UK Luxury Fashion & Designer Brands Market Overview

- The UK Luxury Fashion & Designer Brands Market is valued at USD 40 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable incomes, a rising number of affluent consumers, and a growing demand for high-quality, exclusive products. The market has seen a significant shift towards online shopping, with luxury brands enhancing their digital presence to cater to tech-savvy consumers.

- London stands out as a dominant city in the UK Luxury Fashion & Designer Brands Market, known for its rich fashion heritage and as a global fashion capital. Other notable cities include Manchester and Birmingham, which have also seen a rise in luxury retail outlets. The concentration of high-net-worth individuals and a vibrant tourism sector contribute to the market's strength in these locations.

- In 2023, the UK government implemented regulations aimed at promoting sustainability in the fashion industry. This includes the introduction of the Extended Producer Responsibility (EPR) scheme, which mandates that fashion brands take responsibility for the entire lifecycle of their products, including recycling and waste management. This initiative is designed to reduce environmental impact and encourage sustainable practices among luxury brands.

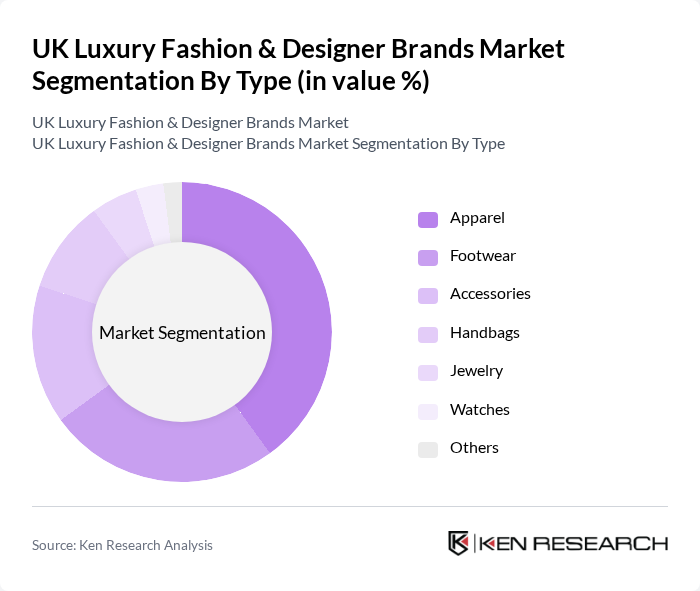

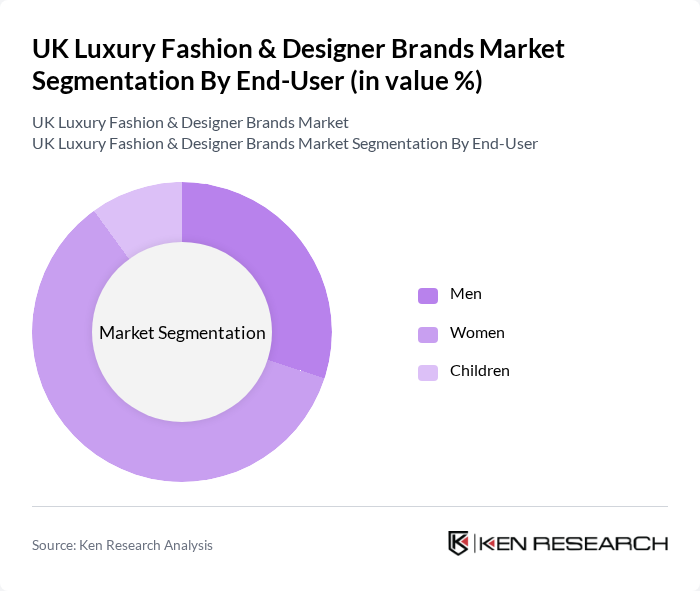

UK Luxury Fashion & Designer Brands Market Segmentation

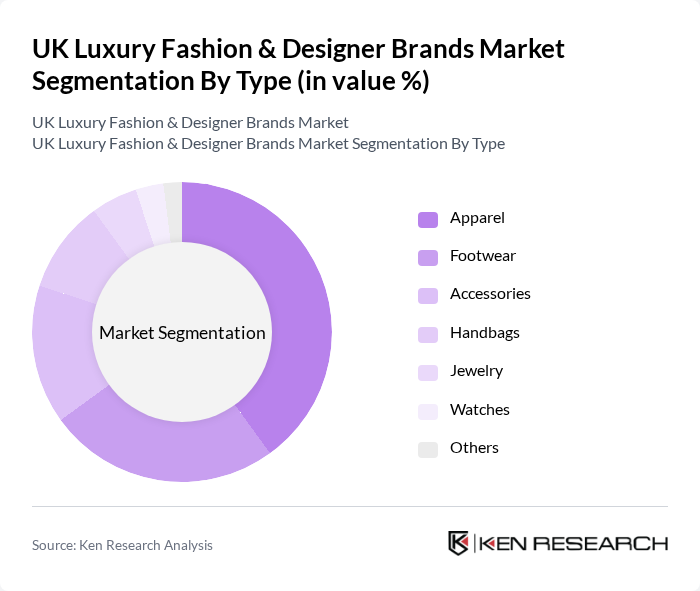

By Type:The luxury fashion market is segmented into various types, including apparel, footwear, accessories, handbags, jewelry, watches, and others. Among these, apparel is the leading sub-segment, driven by consumer preferences for high-quality clothing and the influence of fashion trends. Footwear and handbags also hold significant market shares, as they are essential components of luxury fashion, often reflecting personal style and status. Accessories, jewelry, and watches complement these primary categories, catering to consumers seeking to enhance their luxury lifestyle.

By End-User:The luxury fashion market is segmented by end-user demographics, including men, women, and children. Women represent the largest segment, driven by a higher propensity to spend on luxury fashion and a broader range of product offerings tailored to their preferences. The men's segment is also significant, with increasing interest in luxury apparel and accessories. The children's segment, while smaller, is growing as parents seek high-quality, fashionable items for their children, reflecting their own luxury lifestyle.

UK Luxury Fashion & Designer Brands Market Competitive Landscape

The UK Luxury Fashion & Designer Brands Market is characterized by a dynamic mix of regional and international players. Leading participants such as Burberry Group PLC, Alexander McQueen, Stella McCartney, Mulberry Group PLC, Jimmy Choo PLC, Victoria Beckham Ltd., Paul Smith Ltd., Vivienne Westwood Ltd., Ted Baker PLC, Aspinal of London, Reiss Ltd., AllSaints Retail Ltd., House of Fraser, Selfridges & Co., Farfetch Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

UK Luxury Fashion & Designer Brands Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The UK has seen a steady rise in disposable income, with the Office for National Statistics reporting an increase to £31,000 per household in future. This growth enables consumers to allocate more funds towards luxury fashion, driving demand. Additionally, the affluent segment, which constitutes about 10% of the population, is projected to contribute significantly to luxury spending, estimated at £13 billion in future, further bolstering the market.

