Region:Middle East

Author(s):Geetanshi

Product Code:KRAC1035

Pages:81

Published On:October 2025

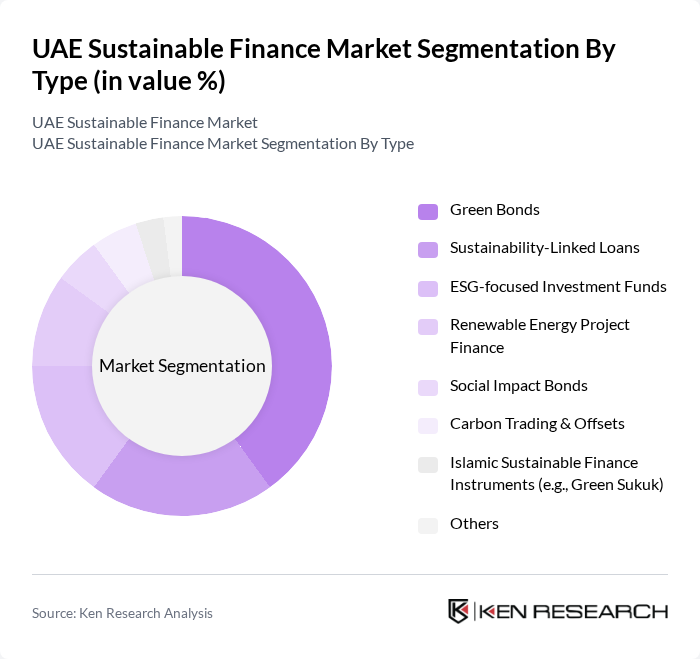

By Type:The market is segmented into various types, including Green Bonds, Sustainability-Linked Loans, ESG-focused Investment Funds, Renewable Energy Project Finance, Social Impact Bonds, Carbon Trading & Offsets, Islamic Sustainable Finance Instruments (e.g., Green Sukuk), and Others. Among these, Green Bonds are currently the leading sub-segment, driven by increasing demand for environmentally friendly projects and the need for financing in renewable energy initiatives. The trend towards sustainable investing has led to a significant rise in the issuance of Green Bonds, making them a preferred choice for investors looking to align their portfolios with sustainability goals.

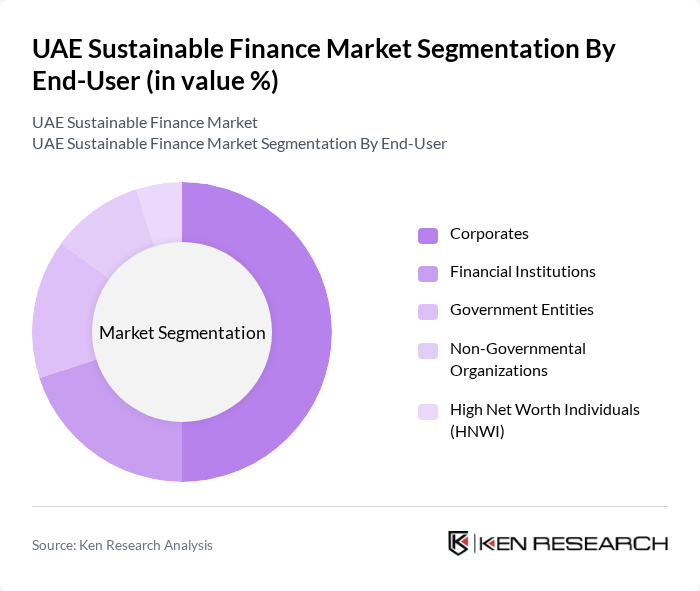

By End-User:The end-user segmentation includes Corporates, Financial Institutions, Government Entities, Non-Governmental Organizations, and High Net Worth Individuals (HNWI). Corporates are the dominant end-user segment, as many companies are increasingly adopting sustainable practices and seeking financing options that align with their corporate social responsibility (CSR) goals. The growing trend of sustainability reporting and the need for compliance with ESG regulations have further propelled corporates to engage in sustainable finance.

