Region:Europe

Author(s):Geetanshi

Product Code:KRAA5261

Pages:98

Published On:September 2025

By Type:The market is segmented into various types of digital advertising, including Display Advertising, Search Engine Marketing, Social Media Advertising, Influencer Marketing, Video Advertising, Affiliate Marketing, and Others. Each of these segments plays a crucial role in shaping the overall landscape of digital advertising, catering to different consumer preferences and advertising strategies.

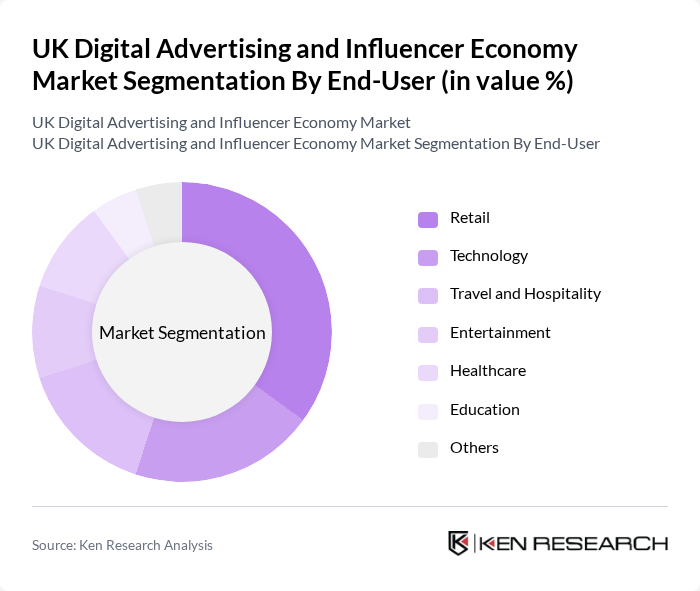

By End-User:The end-user segmentation includes Retail, Technology, Travel and Hospitality, Entertainment, Healthcare, Education, and Others. Each sector utilizes digital advertising differently, with varying levels of investment and engagement based on their target audiences and marketing objectives.

The UK Digital Advertising and Influencer Economy Market is characterized by a dynamic mix of regional and international players. Leading participants such as WPP plc, Omnicom Group Inc., Publicis Groupe, Dentsu International, Havas Group, Interpublic Group, GroupM, Zenith Media, Mediavest | Spark, VaynerMedia, Influencive, The Social Element, Fanbytes, Takumi, Tribe Dynamics contribute to innovation, geographic expansion, and service delivery in this space.

The UK digital advertising and influencer economy is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As brands increasingly prioritize authentic content and sustainability, the integration of AI and data analytics will enhance targeting capabilities. Additionally, the rise of mobile advertising and innovative platforms will reshape engagement strategies. Companies that adapt to these trends will likely capture significant market share, ensuring a dynamic and competitive landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Search Engine Marketing Social Media Advertising Influencer Marketing Video Advertising Affiliate Marketing Others |

| By End-User | Retail Technology Travel and Hospitality Entertainment Healthcare Education Others |

| By Platform | Social Media Platforms Search Engines Video Streaming Services Mobile Applications Websites Others |

| By Campaign Type | Brand Awareness Campaigns Lead Generation Campaigns Product Launch Campaigns Seasonal Campaigns Others |

| By Advertising Format | Native Advertising Sponsored Content Pay-Per-Click (PPC) Cost-Per-Action (CPA) Others |

| By Audience Targeting | Demographic Targeting Behavioral Targeting Contextual Targeting Retargeting Others |

| By Budget Size | Small Budget Campaigns Medium Budget Campaigns Large Budget Campaigns Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Brand Utilization of Influencer Marketing | 150 | Marketing Directors, Brand Managers |

| Consumer Attitudes Towards Digital Advertising | 200 | General Consumers, Social Media Users |

| Agency Perspectives on Digital Trends | 100 | Digital Marketing Executives, Account Managers |

| Influencer Engagement Strategies | 80 | Influencers, Content Creators |

| Impact of Regulations on Advertising Practices | 70 | Compliance Officers, Legal Advisors |

The UK Digital Advertising and Influencer Economy Market is valued at approximately USD 15 billion, reflecting significant growth driven by increased digital media penetration and the rise of social media platforms, alongside the influence of online content creators.