Region:Middle East

Author(s):Rebecca

Product Code:KRAD6290

Pages:96

Published On:December 2025

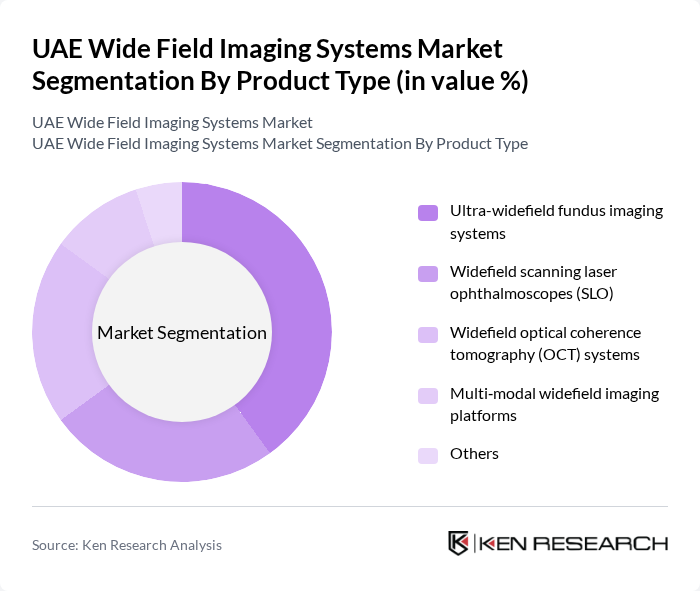

By Product Type:The product type segmentation includes various imaging systems that cater to different diagnostic needs in ophthalmology. The subsegments are as follows:

The Ultra-widefield fundus imaging systems segment is leading the market due to their ability to capture a larger field of view, which is crucial for diagnosing various retinal diseases. The increasing incidence of diabetic retinopathy and age-related macular degeneration has driven demand for these systems. Additionally, advancements in imaging technology have made these systems more accessible and user-friendly, further boosting their adoption in clinical settings.

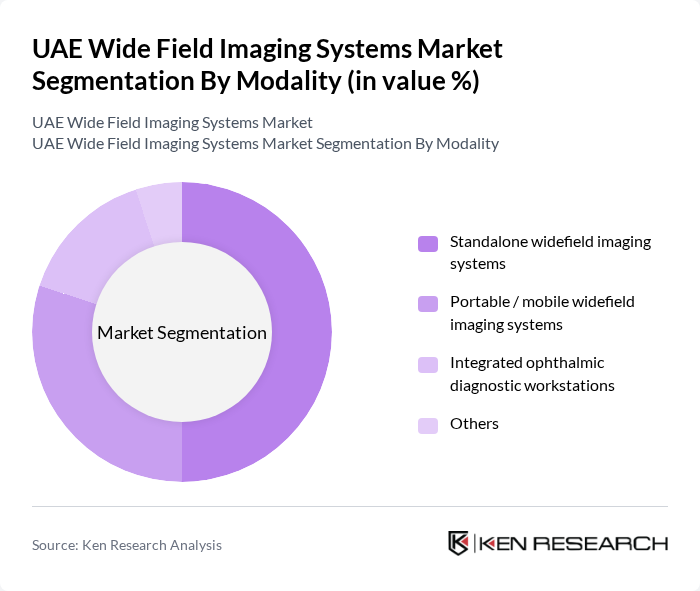

By Modality:The modality segmentation categorizes the imaging systems based on their operational characteristics. The subsegments are as follows:

The Standalone widefield imaging systems segment dominates the market due to their versatility and ease of use in various clinical environments. These systems are preferred by healthcare providers for their reliability and high-quality imaging capabilities. The growing trend towards telemedicine and remote diagnostics has also contributed to the increased demand for portable and mobile systems, allowing for greater accessibility in underserved areas.

The UAE Wide Field Imaging Systems Market is characterized by a dynamic mix of regional and international players. Leading participants such as Optos plc, Carl Zeiss Meditec AG, Heidelberg Engineering GmbH, Topcon Corporation, NIDEK Co., Ltd., Canon Medical Systems Corporation, ZEISS Vision Care / ZEISS Vision Technology Solutions, Haag?Streit Group, CenterVue SpA (part of iCare Finland Oy), Optovue, Inc. (a Visionix Company), Visionix Ltd., Sonomed Escalon, Ellex Medical Pty Ltd (part of Quantel Medical), Bausch + Lomb Incorporated, Local distributors and integrators (GulfMed FZE, MedNet UAE, and others) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE wide field imaging systems market appears promising, driven by ongoing technological advancements and a growing emphasis on preventive healthcare. As healthcare providers increasingly recognize the importance of early diagnosis, the integration of AI and telemedicine solutions will likely enhance patient care. Additionally, the expansion of healthcare infrastructure will facilitate greater access to advanced imaging technologies, ultimately improving health outcomes for the population and fostering innovation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Ultra-widefield fundus imaging systems Widefield scanning laser ophthalmoscopes (SLO) Widefield optical coherence tomography (OCT) systems Multi?modal widefield imaging platforms Others |

| By Modality | Standalone widefield imaging systems Portable / mobile widefield imaging systems Integrated ophthalmic diagnostic workstations Others |

| By Application | Diabetic retinopathy screening Glaucoma diagnosis and monitoring Age-related macular degeneration (AMD) Retinal vein occlusion and other vascular disorders Pediatric retinal diseases and retinopathy of prematurity (ROP) Ocular oncology and chorioretinal diseases Others |

| By End-User | Public hospitals and government ophthalmology centers Private hospitals Specialized eye hospitals and ophthalmology clinics Ambulatory surgical centers Academic and research institutions Others |

| By Technology | Digital non?mydriatic widefield imaging Mydriatic widefield imaging Ultra?widefield imaging (? 200 degrees) AI?enabled / software?enhanced widefield imaging Others |

| By Distribution Channel | Direct sales by original equipment manufacturers (OEMs) Local distributors and agents Group purchasing organizations and tenders Online and e?procurement platforms Others |

| By Emirate | Abu Dhabi Dubai Sharjah Northern Emirates (Ajman, Ras Al Khaimah, Fujairah, Umm Al Quwain) Others |

| By Policy & Reimbursement Support | Government vision?screening programs Public insurance and Thiqa / national schemes coverage Private insurance reimbursement Research and innovation grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Imaging Applications | 120 | Radiologists, Hospital Administrators |

| Industrial Inspection Systems | 100 | Quality Control Managers, Operations Directors |

| Research and Development Usage | 80 | Lab Managers, Research Scientists |

| Security and Surveillance Systems | 70 | Security Managers, IT Directors |

| Educational Institutions and Training | 60 | Academic Coordinators, Technical Instructors |

The UAE Wide Field Imaging Systems Market is valued at approximately USD 15 million, driven by the rising prevalence of eye diseases, advancements in imaging technology, and increased awareness of early diagnosis and treatment options among healthcare providers and patients.