Region:Middle East

Author(s):Dev

Product Code:KRAC4827

Pages:80

Published On:October 2025

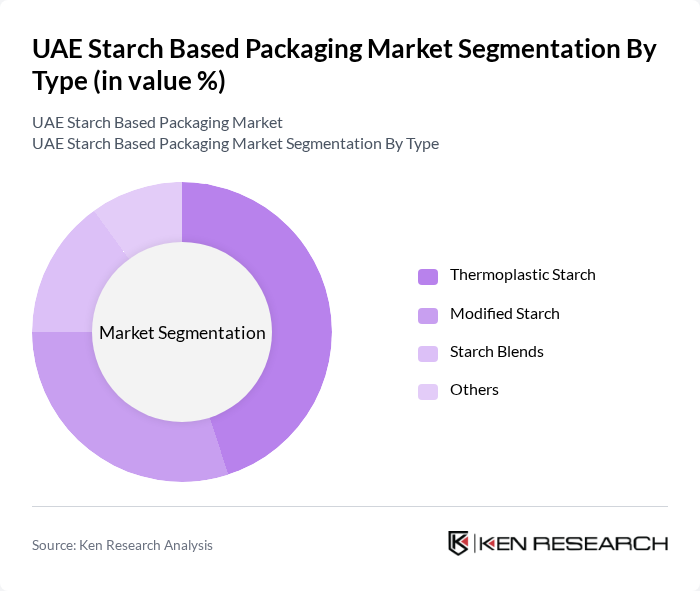

By Type:The market is segmented into Thermoplastic Starch, Modified Starch, Starch Blends, and Others. Thermoplastic Starch is currently the leading subsegment due to its versatility and ease of processing, making it suitable for various applications such as films, wraps, and containers. Modified Starch is gaining traction as it offers enhanced mechanical and barrier properties, while Starch Blends are increasingly used for specialized packaging needs, particularly where improved strength and compostability are required. The Others category includes niche products such as molded packaging and specialty coatings designed for specific industrial applications.

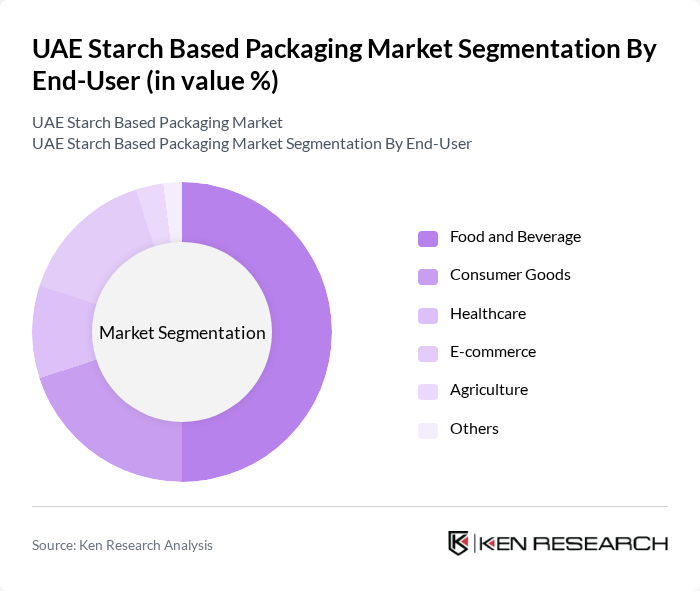

By End-User:The end-user segmentation includes Food and Beverage, Consumer Goods, Healthcare, E-commerce, Agriculture, and Others. The Food and Beverage sector is the dominant segment, driven by the increasing demand for sustainable packaging solutions in food products, especially fresh produce and ready-to-eat meals. The E-commerce sector is also witnessing significant growth, as online shopping trends continue to rise, necessitating efficient and eco-friendly packaging options. Consumer Goods and Healthcare sectors are adopting starch-based packaging for improved sustainability and compliance with environmental standards. The Agriculture segment utilizes starch-based packaging for seed bags and produce containers, while Others includes industrial and specialty uses.

The UAE Starch Based Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novamont S.p.A., BASF SE, NatureWorks LLC, Biome Bioplastics Ltd., Stora Enso Oyj, Tetra Pak International S.A., Mondi Group, Smurfit Kappa Group, Amcor plc, Sealed Air Corporation, Huhtamaki Oyj, DS Smith Plc, WestRock Company, International Paper Company, Crown Holdings, Inc., BioApply FZ-LLC, Ecovative Packaging LLC, Vegware Ltd., Biopak (UAE), Green Packaging Solutions FZCO contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE starch-based packaging market appears promising, driven by increasing regulatory support and consumer demand for sustainable solutions. As the government continues to implement stringent plastic waste management policies, manufacturers are likely to invest in innovative biodegradable technologies. Additionally, the rise of e-commerce and food delivery services will further propel the need for sustainable packaging options, creating a favorable environment for growth in the starch-based packaging sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Thermoplastic Starch Modified Starch Starch Blends Others |

| By End-User | Food and Beverage Consumer Goods Healthcare E-commerce Agriculture Others |

| By Application | Films & Wraps Bags & Pouches & Tags Bottles Boxes & Cartons Tableware (Plates, Cutlery, Cups) Others |

| By Distribution Channel | Direct Sales Online Retail Distributors Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Rigid Packaging Flexible Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Packaging Manufacturers | 75 | Production Managers, Quality Assurance Officers |

| Retail Sector Buyers | 60 | Procurement Managers, Category Managers |

| Environmental Regulatory Bodies | 45 | Policy Makers, Environmental Analysts |

| Research Institutions Focused on Biodegradable Materials | 40 | Research Scientists, Academic Professors |

| Consumer Insights from Eco-conscious Shoppers | 55 | Focus Group Participants, Survey Respondents |

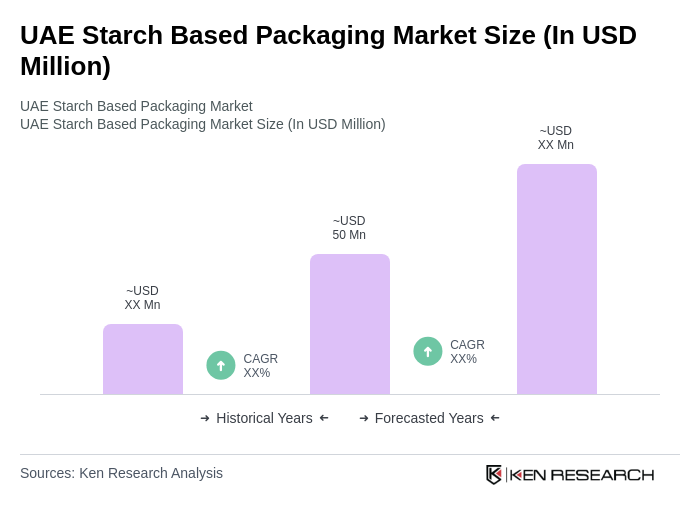

The UAE Starch Based Packaging Market is valued at approximately USD 50 million, reflecting a significant growth trend driven by increasing consumer demand for sustainable packaging solutions and government initiatives promoting eco-friendly materials.