Region:Asia

Author(s):Geetanshi

Product Code:KRAC9431

Pages:98

Published On:November 2025

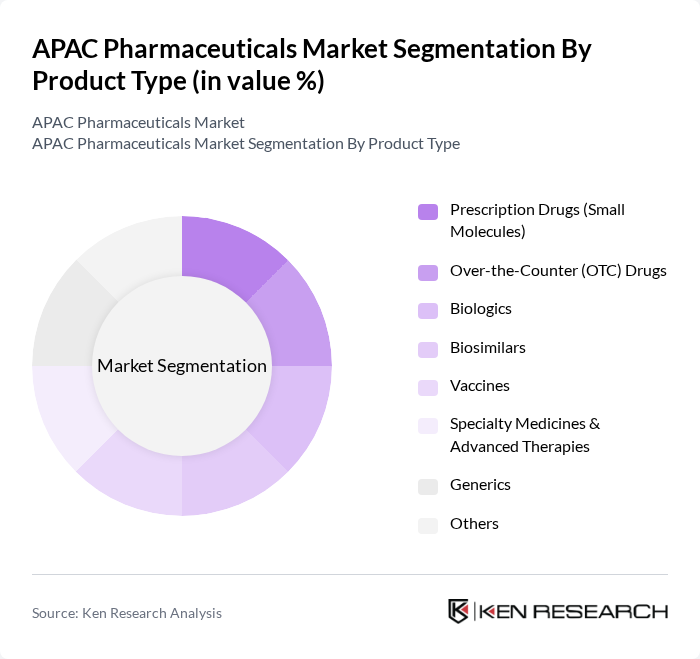

By Product Type:The product type segmentation includes various categories such as Prescription Drugs (Small Molecules), Over-the-Counter (OTC) Drugs, Biologics, Biosimilars, Vaccines, Specialty Medicines & Advanced Therapies, Generics, and Others. Among these,Prescription Drugs (Small Molecules)dominate the market due to their widespread use in treating chronic diseases and their established presence in healthcare systems. The increasing prevalence of lifestyle-related diseases and the demand for effective treatment options contribute to the growth of this segment. Specialty medicines & advanced therapies, including cell and gene therapies, are experiencing the fastest growth, driven by demand for personalized medication and innovative treatments .

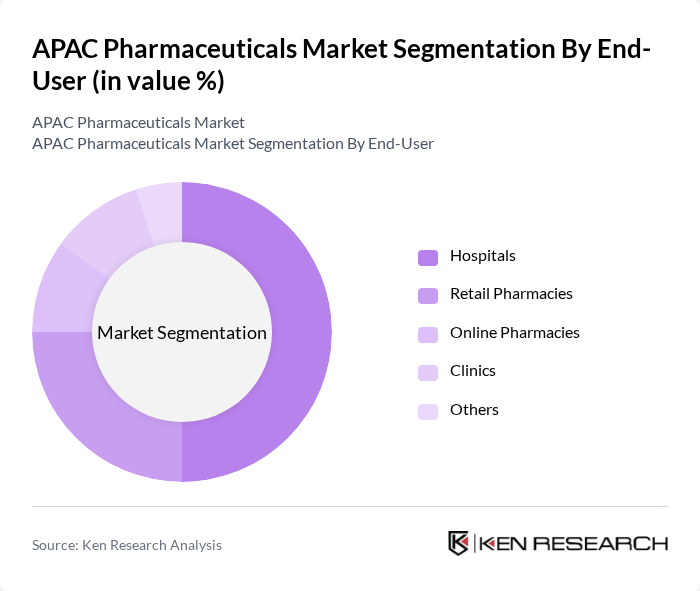

By End-User:The end-user segmentation encompasses Hospitals, Retail Pharmacies, Online Pharmacies, Clinics, and Others.Hospitalsare the leading end-user segment, driven by the increasing number of hospital admissions and the demand for advanced medical treatments. The growing trend of hospital-based healthcare services and the rising number of surgical procedures contribute to the dominance of this segment. Retail and online pharmacies are also expanding rapidly due to increased consumer access and digital transformation .

The APAC Pharmaceuticals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Takeda Pharmaceutical Company Limited, Sun Pharmaceutical Industries Ltd., Aurobindo Pharma Limited, Dr. Reddy’s Laboratories Ltd., Cipla Limited, Daiichi Sankyo Company, Limited, Eisai Co., Ltd., Chugai Pharmaceutical Co., Ltd., Shanghai Pharmaceuticals Holding Co., Ltd., Jiangsu Hengrui Pharmaceuticals Co., Ltd., Sinopharm Group Co., Ltd., Fosun Pharma (Shanghai Fosun Pharmaceutical Group Co., Ltd.), CSL Limited, Zuellig Pharma, DKSH Holding Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The APAC pharmaceuticals market is poised for transformative growth, driven by technological innovations and increasing healthcare investments. As the region embraces digital health solutions and personalized medicine, the focus will shift towards enhancing patient outcomes and streamlining drug development processes. Additionally, collaborations between pharmaceutical companies and tech firms are expected to foster innovation, leading to the emergence of novel therapies and treatment modalities that cater to the diverse needs of the population.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Prescription Drugs (Small Molecules) Over-the-Counter (OTC) Drugs Biologics Biosimilars Vaccines Specialty Medicines & Advanced Therapies (e.g., Cell & Gene Therapy, RNA-based Therapeutics) Generics Others |

| By End-User | Hospitals Retail Pharmacies Online Pharmacies Clinics Others |

| By Geography | China Japan India South Korea Australia Southeast Asia (e.g., Vietnam, Thailand, Malaysia, Philippines, Indonesia) Rest of APAC |

| By Therapeutic Area | Cardiovascular Oncology Neurology Infectious Diseases Diabetes & Metabolic Disorders Rare/Orphan Diseases Others |

| By Distribution Channel | Direct Sales Wholesalers Distributors E-commerce Others |

| By Drug Formulation | Tablets Capsules Injectables Topicals Others |

| By Policy Support | Subsidies Tax Exemptions Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Drug Utilization | 100 | Oncologists, Pharmacists |

| Cardiovascular Medication Adherence | 90 | Cardiologists, General Practitioners |

| Chronic Disease Management | 80 | Endocrinologists, Patient Care Coordinators |

| Vaccination Trends in APAC | 60 | Pediatricians, Public Health Officials |

| Generic vs. Brand Name Drug Preferences | 50 | Pharmacy Managers, Health Economists |

The APAC Pharmaceuticals Market is valued at approximately USD 465 billion, driven by increasing healthcare expenditure, an aging population, and advancements in biotechnology and pharmaceuticals. This growth reflects the region's commitment to improving healthcare outcomes and accessibility.