Region:Middle East

Author(s):Geetanshi

Product Code:KRAA8014

Pages:98

Published On:September 2025

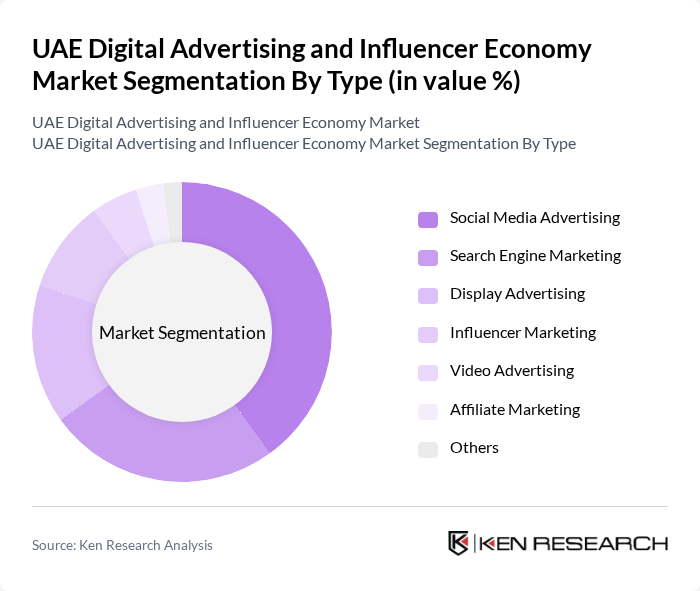

By Type:The market is segmented into various types, including Social Media Advertising, Search Engine Marketing, Display Advertising, Influencer Marketing, Video Advertising, Affiliate Marketing, and Others. Among these, Social Media Advertising has emerged as the leading segment due to the widespread use of platforms like Instagram and Facebook, where brands can engage directly with consumers. Influencer Marketing is also gaining traction as brands seek authentic connections with their target audience through trusted personalities.

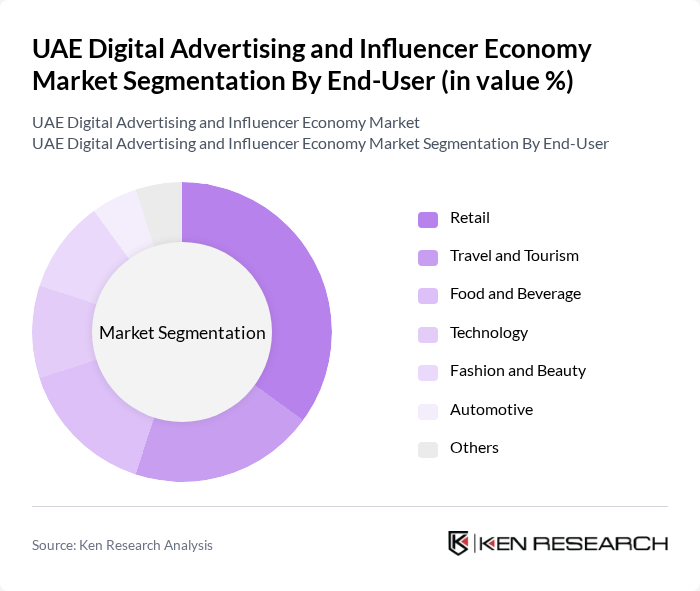

By End-User:The end-user segmentation includes Retail, Travel and Tourism, Food and Beverage, Technology, Fashion and Beauty, Automotive, and Others. The Retail sector dominates this market segment, driven by the increasing trend of online shopping and the need for brands to establish a strong digital presence. The Food and Beverage sector is also significant, as companies leverage digital advertising to promote new products and engage with consumers.

The UAE Digital Advertising and Influencer Economy Market is characterized by a dynamic mix of regional and international players. Leading participants such as Emirates Digital Marketing, Socialize Agency, Influencer Marketing Agency, Digital Marketing Dubai, The Media Lab, DMS (Digital Marketing Solutions), Nexa, Traffic Digital, Blue Beetle, YAPILI, The Social Company, Buzzeff, MMP Worldwide, The Influencer Agency, Social Media 360 contribute to innovation, geographic expansion, and service delivery in this space.

The UAE digital advertising and influencer economy is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As brands increasingly adopt data-driven strategies, the integration of artificial intelligence in advertising will enhance targeting and personalization. Additionally, the rise of video content marketing will reshape engagement strategies, allowing brands to connect more authentically with consumers. This dynamic environment presents opportunities for innovative advertising solutions and deeper consumer insights, fostering sustainable growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Social Media Advertising Search Engine Marketing Display Advertising Influencer Marketing Video Advertising Affiliate Marketing Others |

| By End-User | Retail Travel and Tourism Food and Beverage Technology Fashion and Beauty Automotive Others |

| By Platform | YouTube TikTok Others |

| By Campaign Type | Brand Awareness Campaigns Product Launch Campaigns Seasonal Promotions Engagement Campaigns Retargeting Campaigns Others |

| By Content Format | Image-Based Content Video Content Text-Based Content Interactive Content Live Streaming Content Others |

| By Budget Size | Small Budget Campaigns Medium Budget Campaigns Large Budget Campaigns Others |

| By Duration | Short-Term Campaigns Long-Term Campaigns Ongoing Campaigns Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Advertising Agencies | 100 | Agency Owners, Account Managers |

| Influencer Marketing Campaigns | 80 | Brand Managers, Marketing Directors |

| Social Media Influencers | 150 | Content Creators, Social Media Managers |

| Consumer Engagement Metrics | 120 | Digital Analysts, Market Researchers |

| Emerging Digital Platforms | 70 | Product Managers, Business Development Executives |

The UAE Digital Advertising and Influencer Economy Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by increased smartphone penetration, internet connectivity, and a shift in consumer behavior towards digital platforms for shopping and entertainment.