty Acids & Derivatives, Glycerol & Derivatives, Fatty Alcohols, Ionic Surfactants, Non-Ionic Surfactants, Amides, Esters, and Bio-Based Solvents. Among these, Fatty Acids & Derivatives are leading the market due to their extensive use in personal care products and industrial applications. The growing trend towards natural and organic ingredients is driving demand for these products, as consumers increasingly prefer sustainable options.

By Application:The application segmentation encompasses Personal Care & Cosmetics, Food & Beverages, Pharmaceuticals, Paints & Coatings, Plastic & Rubber, Industrial & Institutional Cleaning, and Oilfield & Mining. The Personal Care & Cosmetics segment is the most significant, driven by the increasing consumer preference for natural and organic products. This trend is further supported by the rising awareness of the harmful effects of synthetic chemicals, leading to a shift towards safer alternatives.

UAE Specialty Oleochemicals Market Competitive Landscape

The UAE Specialty Oleochemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Wilmar International Limited, Cargill, Incorporated, IOI Group, Evonik Industries AG, Emery Oleochemicals, Oleon NV, Godrej Industries Limited, Kao Corporation, Ecogreen Oleochemicals, Vantage Specialty Chemicals, Croda International Plc, AAK AB, Solvay S.A., Arkema S.A. contribute to innovation, geographic expansion, and service delivery in this space.

UAE Specialty Oleochemicals Market Industry Analysis

Growth Drivers

- Increasing Demand for Biodegradable Products:The UAE's commitment to sustainability has led to a significant rise in the demand for biodegradable products, with the market for biodegradable plastics projected to reach AED 1.5 billion in future. This shift is driven by consumer preferences for eco-friendly alternatives, as evidenced by a 30% increase in sales of biodegradable products in future. The growing awareness of environmental issues is further propelling this trend, making biodegradable oleochemicals increasingly vital in various applications.

- Government Initiatives for Sustainable Development:The UAE government has implemented various initiatives aimed at promoting sustainable development, including the UAE Vision 2021, which emphasizes environmental sustainability. In future, the government allocated AED 2 billion for green technology projects, fostering innovation in the oleochemical sector. These initiatives are expected to enhance the production of sustainable oleochemicals, aligning with global sustainability goals and increasing market competitiveness for local manufacturers.

- Expansion of End-User Industries:The growth of end-user industries such as personal care, food, and pharmaceuticals is significantly driving the demand for specialty oleochemicals. The personal care sector alone is projected to grow by AED 1 billion in future, with oleochemicals being integral to product formulations. This expansion is supported by a 15% increase in consumer spending on personal care products, highlighting the critical role of oleochemicals in meeting the evolving needs of these industries.

Market Challenges

- Fluctuating Raw Material Prices:The specialty oleochemicals market faces challenges due to the volatility of raw material prices, particularly palm oil and fatty acids. In future, palm oil prices surged by 20%, impacting production costs for oleochemical manufacturers. This fluctuation creates uncertainty in pricing strategies and profit margins, making it difficult for companies to maintain competitive pricing while ensuring product quality and sustainability.

- Competition from Synthetic Alternatives:The increasing availability of synthetic alternatives poses a significant challenge to the specialty oleochemicals market. In future, synthetic chemicals accounted for approximately 60% of the market share in personal care products, driven by lower costs and widespread availability. This competition pressures oleochemical producers to innovate and differentiate their products, emphasizing the need for effective marketing strategies to highlight the benefits of natural ingredients.

UAE Specialty Oleochemicals Market Future Outlook

The future of the UAE specialty oleochemicals market appears promising, driven by a strong focus on sustainability and innovation. As consumer preferences shift towards eco-friendly products, manufacturers are expected to invest in advanced production technologies that enhance efficiency and reduce environmental impact. Additionally, the collaboration between industry players and research institutions is likely to foster the development of novel oleochemical applications, further expanding market potential and meeting the growing demand for sustainable solutions.

Market Opportunities

- Growth in Personal Care and Cosmetics Sector:The personal care and cosmetics sector presents a significant opportunity for specialty oleochemicals, with an expected market growth of AED 1 billion in future. This growth is driven by increasing consumer demand for natural and organic products, creating a favorable environment for oleochemical manufacturers to expand their product offerings and capture market share.

- Development of Innovative Oleochemical Products:There is a growing opportunity for the development of innovative oleochemical products tailored to specific applications, such as biodegradable surfactants and emulsifiers. With an estimated investment of AED 500 million in R&D in future, companies can leverage this trend to create unique products that meet the evolving needs of various industries, enhancing their competitive edge in the market.