The UAE Sustainable Finance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abu Dhabi Investment Authority, Emirates NBD, Dubai Investments, First Abu Dhabi Bank, Abu Dhabi Commercial Bank, Dubai Islamic Bank (DIB), Noor Bank, Mashreq Bank, Emirates Global Aluminium, Dubai Financial Market, Sharjah Asset Management, Ras Al Khaimah Investment Authority, Abu Dhabi Sustainability Group, Dubai Green Fund, International Finance Corporation (IFC), Mubadala Investment Company, Abu Dhabi National Energy Company (TAQA), Masdar (Abu Dhabi Future Energy Company), HSBC Middle East, Standard Chartered UAE contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE sustainable finance market appears promising, driven by increasing government support and a growing emphasis on environmental, social, and governance (ESG) criteria. As the UAE continues to diversify its economy, investments in renewable energy and sustainable infrastructure are expected to rise. Furthermore, collaboration with international financial institutions will enhance the market's credibility and attract foreign investments, fostering a robust ecosystem for sustainable finance in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Green Bonds Sustainability-Linked Loans ESG-focused Investment Funds Renewable Energy Project Finance Social Impact Bonds Carbon Trading & Offsets Islamic Sustainable Finance Instruments (e.g., Green Sukuk) Others |

| By End-User | Corporates Financial Institutions Government Entities Non-Governmental Organizations High Net Worth Individuals (HNWI) |

| By Investment Source | Domestic Institutional Investors Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Multilateral Development Banks Government Grants |

| By Application | Infrastructure Development Renewable Energy Projects Sustainable Real Estate Sustainable Agriculture Waste Management Solutions Water Conservation Projects |

| By Policy Support | Subsidies for Green Projects Tax Incentives for Sustainable Investments Regulatory Support for ESG Compliance Grants for Research and Development |

| By Market Segment | Retail Investors Institutional Investors Family Offices Sovereign Wealth Funds |

| By Risk Profile | Low-Risk Investments Medium-Risk Investments High-Risk Investments Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Green Bonds Issuance | 65 | Investment Bankers, Financial Analysts |

| ESG Fund Management | 55 | Portfolio Managers, Fund Directors |

| Sustainable Loan Products | 50 | Loan Officers, Risk Management Executives |

| Corporate Sustainability Initiatives | 60 | Sustainability Managers, Corporate Strategists |

| Regulatory Compliance in Finance | 45 | Compliance Officers, Legal Advisors |

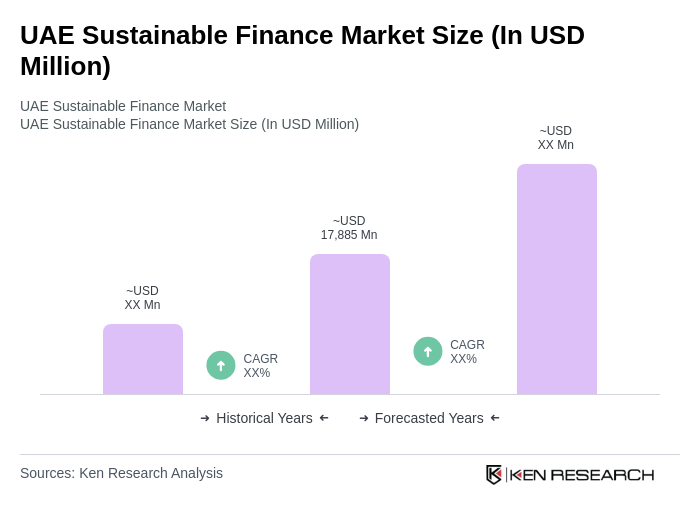

The UAE Sustainable Finance Market is valued at approximately USD 17,885 million, driven by investments in renewable energy, government initiatives, and growing awareness of environmental, social, and governance (ESG) factors among investors and corporations.