Region:Middle East

Author(s):Shubham

Product Code:KRAD0782

Pages:93

Published On:August 2025

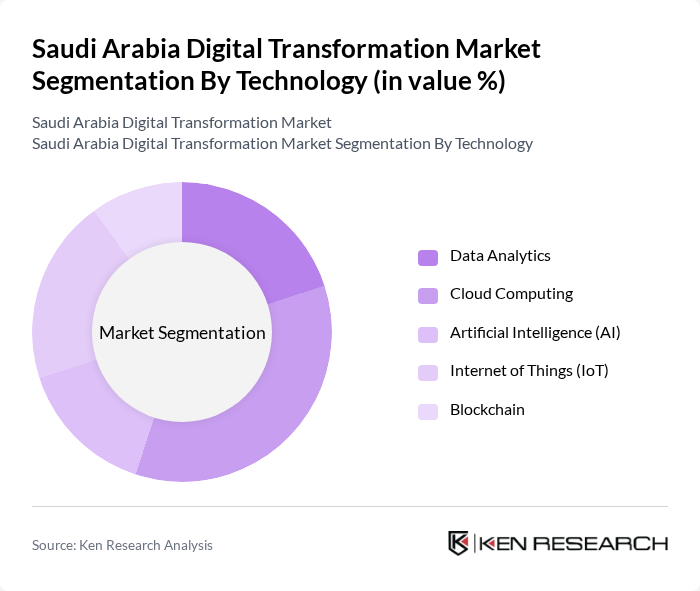

By Technology:

The technology segment of the market includes various sub-segments such as Data Analytics, Cloud Computing, Artificial Intelligence (AI), Internet of Things (IoT), and Blockchain. Among these, Cloud Computing is currently dominating the market due to its scalability, cost-effectiveness, and ability to support remote work and digital collaboration. The increasing reliance on cloud services by businesses to enhance operational efficiency and reduce IT costs has led to a significant uptick in its adoption. Data Analytics is also gaining traction as organizations seek to leverage data for informed decision-making, while AI and IoT are emerging as critical components in enhancing automation and connectivity.

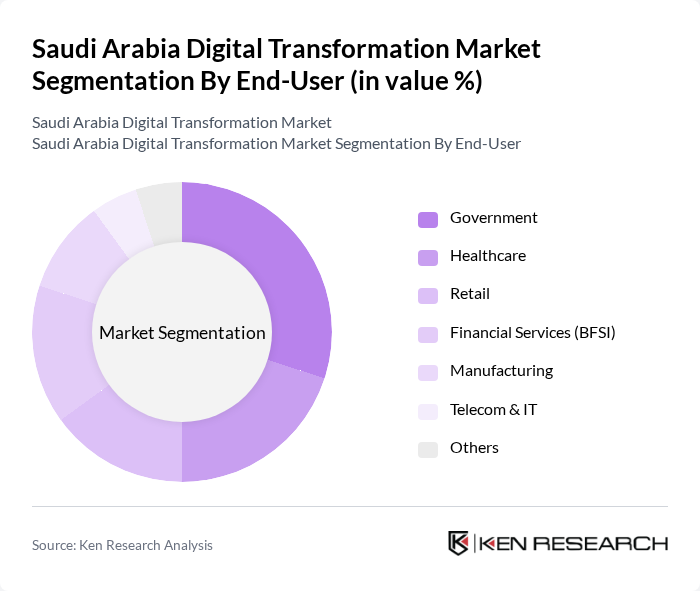

By End-User:

The end-user segment encompasses various industries, including Government, Healthcare, Retail, Financial Services (BFSI), Manufacturing, Telecom & IT, and Others. The Government sector is leading this segment, driven by substantial investments in digital infrastructure and services aimed at enhancing public service delivery. The Healthcare sector is also rapidly adopting digital solutions to improve patient care and operational efficiency. Retail and BFSI are increasingly leveraging digital transformation to enhance customer experiences and streamline operations, while Manufacturing and Telecom & IT are focusing on automation and connectivity to remain competitive.

The Saudi Arabia Digital Transformation Market is characterized by a dynamic mix of regional and international players. Leading participants such as Exponential Digital Solutions (EDS), Advanced Electronics Company (AEC), Al Moammar Information Systems Co. (MIS), Arabic Computer Systems Ltd. (ACS), Microsoft Arabia, EJADA Systems Company Limited, Jeraisy Group, STC Solutions Inc., Saudi Business Machines Ltd. (SBM), Saudi Information Technology Company (SITE), Wipro Limited, Oracle Corporation, IBM Corporation, Cisco Systems, Inc., Accenture PLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia digital transformation market appears promising, driven by ongoing government support and increasing private sector investments. As organizations continue to embrace digital technologies, the focus will shift towards enhancing operational efficiency and customer engagement. The integration of advanced technologies such as AI and IoT will play a crucial role in shaping business strategies. Additionally, the emphasis on sustainability and green technologies will likely influence digital initiatives, aligning with global trends towards environmentally responsible practices.

| Segment | Sub-Segments |

|---|---|

| By Technology | Data Analytics Cloud Computing Artificial Intelligence (AI) Internet of Things (IoT) Blockchain |

| By End-User | Government Healthcare Retail Financial Services (BFSI) Manufacturing Telecom & IT Others |

| By Deployment | Cloud On-Premises |

| By Enterprise Size | Large Enterprises Medium Enterprises Small Enterprises |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Digital Solutions | 100 | IT Managers, Healthcare Administrators |

| Financial Services Digital Transformation | 80 | Chief Technology Officers, Compliance Officers |

| Education Technology Adoption | 70 | School Administrators, IT Coordinators |

| Smart City Initiatives | 50 | Urban Planners, Technology Consultants |

| Retail Sector Digital Integration | 90 | Operations Managers, E-commerce Directors |

The Saudi Arabia Digital Transformation Market is valued at approximately USD 10.9 billion, driven by government initiatives like Vision 2030 and the increasing adoption of technologies such as AI, IoT, and cloud computing.