Region:Asia

Author(s):Geetanshi

Product Code:KRAA8147

Pages:80

Published On:September 2025

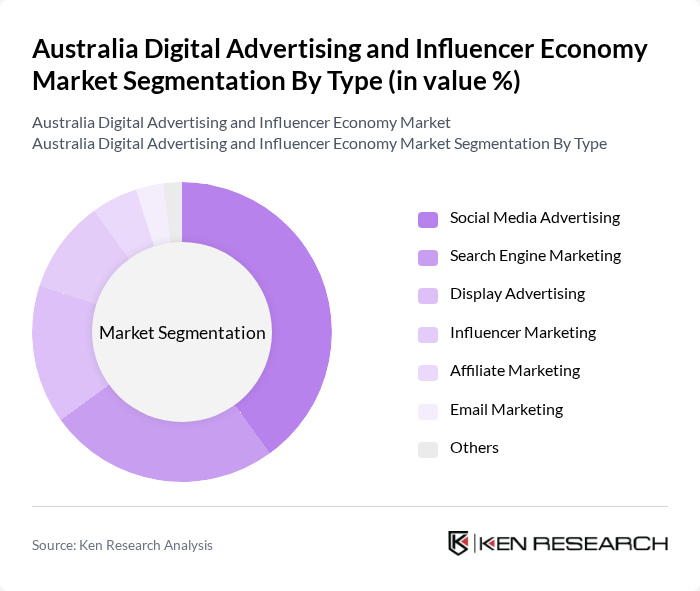

By Type:The market is segmented into various types of digital advertising, including Social Media Advertising, Search Engine Marketing, Display Advertising, Influencer Marketing, Affiliate Marketing, Email Marketing, and Others. Among these, Social Media Advertising has emerged as the leading segment, driven by the increasing engagement of users on platforms like Facebook and Instagram. The trend towards personalized marketing and the effectiveness of targeted ads have made this segment particularly attractive for brands looking to reach their audience effectively.

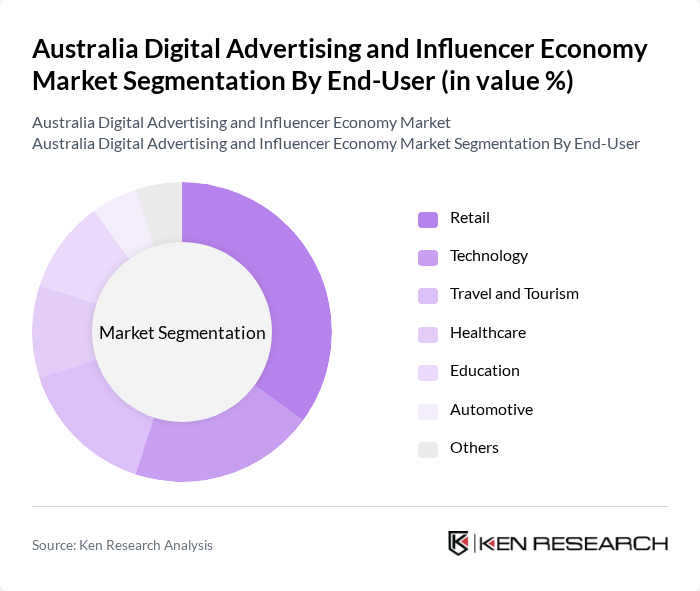

By End-User:The end-user segmentation includes Retail, Technology, Travel and Tourism, Healthcare, Education, Automotive, and Others. The Retail sector is the dominant segment, as brands increasingly leverage digital advertising to drive online sales and enhance customer engagement. The shift towards e-commerce, particularly during the pandemic, has led retailers to invest heavily in digital marketing strategies to capture consumer attention and drive conversions.

The Australia Digital Advertising and Influencer Economy Market is characterized by a dynamic mix of regional and international players. Leading participants such as WPP AUNZ, Omnicom Media Group, Publicis Groupe, Dentsu Aegis Network, IPG Mediabrands, Havas Media, The Monkeys, Thinkerbell, The Influencer Agency, Tribe, Social Soup, Nuffnang, Channel Nine, Seven West Media, News Corp Australia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital advertising and influencer economy in Australia appears promising, driven by technological advancements and evolving consumer behaviors. As brands increasingly adopt data-driven marketing strategies, the integration of artificial intelligence and machine learning will enhance targeting capabilities. Additionally, the growing emphasis on sustainability in advertising practices will likely shape brand narratives, appealing to environmentally conscious consumers. These trends indicate a dynamic landscape where innovation and consumer engagement will be pivotal for success in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Social Media Advertising Search Engine Marketing Display Advertising Influencer Marketing Affiliate Marketing Email Marketing Others |

| By End-User | Retail Technology Travel and Tourism Healthcare Education Automotive Others |

| By Platform | Google Ads YouTube TikTok Others |

| By Campaign Type | Brand Awareness Campaigns Lead Generation Campaigns Product Launch Campaigns Seasonal Promotions Event Sponsorships Others |

| By Advertising Format | Video Ads Image Ads Text Ads Carousel Ads Stories Ads Others |

| By Budget Size | Small Budget (<$10,000) Medium Budget ($10,000 - $50,000) Large Budget (>$50,000) Others |

| By Geographic Focus | National Campaigns Regional Campaigns Local Campaigns Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Brand Engagement in Influencer Marketing | 150 | Marketing Managers, Brand Strategists |

| Influencer Campaign Effectiveness | 100 | Digital Marketing Analysts, Campaign Managers |

| Social Media Platform Utilization | 80 | Social Media Managers, Content Creators |

| Consumer Perception of Influencer Ads | 120 | Targeted Consumers, Social Media Users |

| Trends in Digital Advertising Spend | 90 | Financial Analysts, Advertising Executives |

The Australia Digital Advertising and Influencer Economy Market is valued at approximately USD 10 billion, reflecting significant growth driven by increased smartphone penetration and the popularity of social media platforms, particularly accelerated by the COVID-19 pandemic.