Region:Europe

Author(s):Rebecca

Product Code:KRAA3835

Pages:93

Published On:September 2025

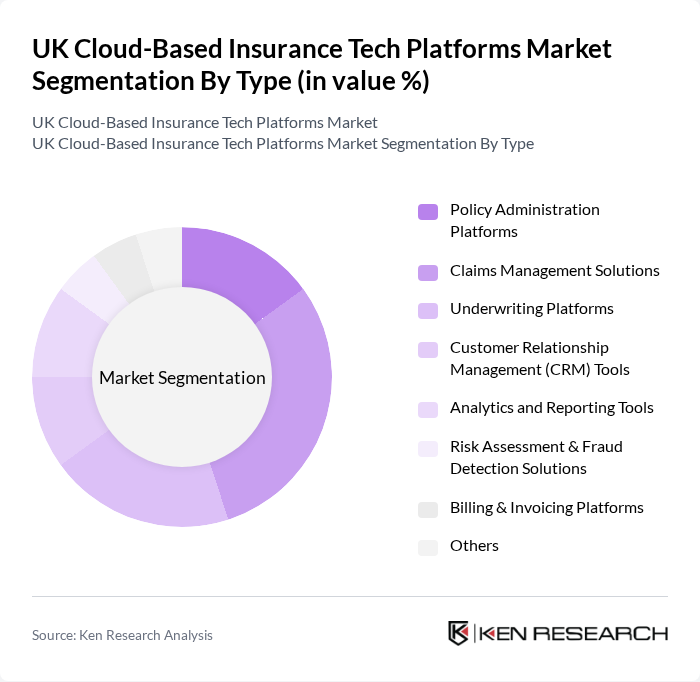

By Type:The market is segmented into various types, including Policy Administration Platforms, Claims Management Solutions, Underwriting Platforms, Customer Relationship Management (CRM) Tools, Analytics and Reporting Tools, Risk Assessment & Fraud Detection Solutions, Billing & Invoicing Platforms, and Others. Among these,Claims Management Solutionsare currently leading the market due to the increasing need for efficient claims processing and customer satisfaction. The demand for real-time data analytics, automation in claims handling, and AI-powered workflow optimization is driving this segment's growth .

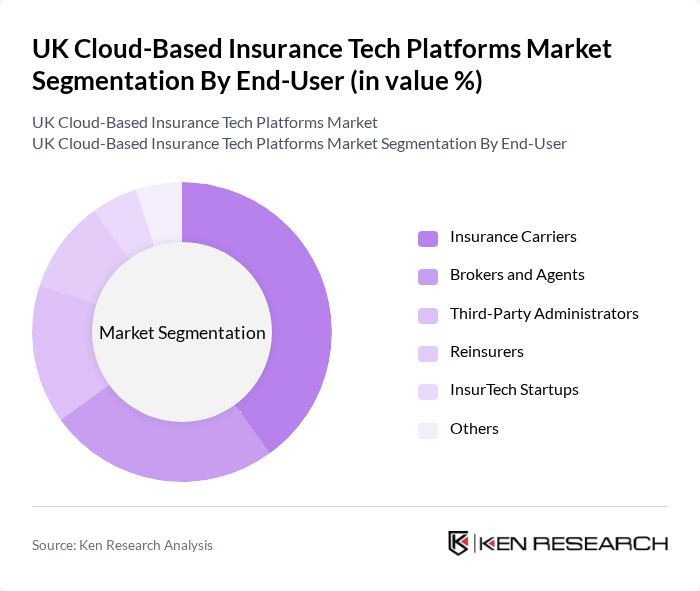

By End-User:The end-user segmentation includes Insurance Carriers, Brokers and Agents, Third-Party Administrators, Reinsurers, InsurTech Startups, and Others.Insurance Carriersdominate this segment as they are the primary users of cloud-based insurance tech platforms, leveraging these solutions to enhance operational efficiency, regulatory compliance, and customer service. Increasing competition among carriers to provide better digital services and personalized insurance products is driving the adoption of these technologies .

The UK Cloud-Based Insurance Tech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Guidewire Software, Inc., Duck Creek Technologies, Charles Taylor InsureTech, Acturis Limited, SSP Limited, Majesco, Salesforce (Financial Services Cloud), Amazon Web Services (AWS) – Insurance Solutions, Applied Systems, Sapiens International Corporation, Instanda, ICE InsureTech, Open GI, Genasys Technologies, Cytora contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UK cloud-based insurance tech platforms market appears promising, driven by ongoing technological advancements and evolving consumer expectations. As insurers increasingly adopt AI, machine learning, and big data analytics, operational efficiencies are expected to improve significantly. Additionally, the focus on customer-centric models and on-demand insurance solutions will likely reshape the market landscape, fostering innovation and competitive differentiation among providers in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Policy Administration Platforms Claims Management Solutions Underwriting Platforms Customer Relationship Management (CRM) Tools Analytics and Reporting Tools Risk Assessment & Fraud Detection Solutions Billing & Invoicing Platforms Others |

| By End-User | Insurance Carriers Brokers and Agents Third-Party Administrators Reinsurers InsurTech Startups Others |

| By Application | Risk Management Customer Engagement & Personalization Compliance & Regulatory Management Data Analytics & Business Intelligence Fraud Detection & Prevention Claims Automation Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Others |

| By Sales Channel | Direct Sales Online Sales Partner Sales Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Freemium Others |

| By Customer Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Life Insurance Cloud Solutions | 100 | Product Managers, IT Directors |

| Health Insurance Technology Adoption | 80 | Operations Managers, Compliance Officers |

| Property Insurance Digital Transformation | 70 | Business Analysts, Technology Strategists |

| Insurance Brokers' Cloud Utilization | 60 | Brokerage Owners, Sales Managers |

| Claims Processing Automation | 50 | Claims Managers, IT Support Staff |

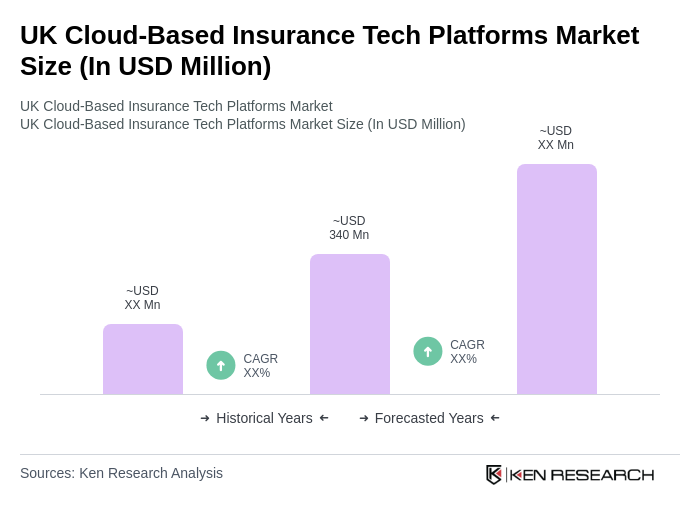

The UK Cloud-Based Insurance Tech Platforms market is valued at approximately USD 340 million, reflecting significant growth driven by the adoption of digital technologies such as AI and machine learning, which enhance operational efficiency and customer engagement in the insurance sector.