Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2393

Pages:96

Published On:October 2025

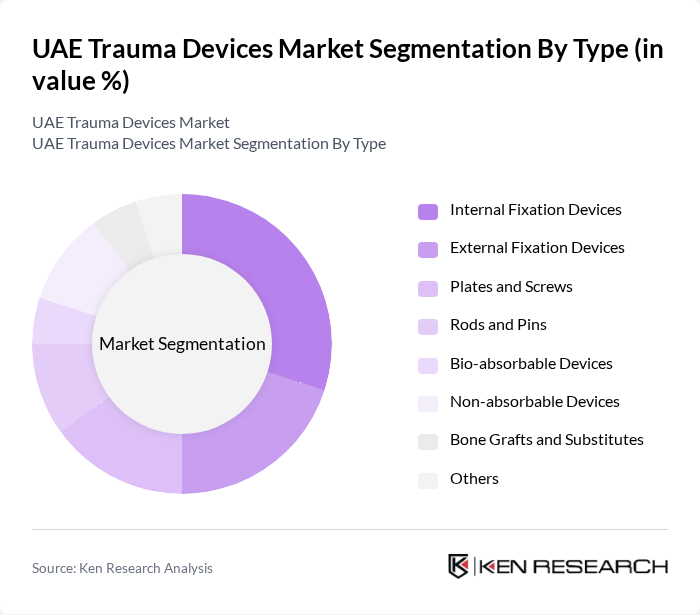

By Type:The trauma devices market can be segmented into various types, including Internal Fixation Devices, External Fixation Devices, Plates and Screws, Rods and Pins, Bio-absorbable Devices, Non-absorbable Devices, Bone Grafts and Substitutes, and Others. Each of these subsegments plays a vital role in addressing specific trauma-related needs. Internal fixation devices and non-absorbable devices represent the largest value segments, with bio-absorbable devices showing the fastest growth due to increasing adoption in minimally invasive procedures .

TheInternal Fixation Devicessubsegment is currently dominating the market due to their effectiveness in stabilizing fractures and promoting healing. These devices are widely used in orthopedic surgeries, which are on the rise due to increasing trauma cases. The growing preference for minimally invasive surgical techniques also drives the demand for these devices, as they offer better patient outcomes and shorter recovery times. As a result, Internal Fixation Devices hold a significant share of the market .

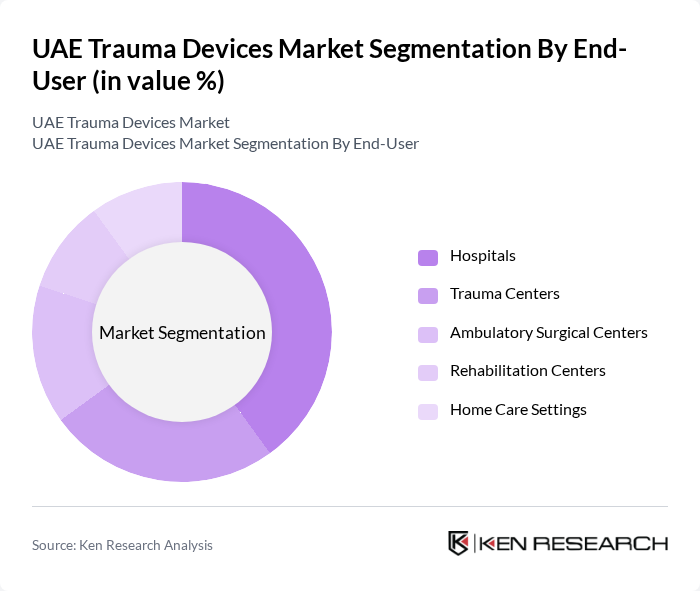

By End-User:The market can also be segmented based on end-users, which include Hospitals, Trauma Centers, Ambulatory Surgical Centers, Rehabilitation Centers, and Home Care Settings. Each of these segments has unique requirements and contributes to the overall demand for trauma devices. Hospitals represent the largest end-user segment, driven by the high patient inflow and the availability of advanced trauma care facilities .

Hospitalsare the leading end-user segment in the trauma devices market, accounting for a significant share. This dominance is attributed to the high volume of trauma cases treated in hospitals, coupled with the availability of advanced surgical facilities and specialized medical staff. The increasing number of trauma cases, particularly in urban areas, further drives the demand for trauma devices in hospitals, making them a critical segment in the market .

The UAE Trauma Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson (DePuy Synthes), Stryker Corporation, Medtronic plc, Zimmer Biomet Holdings, Inc., Smith & Nephew plc, B. Braun Melsungen AG, Orthofix Medical Inc., NuVasive, Inc., Arthrex, Inc., CONMED Corporation, Integra LifeSciences Holdings Corporation, Merz Pharma, GALDERMA, Wright Medical Group N.V., and Enovis Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The future of the UAE trauma devices market appears promising, driven by ongoing advancements in medical technology and increasing government support for healthcare initiatives. As the population ages and the incidence of trauma cases rises, the demand for innovative trauma solutions is expected to grow. Additionally, the integration of telemedicine and digital health solutions will likely enhance patient care and streamline trauma management, positioning the UAE as a leader in trauma care innovation in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Internal Fixation Devices External Fixation Devices Plates and Screws Rods and Pins Bio-absorbable Devices Non-absorbable Devices Bone Grafts and Substitutes Others |

| By End-User | Hospitals Trauma Centers Ambulatory Surgical Centers Rehabilitation Centers Home Care Settings |

| By Distribution Channel | Direct Tender Retail Sales Distributors Online Sales Retail Pharmacies |

| By Material | Metal Polymer Composite |

| By Application | Orthopedic Trauma Surgery Craniofacial Trauma Surgery Spine Trauma Surgery Soft Tissue Trauma Surgery Neurosurgery |

| By Region | Abu Dhabi Dubai Sharjah Others |

| By Price Range | Low-End Devices Mid-Range Devices High-End Devices |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Orthopedic Surgeons | 60 | Orthopedic Surgeons, Medical Directors |

| Hospital Procurement Managers | 50 | Procurement Managers, Supply Chain Managers |

| Medical Device Distributors | 40 | Sales Managers, Business Development Executives |

| Trauma Care Specialists | 40 | Emergency Physicians, Trauma Coordinators |

| Healthcare Policy Makers | 40 | Health Administrators, Policy Analysts |

The UAE Trauma Devices Market is valued at approximately USD 21.9 billion, reflecting a significant growth driven by increasing trauma cases, technological advancements, and government initiatives to enhance healthcare infrastructure.