Region:Europe

Author(s):Geetanshi

Product Code:KRAB3447

Pages:89

Published On:October 2025

By Type:The market is segmented into smartwatches, fitness trackers, smart apparel, connected footwear, AI-enhanced sports equipment, performance monitoring devices, and others. Smartwatches and fitness trackers remain the dominant product categories, driven by their widespread use among fitness enthusiasts and professional athletes for health monitoring and performance optimization. The adoption of sensor-embedded smart apparel and connected footwear is rising, supported by advancements in wearable technology and the demand for real-time analytics. AI-enhanced sports equipment, such as smart balls and rackets, is gaining traction for its ability to provide immediate feedback and personalized coaching, while performance monitoring devices and niche wearables (smart eyewear, headwear) continue to expand their role in athlete safety and tactical analysis .

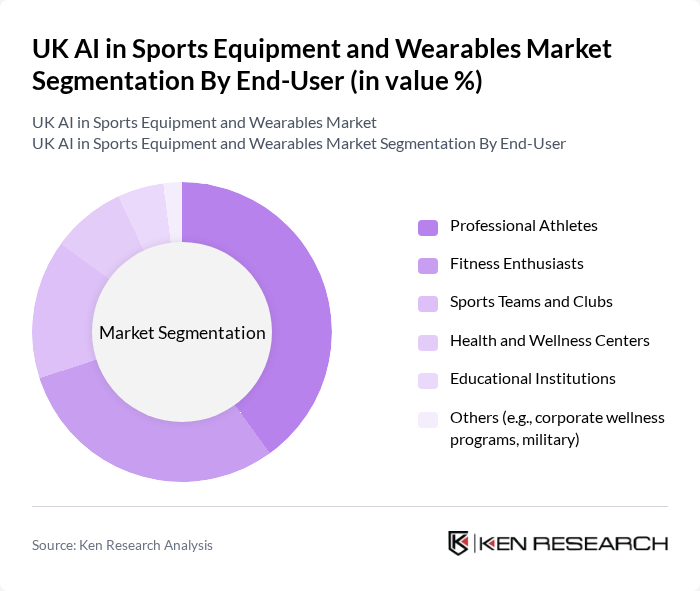

By End-User:The end-user segmentation includes professional athletes, fitness enthusiasts, sports teams and clubs, health and wellness centers, educational institutions, and others. Professional athletes and fitness enthusiasts constitute the largest share, reflecting the high demand for performance tracking and health monitoring solutions. Sports teams and clubs increasingly leverage AI-powered wearables for tactical analysis and injury prevention, while health and wellness centers and educational institutions are adopting these technologies to support broader fitness and wellness initiatives. Corporate wellness programs and military applications represent emerging segments, driven by the need for advanced monitoring and personalized training .

The UK AI in Sports Equipment and Wearables Market is characterized by a dynamic mix of regional and international players. Leading participants such as Apple Inc., Samsung Electronics Co., Ltd., Garmin Ltd., Fitbit Inc. (Google), Xiaomi Corporation, Huawei Technologies Co., Ltd., Polar Electro Oy, Withings, Oura Health Oy, Jabra (GN Group), Nike, Inc., Adidas AG, Under Armour, Inc., PUMA SE, New Balance Athletics, Inc., Decathlon S.A., Mizuno Corporation, Wilson Sporting Goods Co., Fossil Group, Inc., Sony Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK AI in sports equipment and wearables market appears promising, driven by continuous technological advancements and increasing consumer engagement. As AI capabilities evolve, products will become more sophisticated, offering enhanced features that cater to diverse user needs. Additionally, the integration of AI with IoT devices is expected to create a seamless user experience, further driving adoption. Companies that prioritize innovation and consumer education will likely lead the market, capitalizing on emerging trends and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Smartwatches Fitness Trackers Smart Apparel (e.g., sensor-embedded clothing) Connected Footwear AI-Enhanced Sports Equipment (e.g., smart balls, rackets, bats) Performance Monitoring Devices (e.g., heart rate monitors, GPS trackers) Others (e.g., smart eyewear, headwear, neckwear) |

| By End-User | Professional Athletes Fitness Enthusiasts Sports Teams and Clubs Health and Wellness Centers Educational Institutions Others (e.g., corporate wellness programs, military) |

| By Application | Performance Analysis and Optimization Injury Prevention and Rehabilitation Training and Coaching Support Health and Vital Signs Monitoring Gamification and User Engagement Others (e.g., sleep tracking, stress management) |

| By Distribution Channel | Online Retail (e-commerce, brand websites) Offline Retail (specialty stores, department stores) Direct Sales (B2C, B2B) Partnerships with Fitness Centers and Sports Clubs Others (e.g., corporate wellness programs, institutional procurement) |

| By Price Range | Budget (under £50) Mid-Range (£50–£200) Premium (£200–£500) Luxury (£500+) Others (custom, enterprise solutions) |

| By Brand | Global Tech Leaders (Apple, Samsung, Garmin, Fitbit, Xiaomi) Sports Apparel Giants (Nike, Adidas, Under Armour, PUMA, New Balance) Specialized Sports Tech (Polar, Withings, Oura, Jabra) Emerging UK and European Brands Private Labels and Retailer Brands |

| By User Demographics | Age Group (Under 18, 18–34, 35–54, 55+) Gender Fitness Level (Beginner, Intermediate, Advanced, Professional) Others (e.g., occupational, lifestyle) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Wearable Technology Adoption | 120 | Fitness Enthusiasts, Sports Coaches |

| AI-Driven Sports Equipment Insights | 90 | Product Managers, R&D Specialists |

| Market Trends in Sports Wearables | 100 | Industry Analysts, Retail Buyers |

| Consumer Preferences in Sports Technology | 60 | End Users, Fitness Trainers |

| Investment Trends in Sports Tech Startups | 50 | Venture Capitalists, Business Development Managers |

The UK AI in Sports Equipment and Wearables Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by the adoption of AI technologies in smartwatches, fitness trackers, and sensor-embedded gear.