Region:North America

Author(s):Geetanshi

Product Code:KRAA6797

Pages:93

Published On:September 2025

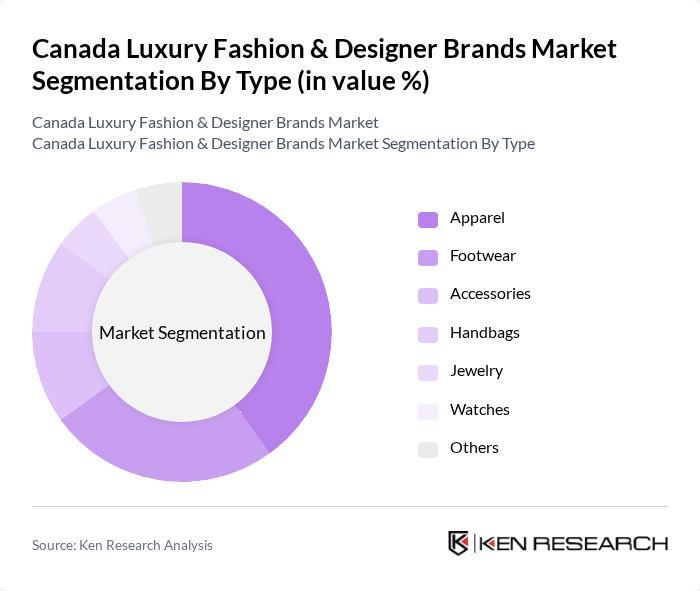

By Type:The luxury fashion market can be segmented into various types, including apparel, footwear, accessories, handbags, jewelry, watches, and others. Among these, apparel is the leading sub-segment, driven by the increasing demand for high-quality clothing and designer collaborations. Footwear and handbags also hold significant market shares, as consumers seek both functionality and style in their luxury purchases.

By End-User:The luxury fashion market is segmented by end-user demographics, including men, women, and children. Women represent the largest consumer group, driven by a strong inclination towards fashion and luxury brands. Men's luxury fashion is also growing, with increasing interest in tailored clothing and accessories. The children's segment, while smaller, is gaining traction as parents invest in high-quality, stylish clothing for their children.

The Canada Luxury Fashion & Designer Brands Market is characterized by a dynamic mix of regional and international players. Leading participants such as LVMH Moët Hennessy Louis Vuitton, Gucci, Prada, Chanel, Burberry, Hermès, Versace, Dolce & Gabbana, Fendi, Valentino, Balenciaga, Ralph Lauren, Tory Burch, Michael Kors, Coach contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada luxury fashion market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a core value for consumers, brands that embrace eco-friendly practices are likely to thrive. Additionally, the integration of digital technologies, such as augmented reality, will enhance shopping experiences, attracting tech-savvy consumers. The luxury market is expected to adapt to these trends, ensuring continued relevance and growth in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Apparel Footwear Accessories Handbags Jewelry Watches Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Department Stores Luxury Boutiques |

| By Price Range | Premium Super Premium Ultra Luxury |

| By Brand Positioning | Established Luxury Brands Emerging Luxury Brands Designer Collaborations |

| By Consumer Demographics | Millennials Generation X Baby Boomers |

| By Occasion | Casual Wear Formal Wear Special Events Everyday Wear |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apparel Purchases | 150 | Affluent Consumers, Fashion Enthusiasts |

| Designer Accessories Market | 100 | Luxury Brand Managers, Retail Buyers |

| Footwear Trends in Luxury Fashion | 80 | Footwear Designers, Retail Store Managers |

| Online Luxury Shopping Behavior | 120 | E-commerce Managers, Digital Marketing Specialists |

| Consumer Sentiment on Sustainability in Fashion | 90 | Sustainability Advocates, Fashion Bloggers |

The Canada Luxury Fashion & Designer Brands Market is valued at approximately USD 8.5 billion, reflecting a significant growth trend driven by increasing disposable income and a rising affluent population, particularly among younger consumers.