- Rising Demand for Sustainable Fashion:The UK luxury fashion market is increasingly influenced by sustainability, with 68% of consumers prioritizing eco-friendly brands in future. The market for sustainable luxury goods is projected to reach £4.5 billion, driven by consumer awareness and demand for ethical sourcing. Brands that adopt sustainable practices are likely to capture a larger market share, as 56% of millennials express a willingness to pay more for sustainable products, indicating a significant shift in purchasing behavior.

- Growth of E-commerce Platforms:E-commerce sales in the UK luxury fashion sector are expected to exceed £9 billion in future, reflecting a 22% increase from the previous year. The convenience of online shopping, coupled with enhanced digital marketing strategies, has led to a surge in online luxury purchases. Additionally, 46% of luxury consumers now prefer shopping online, highlighting the importance of digital channels in reaching a broader audience and driving sales growth in the luxury fashion market.

Market Challenges

- Economic Uncertainty:The UK economy faces challenges, including inflation rates projected at 5% in future, which may impact consumer spending on luxury goods. Economic uncertainty can lead to reduced discretionary spending, as consumers prioritize essential purchases over luxury items. This shift in consumer behavior poses a significant challenge for luxury brands, which rely on a stable economic environment to maintain sales and profitability.

- Intense Competition:The UK luxury fashion market is characterized by fierce competition, with over 210 established brands vying for market share. New entrants and established brands alike are investing heavily in marketing and product innovation, making it difficult for smaller brands to compete. This competitive landscape can lead to price wars and reduced profit margins, challenging the sustainability of many luxury brands in the market.

UK Luxury Fashion & Designer Brands Market Future Outlook

The UK luxury fashion market is poised for transformation, driven by evolving consumer preferences and technological advancements. As sustainability becomes a core value for consumers, brands that prioritize ethical practices are likely to thrive. Additionally, the integration of augmented reality and AI in retail is expected to enhance customer experiences, making shopping more interactive. The focus on personalization and unique offerings will further shape the market, ensuring that brands remain relevant in a competitive landscape.

Market Opportunities

- Expansion into Emerging Markets:Luxury brands have a significant opportunity to expand into emerging markets, particularly in Asia and Africa, where the middle class is growing rapidly. With an estimated 1.6 billion new consumers entering the luxury market by future, brands can tap into this potential for increased sales and brand loyalty, driving overall market growth.

- Collaborations with Influencers:Collaborating with social media influencers presents a lucrative opportunity for luxury brands to reach younger audiences. In future, influencer marketing in the fashion sector is projected to generate £1.6 billion in revenue. By leveraging influencers' reach and credibility, brands can enhance their visibility and appeal, driving engagement and sales among target demographics.