Region:Middle East

Author(s):Shubham

Product Code:KRAC4275

Pages:84

Published On:October 2025

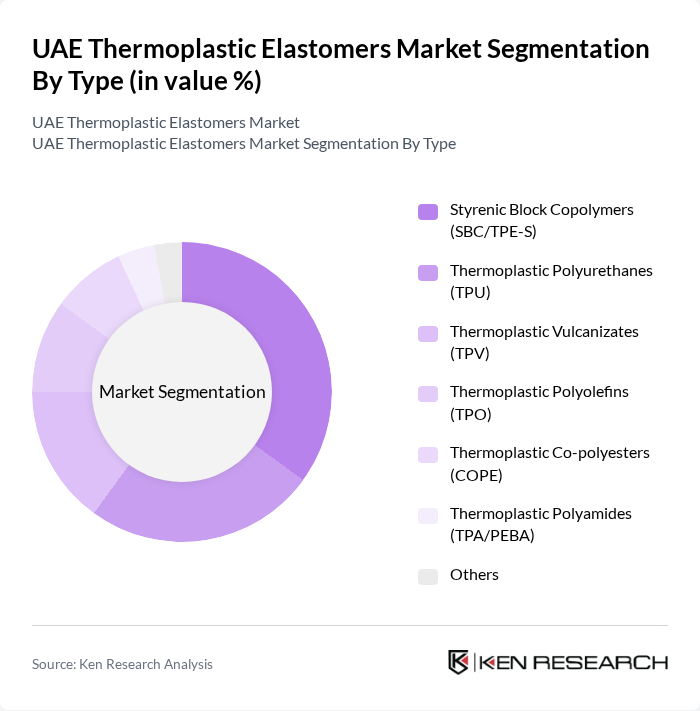

By Type:The thermoplastic elastomers market in the UAE is segmented into Styrenic Block Copolymers (SBC/TPE-S), Thermoplastic Polyurethanes (TPU), Thermoplastic Vulcanizates (TPV), Thermoplastic Polyolefins (TPO), Thermoplastic Co-polyesters (COPE), Thermoplastic Polyamides (TPA/PEBA), and Others. Among these, Styrenic Block Copolymers (SBC/TPE-S) continue to lead the market, attributed to their excellent elasticity, processability, and versatility. These characteristics make SBC/TPE-S especially suitable for automotive interiors, consumer goods, and packaging applications, where demand for lightweight and durable materials is increasing .

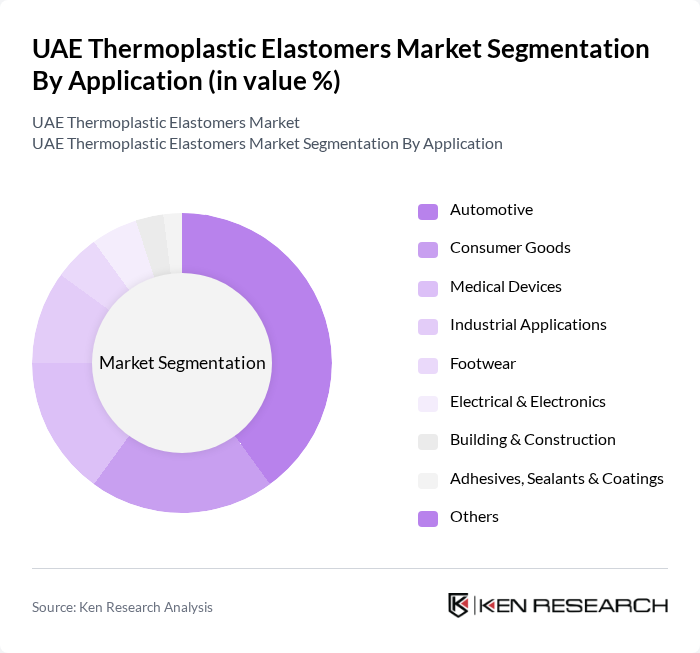

By Application:The applications of thermoplastic elastomers in the UAE cover a broad spectrum, including Automotive, Consumer Goods, Medical Devices, Industrial Applications, Footwear, Electrical & Electronics, Building & Construction, Adhesives, Sealants & Coatings, and Others. The automotive sector is the largest consumer, driven by the rising demand for lightweight materials to improve fuel efficiency, reduce emissions, and meet evolving regulatory standards. Medical devices and consumer goods are also significant segments, reflecting increased adoption of TPEs for their safety, flexibility, and recyclability .

The UAE Thermoplastic Elastomers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Kraton Corporation, LG Chem Ltd., DuPont de Nemours, Inc., Mitsubishi Chemical Corporation, Wanhua Chemical Group Co., Ltd., Huntsman Corporation, Evonik Industries AG, TSRC Corporation, Asahi Kasei Corporation, Covestro AG, Solvay S.A., RTP Company, KRAIBURG TPE GmbH & Co. KG, Avient Corporation, Arkema S.A., The Lubrizol Corporation, Teknor Apex Company, Inc., SABIC (Saudi Basic Industries Corporation), Borouge (Abu Dhabi Polymers Company Ltd.) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE thermoplastic elastomers market appears promising, driven by technological advancements and a growing emphasis on sustainability. As manufacturers increasingly adopt bio-based TPEs, the market is likely to witness a shift towards environmentally friendly materials. Additionally, the rise of e-commerce is expected to facilitate easier access to TPE products, enhancing market penetration. Strategic collaborations among industry players will further foster innovation and expand the application scope of TPEs across various sectors.

| Segment | Sub-Segments |

|---|---|

| By Type | Styrenic Block Copolymers (SBC/TPE-S) Thermoplastic Polyurethanes (TPU) Thermoplastic Vulcanizates (TPV) Thermoplastic Polyolefins (TPO) Thermoplastic Co-polyesters (COPE) Thermoplastic Polyamides (TPA/PEBA) Others |

| By Application | Automotive Consumer Goods Medical Devices Industrial Applications Footwear Electrical & Electronics Building & Construction Adhesives, Sealants & Coatings Others |

| By End-User | Automotive Manufacturers Electronics and Electrical Construction and Building Medical & Healthcare Footwear Manufacturers Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Abu Dhabi Dubai Sharjah Others |

| By Price Range | Economy Mid-Range Premium |

| By Product Form | Granules Sheets Films Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications | 60 | Product Development Managers, Procurement Specialists |

| Construction Materials | 50 | Project Managers, Materials Engineers |

| Consumer Goods Manufacturing | 40 | Operations Managers, Quality Assurance Managers |

| Medical Device Applications | 45 | Regulatory Affairs Managers, R&D Scientists |

| Adhesives and Sealants | 40 | Product Managers, Technical Sales Representatives |

The UAE Thermoplastic Elastomers Market is valued at approximately USD 1.1 billion, reflecting a robust growth trajectory driven by increasing demand for lightweight and flexible materials across various industries, including automotive, consumer goods, and healthcare.