Region:Europe

Author(s):Dev

Product Code:KRAA4932

Pages:86

Published On:September 2025

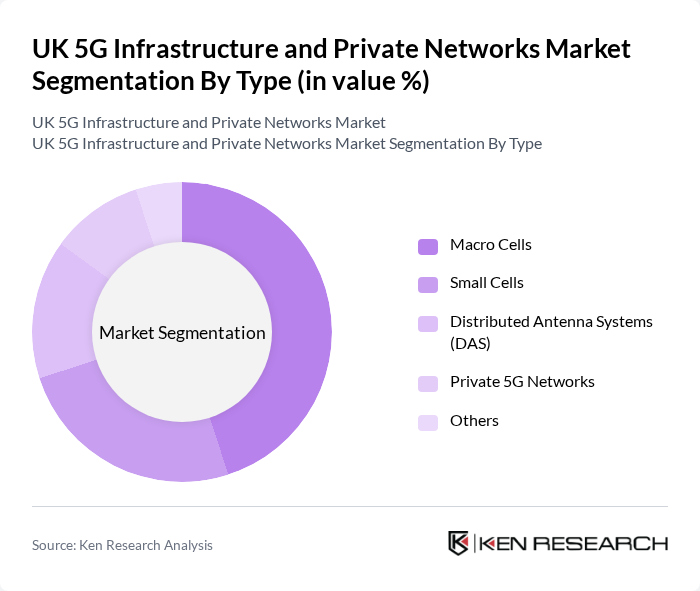

By Type:

The market is segmented into Macro Cells, Small Cells, Distributed Antenna Systems (DAS), Private 5G Networks, and Others. Among these, Macro Cells are the leading subsegment due to their extensive coverage capabilities, making them essential for urban areas with high user density. Small Cells are gaining traction as they complement Macro Cells by enhancing capacity in specific locations. The demand for Private 5G Networks is also increasing, particularly in industries requiring secure and dedicated connectivity.

By End-User:

The end-user segmentation includes Telecommunications, Manufacturing, Healthcare, Transportation, and Others. The Telecommunications sector is the dominant segment, driven by the need for enhanced network capabilities and the rollout of 5G services. Manufacturing is also a significant user, leveraging 5G for automation and smart factory solutions. The Healthcare sector is increasingly adopting 5G for telemedicine and remote patient monitoring, showcasing the technology's versatility across various industries.

The UK 5G Infrastructure and Private Networks Market is characterized by a dynamic mix of regional and international players. Leading participants such as BT Group plc, Vodafone Group plc, Ericsson AB, Nokia Corporation, Huawei Technologies Co., Ltd., Cisco Systems, Inc., Samsung Electronics Co., Ltd., Qualcomm Incorporated, ZTE Corporation, O2 (Telefónica UK Limited), Arqiva Limited, Colt Technology Services Group Limited, Mavenir Technologies, Inc., Ciena Corporation, CommScope Holding Company, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK 5G infrastructure and private networks market appears promising, driven by technological advancements and increasing demand for connectivity. As businesses adopt 5G for enhanced operational efficiency, the focus will shift towards integrating advanced technologies like AI and machine learning. Additionally, the development of smart cities will create new avenues for investment and innovation, fostering a collaborative ecosystem among stakeholders. The emphasis on sustainability will also shape future deployments, ensuring that environmental considerations are integrated into infrastructure planning.

| Segment | Sub-Segments |

|---|---|

| By Type | Macro Cells Small Cells Distributed Antenna Systems (DAS) Private 5G Networks Others |

| By End-User | Telecommunications Manufacturing Healthcare Transportation Others |

| By Application | Smart Cities Industrial Automation Remote Monitoring Augmented Reality/Virtual Reality Others |

| By Component | Hardware Software Services |

| By Sales Channel | Direct Sales Distributors Online Sales |

| By Distribution Mode | Retail Wholesale E-commerce |

| By Price Range | Low Medium High |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Telecom Operators | 100 | Network Engineers, Product Managers |

| Enterprise Users of Private Networks | 80 | IT Managers, Operations Directors |

| Industry Experts and Consultants | 50 | Telecom Analysts, Technology Advisors |

| Government and Regulatory Bodies | 30 | Policy Makers, Regulatory Analysts |

| Research Institutions and Academia | 40 | Researchers, Professors in Telecommunications |

The UK 5G Infrastructure and Private Networks Market is valued at approximately USD 7.5 billion, reflecting significant growth driven by the demand for high-speed internet, IoT proliferation, and enhanced mobile broadband services across various sectors.